This article is part of the Under the Lens series

The Racial Wealth Gap—Moving to Systemic Solutions

The racial wealth gap has been an intractable problem for decades. How do we move beyond what we’ve been trying to solutions that will help individuals and communities?

Authors from Shelterforce’s recent series, The Racial Wealth Gap—Moving to Systemic Solutions, and other experts recently talked about the role homeownership plays in addressing the wealth gap and more. The event was co-hosted by Miriam Axel-Lute, CEO/Editor-in-Chief of Shelterforce, and Holden Lewis, home and mortgage expert at NerdWallet.

Joining us were:

- Nikitra Bailey, SVP of Public Policy at the National Fair Housing Alliance

- Jeremie Greer, executive director of Liberation in a Generation

- Joe Hanson, EVP Strategic Initiatives at Indianapolis Neighborhood Housing Partnership

- Dan Reed, freelance writer, Realtor, and urban planner

Whether you missed the webinar and want to catch up, joined us and now want to rewatch or share the replay, or if you want to learn more about what you heard, we’ve got you covered!

Below is an edited version of the conversation. Watch the full video above.

Miriam Axel-Lute: One of the most common responses to the existence of the racial wealth gap is, understandably, to look for ways to help people build up wealth who don’t have as much. Jeremie, you’ve argued that there is a flip side to that that we too often ignore. Can you tell us more?

Jeremie Greer

Jeremie Greer: It feels good to talk about helping people build wealth. It’s like the feel-good part of the work. Everyone puts together their report and they got the smiling face of the Latino family in front of the “Sold” sign, in front of the house, or the Black business owner in front of his food truck with a big smile on his face. That’s the stuff that feels good. The reality is that there’s two sides of wealth. There’s the assets you have, but also the debt. While resources are going into households, there’s also forces out there in the world stripping and pulling wealth out of households.

When we’re talking about the racial wealth gap, we have to reckon with the reality that we call at Liberation in a Generation “the oppression economy.” That’s an economy that we live in now, where baked into the structures and systems of the economy are forces of systemic racism or white supremacy that are intentionally created to extract wealth from communities of color.

When you think about the way communities of color are criminalized in this country, when you think about the ways that communities of color are politically disenfranchised in this country, you think about the ways in which corporate power holds such a hold over the wallets and the livelihoods of people of color, and of course, the dual financial system that people of color have to navigate.

We have a financial system where on one hand, there’s all sorts of products and services mostly available to white folks that build wealth, your home equity, your 401(k) plans, all of that stuff over there. Then on the other side, there’s a lot of stuff that is extracting wealth from people, and much of that is concentrated and marketed to people of color, for people of color, and really extracting wealth out of people of color.

Some things we should pay attention to: there’s a real effort to deny access to people of color to core resources and services, and some of the other panelists are going to talk about some of that exclusion. You think about the way that risk is priced and letting risk be the thing, and when you know that all the metrics say that like Black people are more risky, you get higher interest rates for Black people. That’s how you get that outcome.

Student loan debt. When students are targeted to go to these for-profit institutions that aren’t going to give them any real education but are going to put them in debt for the rest of their lives, that’s an example of that wealth-stripping portion of the economy. And then stuff that’s not actually in the financial services sector that we have to pay attention and focus on. Things like medical debt. When people of color are more reliant on health care because, basically, racism is making us sick, you’re going to run up more medical debt. Rental debt. When you see disproportionate numbers of people of color being put out for eviction or being brought to court for eviction, that creates more rental debt, back rent.

And I’m going to close with this one because it’s one that I think is really illustrative about how this is really intentional and really systematic. I’m going to talk about municipal fines and fees and court fines and fees, and I’m going to use an example in Florida.

In Florida, there was all this advocacy work that went to make sure that people who were formally convicted of crime and served time in prison could vote and take part in the democratic process. The voters of Florida voted on a referendum to make that happen. State legislature said, “No, no, no, we’re not going to let this happen.” What they did was, they passed a law that said, if you haven’t paid all of your court fines and fees—some of them up to like $50,000 and $60,000 for some people—you could not participate in the democratic process.

That is a very intentional act, targeted a very group of people. While, yes, it was about the right to vote, I think what it illuminates is that there are things that are outside of the financial sector, court fines and fees, for example, that are really stripping the wealth and resources out of communities of color, which are really making it hard for them to get ahead.

What I’ll say is, when somebody comes to you and presents an argument that assumes that there’s some choice for a Black or a Latinx person around whether they can purchase a home or whether they can start a business, whether that’s like a choice point for them, I would say to you, there are a lot of things outside of their control that are pulling those resources that are really making that a non-choice for them, and that we shouldn’t be worrying about the choices that people make, but we should be focusing on the systems that are extracting and stripping wealth out of communities of color.

Axel-Lute: Nikitra, government intervention helped create the racial wealth gap by making it easier or possible for white households to build wealth. Some of those policies are gone now. Is just removing those biased policies enough or do we need to do something more?

Nikitra Bailey

Nikitra Bailey: Race-conscious policies favoring whites created today’s homeownership and wealth disparities, and we believe only race-conscious remedies can fix them. These policies entrenched homeownership disparities by giving white Americans access to federally insured mortgages. These mortgages were low cost, and they denied equal opportunity for Black families and other families of color to build similar opportunities in homeownership that could translate later to wealth.

These policies and practices underlying federal programs included denial of credit for qualified borrowers buying in predominantly Black neighborhoods, creating a depressed value of homes in those neighborhoods. Just for background purposes, in the first 35 years of the FHA-insured mortgage program, only 2 percent of federally backed mortgages went to families of color. White families had an initial investment of $120 billion in federal investments to really help jumpstart their ability to build home equity, which they’ve later been able to pass forward across successive generations in the form of wealth.

We know that that support did not only limit itself to those homeowners. Private developers also benefited from these federal investments and they used racially restrictive covenants to exclude families of color from whole communities. When we look at places like Levittown, New York, we see that families who have been able to purchase homes in those communities are living in homes today that are valued in the upwards of $400,000 to $500,000. Many families of color were locked out of having that same opportunity.

What we know for sure is that this discrimination actually hurts us and it cost the entire economy. Research has shown that discrimination included in housing over the last 20 years has cost the U.S. GDP $16 trillion, and that if we actually take efforts to address the discrimination, we have a chance to grow the economy by a trillion dollars per year over the next five years. We actually need to have the courage to put forth policies that are inclusive, that will bring in the very communities that we left behind. I’m hopeful to get to those policies as we continue our discussion.

Axel-Lute: Dan, one of the ways that wealth is extracted from particularly Black homeowners is appraisal bias, which you wrote about in our recent series. Can you tell us a little bit about that, and why the solutions to it are complicated?

Dan Reed

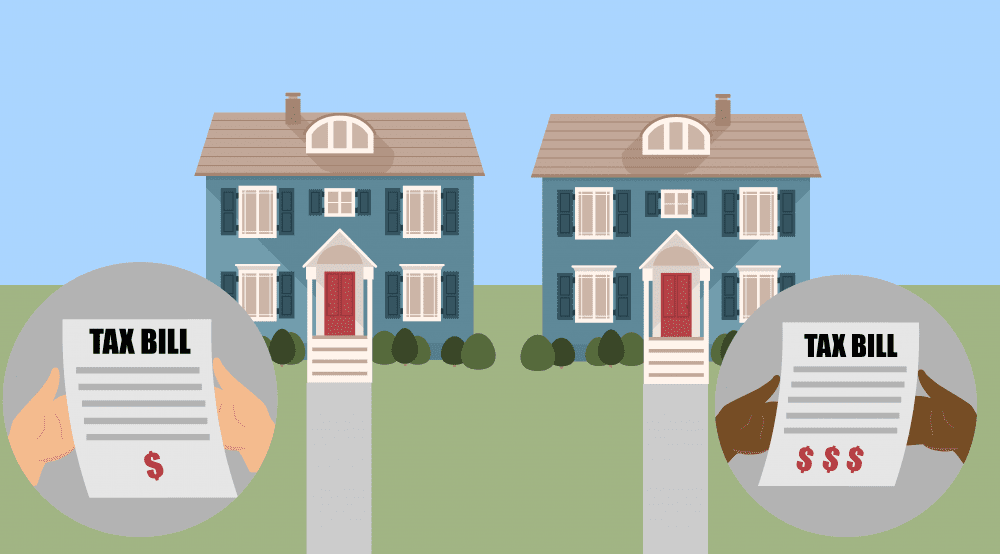

Dan Reed: I looked at how there’s frequently a difference in how much homes are appraised for, identical homes if one is in a Black neighborhood or in a white neighborhood, and that there’s research showing basically that the cost of Blackness when you get an appraisal can be anywhere from one-quarter to 50 percent of a decrease in value compared to a home in a white community.

We’ve seen a lot of stories about this in the news. There was a big story from the Bay Area a couple of years ago about a family that had put hundreds of thousands of dollars of renovations into their home and got it appraised for what they had paid for it without that $500,000 for improvements. There was another story in The Washington Post just today about a Black family in a very affluent Black community here in Maryland … their home was appraised for $300,000 less than they paid for it six years ago. This is an increasingly high-profile phenomenon, but the solutions are elusive.

Appraisers are generally independent contractors. They often work for themselves and they are trained through apprenticeships. Today’s appraisers are often being trained by people who were trained several decades ago when there was explicit direction to use race as a factor in determining the value of a house. It’s really difficult to get in the industry because it is so insular. Basically, even though fair housing laws and all these other things exist to prevent discrimination, it is literally baked into the way appraisers do their work. That’s part of the issue.

There have been a lot of discussions about, “Can we automate that process instead?” but the algorithms used to automate home appraisals also have errors in them because they’re designed by people, and [that] also affects the scale, too. Even if you use an automated appraisal, if you’re looking at homes in the same community, you’re still reflecting, and essentially, recycling that discrimination, at least lower home prices.

One of the most intriguing proposals in the story that I researched was one that basically would take homes and use an automated appraisal to compare them to every comparable house in the region. Homes of similar features, but in neighborhoods with similar characteristics regardless of race. This could be a very significant way to dramatically improve the wealth for Black homeowners, by putting them on an equal playing field with white homeowners who might be 5, 10, 20 miles away in the same region in a comparable neighborhood.

It was a really interesting look at a problem that is, I think, way more common than we might give it credit for. It’s one of those things where like it’s in the air we breathe, how we perceive neighborhoods and how we perceive the value of place.

Holden Lewis: Joe, you’re a lender and you know that racial bias is out there. How do you prepare prospective homeowners of color to know what they’re going up against and what tools are available to help them achieve homeownership?

Joe Hanson

Joe Hanson: I’ll just talk about our approach and what we’ve been doing for nearly 35 years in Indianapolis. It all starts with preparation. Whether it’s the homeownership advising process, where we’re working one-on-one with someone, or it’s the specific education around the homebuying process, it is about preparation. It’s about making sure that the buyers understand what they’re taking on. If homeownership is, in fact, their choice, they need to understand what a good deal is.

It’s not just the value of the real estate, but the importance of an inspection and the importance of appraisal and the limits of an appraisal, to Dan’s comments. Then to some of Jeremie’s comments, it’s understanding the competitive nature of pricing. Don’t get one mortgage offer, but let’s look at multiple offers. Let’s compare and contrast offers to make sure you’re getting the best deal to protect yourself from some of the risks of extraction that Jeremie was talking about. That’s really the heart of the preparation, is just having that education.

Then some of the additional tools, as we’ve looked at the data—national data and local data—we’ve tried to unpack what’s really prevented access. That’s where we come in as a lender with tools specifically designed to overcome barriers. For instance, we know that African American borrowers are more likely to be denied credit than their peers.

We’ve developed and are implementing programs that try to focus on other factors rather than just the credit score. Let’s try to remove that barrier and identify other indicators of success. In this case, we’re focused on their rent payments. Do they have a rental history that demonstrates a seriousness that would be transferable into they’re going to make a mortgage payment, and therefore, we’re setting them up for success in the future? Using different programs that overcome a barrier.

Another example that really gets into some of the potential siphoning. Two examples, in fact. One is a very low-interest rate mortgage. We’ve been offering 1.25 percent 20-year fixed-rate mortgages. That means very little of the payment is actually going toward interest service and most of it is going to principal reduction. In fact, that principal reduction is wealth and it’s accumulating over 20 years instead of 30. That’s allowing for a much quicker accumulation of that wealth and subject to appraisal bias, then the homeowner is able to tap into that wealth and do the business formation or whatever else that household wants to do with the equity that they’ve accumulated more quickly in their home.

You pair that with other programs around downpayment assistance and individual development accounts that help people overcome barriers—some of the most common barriers for African American applicants is to overcome that down payment—and so we’re having programs that provide that downpayment assistance.

Axel-Lute: Joe, when you have these conversations, do you go in saying, “Look, this system is rigged. It’s not fair, and so we’re going to help you get over these barriers.” Are you explicit about that when you talk to homebuyers?

Hanson: It’s a great question. I’m not in those conversations. I can’t be explicit in terms of whether we do or not, but I think our African-American applicants already know that it’s not fair. I don’t think that’s really something we have to tell them. I don’t mean to be cute with that response.

Axel-Lute: Yes, good point.

Bailey: If I may jump in, I think Jeremie made a really important point earlier. Our nation’s fair lending laws have yet to be fully enforced. We’ve had fair housing and fair lending laws on the books since 1866. In 1866, Congress decided that it was against the law to have housing discrimination. That law went unenforced for 102 years until we were able to pass the ’68 Fair Housing Act, which provided an affirmative responsibility on the federal government to actually root out discrimination in housing.

I just want to clarify the point that there is much that we can actually do here. We need to give people equitable opportunities and we need to put people on a level playing field where they have a fair shot and have access to the game in the same way that everyone else has. Rev. Jackson has a saying that I always like to borrow. He says that when the rules are fair and the refs are fair, we win.

The reality is for Black, Latino, and other consumers of color, we’ve never been in a fair system. This idea that homeownership might not work for us is rooted in a system of oppression. If we are allowed to participate in the system fairly, we know that we succeed. I’ll just point to Dan Immergluck’s research, which looks at homeownership after the Great Recession.

We had worked really hard to put in place the Dodd–Frank Wall Street Reform and Consumer Protection Act, which eliminated many of the issues that we had leading into the Great Recession of 2008, where Black and Latino consumers were disproportionately steered into dangerous and risky toxic loans, even though they qualified for loans on safer and more affordable terms.

His research shows that in a five-year period, Black families that were able to get mortgages were able to get loans that were safe and they were able to accumulate about $45,000 in home equity. It shows that when we’re given an opportunity to participate fairly in the system, we actually perform well.

Lewis: Jeremie, you talked about how there’s just so many different ways that wealth extraction works. If you had one action to take, the first step to fight back against wealth extraction, what would that be? Where do you start?

Greer: I get that question a lot, like what’s the silver bullet? I got bad news. I don’t have one. We have to scour every element and every aspect of these systems because the oppression that we’re talking about is baked into many, many systems. I want to double-click on something that Nikitra talked about, which is this idea of making sure that we’re race-conscious in whatever we do across the board. The reason why we have to do is because it was a race-conscious approach that got us here. It was just another direction. It was in the direction of discrimination; it was in the direction of racism.

It was a very race-conscious approach to block people from opportunity, to extract resources from them, all of the things that have been talked about. Whether it’s reforming our credit reporting system, for example—something that’s going to come up a lot in this conversation as a barrier to people of color getting access to credit—we have to do that with a race-conscious approach, recognizing that the system as it lives today is one that uses credit reporting as a proxy to identify who is Black and who is not, or who is Latino and who is not, when applying for a mortgage. Let’s be straight: That’s what it does.

Whether it’s that, whether it’s the appraisal process that Dan is talking about, is a very race-conscious. You talked about race-conscious effort. They got us to the point that it is used as a way to devalue Black homeowners so that they can take advantage of us. We need a race-conscious approach to flip that back on the other end. Again, I don’t have a silver bullet. I think there’s places we should look at across the board in every aspect of our housing system. We have to approach it with a race-conscious approach in the direction of justice, not in the direction of racism and discrimination.

Lewis: Nikitra, you said we have tools, we just need the political courage to wield them. What are some of those tools?

Bailey: Starting with our nation’s fair lending laws, the Equal Credit Opportunity Act already allows for the use of special-purpose credit programs. Special-purpose credit programs are a tool that lenders could use to think about the people that they are underserving, and then to design a product to reach those underserved consumers who might be excluded by their other requirements for determining credit-worthiness.

I love when we have a conversation about credit scoring because it’s important to talk about the history of discrimination that’s baked into credit scores. We know that families of color were not in a position to enter into homeownership at the same rate that whites were in the initial years of these federal policies. Whites have more wealth. They have eight times the wealth of Black Americans and five times the wealth of Latino Americans, for an example.

When we look at things like credit scoring, we see that history of wealth baked into those [scores]. Families who have not had the opportunity to pass forward to successive generations downpayment assistance that they were able to build up in the form of home equity are going to need to purchase a home and will have a lower downpayment, and their credit score will be lower as a reflection of needing to utilize a higher level of their loan amount. That’s going to be reflected in their credit score.

We need less discriminatory alternatives to credit scoring so we can look at something like rental payment history, which is very much so analogous to a home mortgage payment history. That’s one way that we can think about less discriminatory alternatives. It’s not the only one, but it’s one that we should take into consideration. We shouldn’t do that without realizing that renters also face discrimination. We have to attack these issues on multiple prongs.

That’s the most important point. We’re not going to have one single solution to closing the racial wealth gap, we’re going to need an all-out attack. We are literally at war, but we have to put it in the context that not addressing the racial wealth gap through homeownership gives us an opportunity to leave behind the communities that we left behind, but it also will hurt the overall economy.

Some other things that we need to consider are right before us. The Build Back Better Act’s housing provisions contain $10 billion for first-generation homebuyers. These are homebuyers whose families were excluded by prior federal policies. By giving these homebuyers access to this downpayment assistance, we overcome one of the very important barriers that families of color face in attempting to enter into homeownership.

If we invest $10 billion in targeted first-generation downpayment assistance based on a proposal that my organization developed along with a partner organization, we could actually grow homeownership by 5 million homebuyers across the country—1.7 million of those homebuyers would be Black, 1.32 million would be Latino, and 1.4 million of them would be white. We know that by doing that, we would ignite the economy because creating homeownership also creates jobs. We would generate an opportunity to create thousands of jobs and billions of dollars in local revenues. These types of inclusive policies are the things that we have to have the courage to do.

The House of Representatives already passed the Build Back Better Act. Everyone here should call their member in the Senate and tell them to pass the Build Back Better Act. We’re experiencing a recovery that’s not inclusive, that’s not equal, so we have a tool that we could actually use, and we just need to help our policymakers understand that now is the time to act.

Hanson: Nikitra, I appreciate your reference to the special-purpose credit program. Have you seen that done well anywhere? Do you have any examples to hold up?

Bailey: I really do. We know that a major lender is using a place-based special-purpose credit program. I can’t say their name. They’re a major lender, I don’t want to sound like I’m endorsing, but they have a program. We also know that in San Diego, LISC has a program where there is targeted first-time homebuyer assistance for African-American consumers. I’ll drop that link in the chat so that everyone can look at that.

We know that it’s a tool that we can use. It’s already legal. The Department of Housing and Urban Development came out with a statement saying that if lenders adopt a special-purpose credit program in compliance with the Equal Credit Opportunity Act, that it also comports with the promises of the Fair Housing Act. We’ve heard from CFPB, which is responsible for ECOA, and the Department of Housing and Urban Development, which is responsible for the federal Fair Housing Act, and then all the other regulatory agencies have chimed in. We have this too and now is the time for us to use it.

Axel-Lute: Speaking of tools that we have, Dan, you started to talk a little bit about how one might change the way that we appraise properties. You’ve also noted that changing the values of an undervalued neighborhood all at once, if we move to that regional approach, could potentially have the problem of contributing to gentrification and even housing affordability problems. Talk about the homebuyer–homeowner tension in fixing the appraisal gap.

Reed: A lot of housing conversations we have right now, there is this tension between potential homebuyers and homeowners. We have a massive national housing shortage right now. We’re short 3 or 4 million homes that haven’t been built in the past 10 or 15 years due to the recession, and so you have homebuyers competing to purchase homes and enter into highly desirable areas.

Their interest is for homes to be less expensive so they can have access to them and they can go on the economic ladder themselves, but for the homeowner, the fact that there’s a housing shortage and the fact that there’s 20 people in a bidding war on their home are fantastic. They would like to get a bigger return on their investment. Oftentimes, we see homeowners fight any attempts to change that or anything that might impact their property values because they’re trying to maximize their investment. These two things are always in tension with each other.

Appraisal bias is no different. Incumbent homeowners benefit from the difference in home values in white neighborhoods versus Black neighborhoods. If you’re in a white neighborhood, that is a cohort that probably won’t be very happy with an approach that values all homes the same because their home is suddenly … even if it’s equally valuable, that’s still in the eyes of some a loss.

For potential homebuyers, homebuyers of all races are seeking out affordable areas in a given region because homes are more affordable there and that, as you described, can lead to processes like gentrification, but their interest is to find affordable homes where they are. If all homes are suddenly appraised at a regional level now, those areas are now taken out of reach.

One of the solutions that Dr. Andrew Perry, who’s done a lot of research on this, recommended in the story that I wrote, was this is the time to give people direct cash and financial support to buy homes. This is downpayment assistance, these are homebuyer grants, these are special loan products like Joe was talking about, that lower the barriers to buying a home or reduce the burden of a large mortgage.

Even were that to happen, the tension still remains. Across the entire region … the homebuyers have increased, there is still somebody who’s going to be left out of that. The broader economic disparities that we see also have to be addressed. I know it sounds a little defeatist to say that we have to fix capitalism first, but as long as home prices are outpacing incomes, appraisal bias and addressing appraisal bias is still only tinkering around the edges of the broader issues that we have.

Lewis: When people talk about fixing the racial wealth gap, they start talking about Black and brown people just maybe don’t know as much about personal finance. What do we do to address those systemic practices and inform the dominant culture that we have these practices that extract wealth from even savvy homebuyers and investors?

Bailey: Let me be clear, I don’t think that consumer education is the solution to systemic challenges in the marketplace. I think that we need to make sure we have proper laws fully enforced to deal with systemic challenges. We actually have a robust fair housing and fair lending infrastructure. To do so, the Fair Housing Act and the Equal Credit Opportunity Act provides many protections that we simply need to better use, and they also provide solutions in a way that you can create and design programs. I’m going to go to the appraisal issue specifically. Just this morning, the White House and Secretary Fudge, and Ambassador Rice along with Vice President Harris announced a very critical action plan on ways that we can address systematic devaluations of homes in Black communities and other communities of color. We need multilateral approaches. We need tweaks to existing laws for appraisal bias issues to be addressed. We need to make sure that the appraisal industry itself is more diverse. We know that there are barriers to entry in that system, and oftentimes there are requirements for a college education. There is an apprenticeship requirement.

All of these barriers to entry make it more difficult for that industry to diversify. It’s time for that industry to diversify itself. We know that more than 90 percent of appraisers are white males. There is a challenge when there isn’t lived history being utilized in doing these evaluations. Simply moving to automatic valuation methods won’t simply solve the problem because the reality is that in communities of color, many families live in older homes, homes that you can’t just send housing floor plans for.

We can do that in suburban communities with newer properties, but it’s more difficult to do that in neighborhoods of color. We need to make sure within that industry, everyone is receiving fair housing training. That’s not something that is being required. If we utilize our nation’s fair housing and fair lending laws in a more effective way, we can solve many of these issues, but I think it’s critical that the burden can’t be on the individual to protect themselves from discrimination.

Systemic discrimination has to be rooted out by policymakers and also the marketplace. The marketplace should appreciate that discrimination is a drag on the economy. If the marketplace wants to see itself excel, especially when we know that 7 out of 10 future homebuyers are going to be families of color. If we’re going to have a safe and sound mortgage market, we need families of color able to get safe and affordable loans because the reality is, older homeowners who need to sell their homes won’t have a pool of potential homebuyers to sell their properties to, which will impact their ability to have a safe retirement.

It’s an all-of-us-based solution to really allow for inclusive policies to drive the future economic growth that we all need.

Greer: This conversation about financial education and knowledge or lack of knowledge, or people making poor choices, it is all a veil. It is all a curtain to be held up to hide some things, and I’m going to identify two things that I think it is hiding.

One, that racism is profitable. The existence of racism in this country is something that people can exploit to make profit. When I say it, I’m not just talking about the predatory lender in the strip mall. I’m also talking about the major multinational bank that is running and operating this economy with its cohorts and its friends. That is something that is a real truth, that veil. Because if you’re telling people that it’s about they don’t know enough, or they’re not smart enough, it distracts us from the fact that it is the color of their skin that is creating the barriers that are before them.

The other truth that it distracts us from really talking about and really reckoning with this, yes, Black skin is devalued, brown skin is devalued, but white skin is valued and put on a premium. There is a real value to whiteness, and through public policy, when we’re talking about creating equitable practices, what you are doing is to lower the valuation of whiteness. That is something that we have to be real about if we’re moving in that direction.

This appraisal thing is not just about devaluing Black homes, it is also about scaling the value of white homes. We have to get real about these things if we’re going to do it, and these conversations about people’s choice, people’s knowledge, and people’s ability is to distract us from having that real conversation.

Reed: Absolutely. . . . I was really struck by this story in The Washington Post today [where] they interviewed this Black family in a very rich Black suburb of Washington, D.C., where this family owns a company, they bought a $1.5 million house. These are wealthy, educated people who put a wine cellar and a spiral staircase in their house. To an appraiser, all of that goes out the window because this family was Black.

That just goes to show that the way that it’s constructed, even if you try to take on these emblems of status, the color of your skin still overrides that. That is one of the things that underpins all of this. We create these signifiers of status and types of homes you have, or especially school districts. Quality of schools are a big thing, but so much of that is intertwined with whiteness. I talk about schools a lot because you are buying into a certain school district when you purchase a home.

Appraisers basically recycle that . . . every time they do an appraisal on a house, [it’s] basically showing you what’s the value of being in access to this community. Studies show that middle-class families, families with means, do well regardless of the school that they’re in, but we assign value to the schools where most of the kids are white, and that is in many ways, parallel to what we see with appraisal bias.

What is in the house is often irrelevant in the eyes of valuation. It’s about who’s living in the house and who’s living around the house. That has to change. I think it is often so baked into our perceptions and our culture of a place. Every kid growing up in a city or in a region learns the geography of what are the desirable neighborhoods, what are the not desirable neighborhoods, what are the desirable schools, the undesirable schools, and how they fit into it.

I can’t necessarily blame the individual appraiser for absorbing that too and recycling it, but the question is, do we address this culture first, or do we address the laws around it first? If we address the laws first, is that going to trickle down to changing the culture of place that undergirds all this valuation?

Axel-Lute: This culture that Dan is talking about is still very present, and that premium of whiteness that Jeremie mentioned means that by this supply and demand, there’s still more demand for neighborhoods that are primarily white.

Even if we fix the appraisal numbers, it might not fix what people are willing to pay in those different areas. That’s something that’s very hard to get at in policy. How do we approach that?

Bailey: When we’re talking about the value of whiteness, it’s important to remind everyone that not all Americans have always been white. All white Americans now who are identifying as white are able to do so because of federal housing policies, and that’s why I’m such a champion for policy change because the reality is when neighborhoods were graded based on color code and those maps were actually created to redline communities, there were gradations for those color codes.

Green were a certain type of white, yellow were a different kind of white, and then naturally red was mostly Black, including Black families who were able to afford a mortgage. That’s something critical for us to talk about. We have to look at how those New Deal policies really cemented this idea of what whiteness is and expanded it to more Americans while denying that opportunity to Black families and other families of color.

I dropped in the chat just a description that the Fair Housing administration adopted that gradation from the Homeowners’ Loan Corporation in the way that communities were color-coded and graded. It’s important to understand that white isn’t even a permanent construct. It’s very fluid, and it’s been used to include Jewish people, Polish people, Italians, and Catholics who were not always considered white.

We have to be very, very careful when we talk about changing attitudes and hearts, and separating that from public policy because it is very much so public policy that it cemented what the idea about what whiteness is. We have work to do to help our neighbors appreciate that the way that we have the system set up is such that in those public schools as Dan has mentioned, we see that education is being funded in a disparate way as well. Schools that have predominantly white students in their school districts, they are spending about $332 more, about $23 billion more, on a student.

We are making intentional public policy investments beyond housing in these disparities. That’s why we have to address them through housing because housing is so central and critical to all of them. If we had a whole other panel, we could talk about how, where you live matters so much, that the very air that you breathe… Black people living in formerly redlined neighborhoods, and Latinos living in formerly redlined neighborhoods breathe more toxic air. Housing is the driver, and I really believe firmly that public policies that center inclusive housing growth are the way that we go forward.

Lewis: There’s a lot of interest about special purpose credit programs, [which] are supported by the current administration. Is there concern that that support could change in other administrations and then open lenders who created the programs to the risk of discrimination claims? And what can you do to mitigate that? The second question, is there a way to use special purpose credit programs to target Black small businesses, farm loans, and that kind of thing?

Bailey: No matter what we do, we’re going to face challenges. The point is to design programs in a way that they can withstand judicial scrutiny. That’s why I dropped the link in earlier to the NFHA blog that we did and the legal paper that we produced on how you actually properly design a special purpose credit program. The Equal Credit Opportunity Act is very specific about how those programs need to be designed.

First, the program has to be established and administered pursuant to a written plan that identifies the class of persons that the program is designed to benefit. It must set forth the procedures and standards for extending credit pursuant to the program. Then the second one is that the program is established and administered to extend credit to a class of persons who under the organization’s customary standards of creditworthiness probably would not receive such credit or would receive it on less favorable terms than other applicants.

The Equal Credit Opportunity Act is very prescriptive in how the programs have to be designed and designing those programs with counsel can allow it to withstand any type of judicial scrutiny, but the reality is any inclusive policy in this climate in our country is going to come under attack. We just have to build enough political will that we push back against those attacks. The data shows us that inclusive growth is in the benefit of all of us.

I’m saying that simply because it’s in the benefit of all of us, We should do these things because they’re the right thing to do. Don’t get me wrong. Sometimes in order to convince people to come along with you, you have to help them understand how it benefits them.

I’m sharing that it has broader and global benefits for consumers. Then absolutely you can create a special purpose credit program beyond traditional housing and lending policies. It could be designed for small businesses and other forms of lending. It’s authorized under the Equal Credit Opportunity Act, which applies to lending transactions.

Greer: I’m not at all disagreeing with what Nikitra said about the practicality of where we are now, and what the law’s allowed to do. What I want to add to that is in order for us to get out of this mess, we need to 1) move forward in a way that is creating more inclusivity, and 2) [take] a retrospective and [undo] the harms of the past. That means really reckoning that … certain groups have been disproportionately harmed by our housing system and our land-use system across the country, all these systems, and that there should be an effort to target repair that maybe our current laws won’t allow to those folks. That is the thing that we have to think about moving forward.

If the law doesn’t allow us to just provide first-time homebuyer assistance to Black people, that is something that we should advocate for in law, changes to law, so that we can do, because the reality is, if we keep using these proxies like income, we’re going to miss Black people who have been harmed by that. We’re going to miss indigenous people who have been harmed by land-use policy in this country/ We can’t end our advocacy with the tools that we have today, because they aren’t adequate to really get us out of where we are, into our future.

Axel-Lute: I wanted to give Joe a chance to talk to us a little bit more about the rent-focused underwriting and particularly the surprise that you had when you first got the applicants in.

Hanson: Most of this conversation has been about the systemic issues that have led to it and the systemic solutions that are going to be needed to solve it at scale. In the meantime, we still have families pursuing homeownership.

My part of this conversation is really about how are we coming alongside them and helping with that. The rent focus was one of those responses. It’s really replacing viewing the credit score as the primary vehicle and looking at their ability to sustain rent. Nikitra, I think you made the comment it’s going to be important to understand there’s also some racial bias in rental contracts that could result in disruptions in rental payments, and that could further cost someone to not be able to qualify for this program. We’ll have to be sensitive to that. That’s good, additional learning.

One of the things we learned in the roll-out of this program was we gave applicants a chance to think that there might be a different program, the program that was not previously available to them. Now they have a chance to consider an alternative approach to pursuing their goals of homeownership. What we found was that about 10 percent of the people that approached us and asked us to participate in the rent focus, they already qualified for traditional market product. We were able to connect to them and move them on their way. They didn’t even need this special product. That surprised us.

Oftentimes, too often, people feel they are cut out of a system that they really do have access to. We gave them an excuse, a reason, an opportunity to engage and ask the question. Fortunately, we were there to answer that and move them along. The rest of the families are engaged in various levels of, let’s sort it out. Let’s try to understand your rental history. That’s the second lesson we learned … everyone’s rental history is a little bit different.

There were a lot of cash payments. There were payments of cash to a roommate, and the roommate was on the lease. How do you unpack each one of those very unique rental situations? That is simply not, based on our experience to date, that is not a scalable model as we’re currently experiencing it. How we overcome that as a system is just yet to be understood and yet to be learned, and we’re hopeful that others will learn from what we’re doing and will continue as a system to develop tools that can meet the consumers where they are.

Lewis: There’s a lot of unbanked and underbanked people out there, and a lot of landlords want automatic withdrawals for rent payments. I’m just guessing that there’s a differential between renters of color and white renters and the number of people who are willing and able to pay their rent that way. Do you see that as an issue? Is there any solution to it?

Hanson: To the unbanked, underbanked, I probably don’t have the necessary information to respond to that, but to your comment that many landlords want automatic payments. We were surprised by how many landlords are requesting cash payments. As we’re trying to verify rents, we’re actually relying on checking account statements to see regular cash withdrawals or paychecks being received and $200 less being deposited and really inferring and trusting. That’s probably a stretch that that $200 was the rent payment. For us, it’s more of a cash economy than we anticipated going into this program.

Bailey: That speaks to the challenge of banking in communities of color. We see that bank branches are closing at disproportionately higher rates in neighborhoods of color and upper income, more affluent neighborhoods of color, than they are in white neighborhoods that are less affluent. It’s important that we work on the Community Reinvestment Act and make sure we bring a race-conscious focus to any reform of the Community Reinvestment Act.

Hanson: I want to [say] just one thing. It’s not always a landlord issue because sometimes we have multiple generations living together. It’s the daughter or the granddaughter that wants to buy a house and they’re paying rent to mom or grandma, and that’s a cash payment. It can be a wide variety of situations, but that’s what we’re running into, a cash economy.

Greer: I’ll add quick, the thing that I want to be conscious of and careful of [is] the extent to which that would affect people having overdraft fees, minimum payment fees, within their bank accounts when the timing of the rent payment doesn’t maybe match up with the income coming in.

Bailey: Which takes us right back to credit scoring, because one of the things that we know is that traditional credit scoring doesn’t often report rental payment history. That’s why we need less discriminatory alternatives.

Axel-Lute: Yes, absolutely. There’s been data that shows that just including rent utility payments would shrink the racial difference in credit scores dramatically.

I’d like to give each of the panelists an opportunity to give any final thoughts.

Reed: I’m in the middle of refinancing my house. The appraisal bias has become very relevant to me. I looked for a lender that didn’t require in-person appraisal, and I found one, and they said they actually had to do one. Next week I’m going out of town. I’m taking my dog with me. I’m taking any pictures of me out of the house. I look forward to getting an appraisal for what my neighbor’s house is worth, if not more.

Bailey: I’d like to encourage everyone to pick up the phone and call their Senate offices. Let them know it’s time to pass the Build Back Better Act. It’s $150 billion in a wonderful housing package that has been really negotiated, that has broad support. Polling shows that Americans across the political spectrum want to see a substantial investment in housing. If we invest in housing as a fundamental right, we have a chance to really grow the economy for everyone. Thank you.

Greer: What I want to advocate for housing advocates, to which I include myself as one of them, is to think about the totality of everything that is stripping wealth out of households. Think about the fights that are happening from an advocacy standpoint in those areas and that they are housing issues. For example, the criminalization of people of color, in a way that extracts people’s wealth through court fines and fees, the medical debt that people are carrying because of health care, our awful health care system in this country, just thinking of all of those things and understanding that because they’re extracting wealth, those are housing issues because those are resources that could be going towards housing people.

I think it’s important that housing advocates broaden our perspective to understand the totality of what people are facing when they’re navigating the economy.

Hanson: I’ll make one final comment about just engagement. Everyone’s participation in this panel and on this call represents engagement. They’re interested and engaged in the conversation. Whether it’s as narrow geographically as the Indianapolis Neighborhood Housing Partnership or topically like Dan’s comments about appraisal bias or systemic changes represented by Nikitra, it’s find your point of entry, your point of engagement, and continue the conversation.

Thanks to NerdWallet and Holden for participating with us in this event, all our participants, and all of the audience. Take care.

Comments