This article is part of the Under the Lens series

The Racial Wealth Gap—Moving to Systemic Solutions

Designed by Freepik

Homeownership is widely recognized as a cornerstone of the American dream, especially as a more or less guaranteed ticket to wealth accumulation over time. Despite this hallowed reputation, however, real estate is anything but a level playing field; and while the overt racism of federally sanctioned redlining may be an increasingly distant memory, the deck is still systematically stacked against BIPOC owners ever realizing the true value of their properties. Why? In part, because the very professionals and systems tasked with determining that value—namely those focused on property appraisals (for loan and mortgage purposes) and assessments (for property taxation)—contribute to the problem.

The role of private appraisers in stifling wealth accumulation among minority homeowners is relatively straightforward: an unrealistically low appraisal curtails an owner’s ability to obtain a mortgage or home equity loan, and ensures they receive less than they should at point of sale. The reasons appraisers undervalue minority-owned properties are many, and include a lack of familiarity with the neighborhoods in which they are working, as well as insufficient professional training and expertise. Research published by Freddie Mac in 2021 found that 12.5 percent of the properties in majority-Black census tracts and 15.4 percent of properties in majority-Latino census tracts received an appraisal value lower than the contract price, compared to just 7.4 percent of the properties in White census tracts. This demonstrates an “appraisal gap” of 5.2 percent—meaning that homes in majority Black census tracts were much more likely to be appraised at less than the contract price.

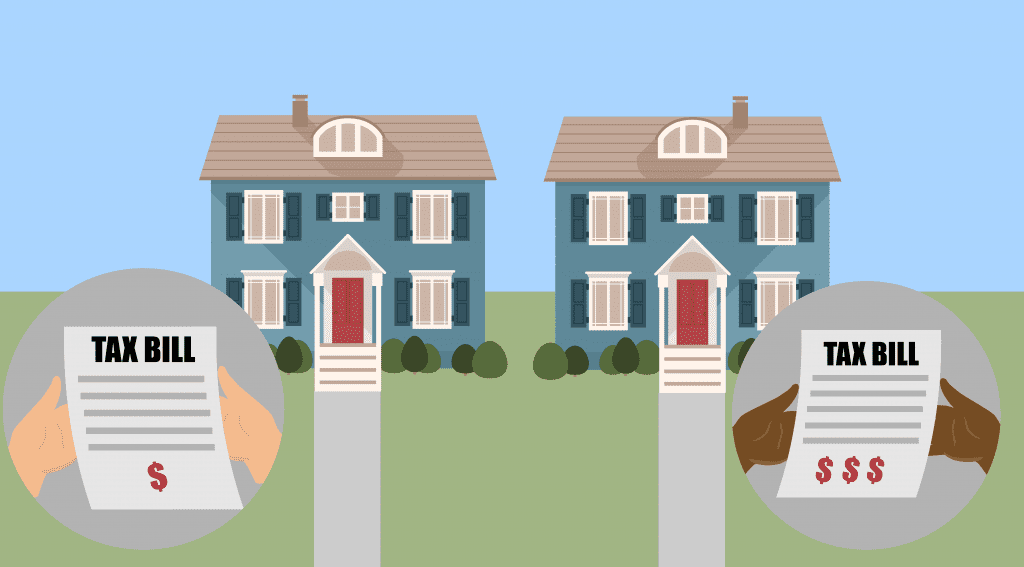

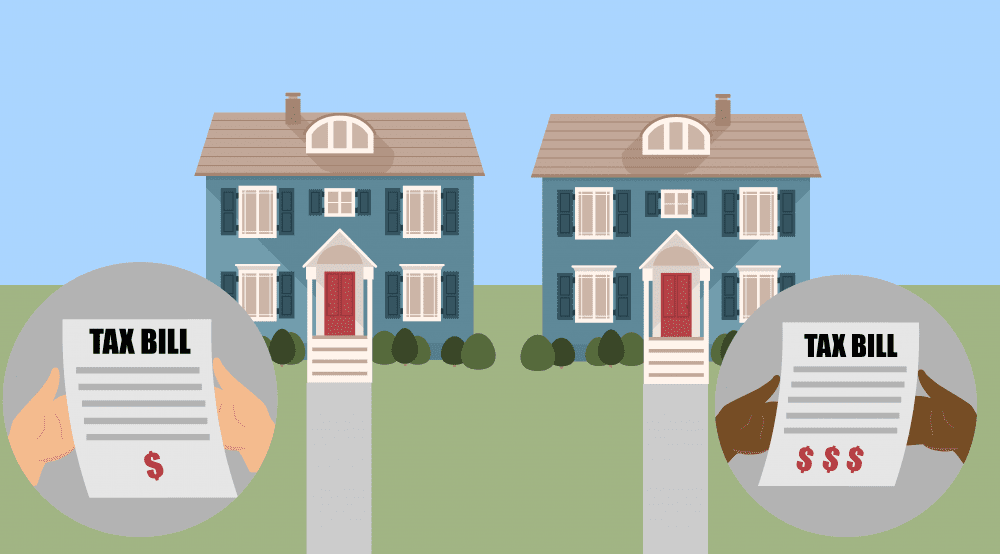

It’s perhaps logical to assume that if these owners suffer in some ways as a result of lowball valuations, they should also see financial benefits in the form of property tax savings. After all, (ignoring the effects of intervening policies like homestead exemptions and tax abatements) property tax bills are the result of applying a uniform tax rate to the value of an owner’s parcel, and the lower that value, the lower the resulting bill. Yet while the assumed relationship between property values and tax bill size holds, the seemingly logical conclusion—that the same households that suffer from low appraisals will benefit through lower taxes—does not. In fact, a number of recent academic studies have shown that minority and low-income property owners pay proportionately more in property taxes than their whiter, wealthier counterparts.

The equity implications of these dual realities are stark. And if we are to move toward creating a real estate market in which all participants receive financial benefits commensurate with their participation, it’s imperative that we understand how the inequities are introduced and what can be done to correct them.

Considerable good work has been done to understand the causes and combat the effects of appraisal bias. In June 2021, the Biden administration called on the Department of Housing and Urban Development to create a Task Force on Property Appraisal and Valuation Equity, charged with addressing inequities in home appraisals. In January of this year, the National Fair Housing Alliance released an 84-page, federally funded report that contains a thorough exploration of the sources of bias in appraisals and makes a series of practical recommendations for beginning to address what it describes as “one of the key drivers of today’s wealth gap.” And state and federal policymakers are similarly becoming engaged in combating this form of valuation bias.

Biased Assessments

Like appraisal bias, bias in assessments has also garnered media attention. Cities from Chicago and Detroit have made headlines for their inequitable, and sometimes downright indefensible, valuations. In Philadelphia, a 2018 investigation revealed that homes that sold for between $25,000 and $50,000—many of which were in communities of color—were assessed 70 percent higher than they should have been, inflating the tax bill for a $37,500 home by about $360 annually. Meanwhile, homes that sold for between $1 million and $2 million were assessed at nearly 11 percent below their actual value, resulting in tax bills that were $2,000 less than they should have been.

And academic researchers like Christopher Berry and Troup Howard have shown beyond a (statistical) shadow of a doubt that while certain cities may serve as the poster children for disproportionately taxing minority and low income homeowners, the problem is truly national in scale, with evidence of assessment bias discernable in large and small taxing jurisdictions alike.

The problem of assessment bias is also squarely on the radar of professional assessors; in fact, it was a major topic at the 2021 International Association of Assessing Officers (IAAO) annual conference. Titled “Embracing Change,” the conference program featured sessions on relevant topics including “Racial Equity in Assessments,” “Diversity and Inclusion: Let’s Dance!,” and “Conscious Objectivity: Beyond Conscious Bias.”

Yet despite public and professional awareness of the problem, efforts to systematically identify its causes and catalog possible solutions are less far along than for appraisal bias, and there are numerous reasons for this lag. The reality that appraisers are employed by private companies, while assessors work for local governments is probably among them. Federal and state authorities may simply be less inclined to go after their municipal counterparts, many of whom are egregiously under-resourced, to correct inequities in a system that is squarely under local control and functions as the financial backbone for most municipal budgets.

The very nature of appraisals versus assessments also helps explain why one has so far garnered more of lawmakers’ attention than the other. Property owners are acutely aware of the activities of appraisers, as they occur at specific times and in conjunction with personally significant activities, like attempting to obtain or refinance a mortgage, or take out a home equity loan. And the results of a too-low appraisal are immediately financially damaging in potentially significant ways. Finally, a too-low appraisal is easy to spot—simply visit Trulia, Zillow, or any other of a number of freely available real estate search engines to gain immediate access to the selling prices of neighbors’ properties.

In contrast, property assessments often happen without an owner’s awareness, let alone involvement. The effects of an inaccurate assessment are less obvious but long-lasting, yielding tax bills that may be too high by tens or hundreds of dollars—amounts that can easily go unnoticed, especially by individuals whose taxes are paid as part of a monthly mortgage. And although many jurisdictions make their assessment data publicly available, it typically comes as downloadable CSV files with less-than-user-friendly data dictionaries—a far cry from the user experience offered by a for-profit real estate app.

Why Are Assessments so Unfair?

Regardless of the explanation, researchers at the Center for Property Tax Reform (CPTR) saw this paucity of information about assessment bias as an opportunity, and set out to learn how it is introduced into public tax rolls and what can be done to address it. The research began with an extensive review of the academic and popular literature, and while this helped lay a foundational understanding of the problem, it became clear that to truly understand how bias arises and the ways it can be addressed and prevented, it would be necessary to learn directly from the assessors who are leading their profession in these efforts. Having identified them at the IAAO 2021 annual conference as leaders in this area, CPTR researchers spoke with professional assessors from four major taxing jurisdictions: King County, Washington; Cook County, Illinois; Minneapolis; and New York City. That research led to the creation of a handbook that identifies 11 unique sources of assessment bias and 25 solutions to address it, a few of which are discussed here.

Some of the sources of bias will be all too familiar to those interested in equity-based issues. A lack of diversity in the assessing profession as a whole, for example, is often cited as a reason why assessments of parcels in neighborhoods of color may be less accurate than in whiter areas. The solutions to this particular problem, unsurprisingly, focus on workforce diversification. And while some jurisdictions have found that connecting to local colleges and universities allows them to hire diverse candidates for internships and entry-level positions, others are choosing to delay civil service exams or de-emphasize the importance of obtaining certain professional certifications prior to employment as ways to remove barriers to entry into the field.

Other sources of bias are more unique to the act of assessing, and in fact are direct outgrowths of professionals’ efforts to increase the uniformity, transparency, and defensibility of their valuations. Although many assessing offices are small and (arguably) under-resourced given the importance of their charge, the use of sophisticated, off-the-shelf computer-assisted mass appraisal (CAMA) software is now relatively routine. At first glance, this practice seems reassuring in that it appears to remove some of the human discretion—and therefore, opportunities for bias to enter the numbers—from the equation. Unfortunately, for majority-Black neighborhoods, the results of these models may leave owners paying proportionately more tax than their counterparts in whiter areas. Why? The answer is somewhat complex, but worth examining.

CAMAs rely on comparable sales to impute property values, but while two properties may look similar on paper (with regard to factors like age, square footage, style, and other factors that affect value), one located in a majority-Black area may, in the actual real estate market, command a lower price than one in a majority-white neighborhood. It is worth noting that the undervaluation happening in appraisals is essentially an exaggerated representation of this actual market trend. So, to the extent that an assessor’s model includes comparable properties, known as comps, from whiter neighborhoods, it will tend to overvalue (and as a result, overtax) the properties of Black owners.

Off-the-shelf CAMAs also appear to be less reliable in providing accurate valuations in urban locales, as opposed to places with more rural or suburban characteristics, an important limitation given that the majority of urban residents in the U.S. are non-white, while suburban and rural locales are majority white. Largely an artifact of the assumptions that went into the models’ construction by commercial vendors, many assessing offices lack the internal capacity to detect or correct such shortcomings.

Finally, there exists a particular set of circumstances under which CAMAs (and even non-model-based techniques) can yield inaccurate valuations that negatively affect minority owners, namely, one in which white buyers are flooding the market, driving rapid price increases. That’s right; inasmuch as assessors rely on (even somewhat) dated data, their values can effectively subsidize gentrification because new owners receive an invisible tax break when valuations fail to keep pace with the market.

The solutions to address model-based bias—and in fact, data-driven bias of almost any sort—are numerous, and begin with assessment frequency. Simply put, the shorter the assessment cycle, the more likely the results are to be accurate, particularly in periods of rapid market changes. Ensuring that comps are representative of all neighborhood and property types to be valued, along with customizations to modeling software, can also go a long way toward producing unbiased results.

Appeals are another double-edged sword in the world of assessment equity. Intended to provide taxpayers the opportunity to challenge unfair assessments, the appeals process can be applied in a way that disproportionately benefits wealthy property owners, often at the direct expense of less well-off ones. In Los Angeles, for example, mass appeals filed by private law firms representing new owners of expensive homes flood the system and, to the extent they are successful, put additional fiscal pressure on other property owners whose bills must make up the difference. In Chicago, which unlike the majority of taxing jurisdictions lacks a millage rate, one owner’s success in reducing their assessment translates directly into higher bills for other residents who must fill the revenue void. This is especially problematic in a city where challenging assessments is a routine undertaking for owners able to afford it, and the mailboxes of new homeowners flood with advertisements from lawyers willing to file on their behalf.

The solutions to appeals-related inequities are complex and necessarily place-specific. Some jurisdictions have considered levying fines in conjunction with unsuccessful mass appeals as a way to deter them, but others fear even the threat of a new financial barrier to appeals will dissuade lower-income owners from pursuing them, potentially exacerbating tax inequities in the process. Others, like Chicago, are working to increase the accessibility of their assessment data to lay audiences and providing guidance about when an appeal might be warranted, while also limiting the effect of heavy-hitting lawyers by anonymizing portions of the appeals process.

So the fact remains: like property appraisals, property assessments put BIPOC property owners at a financial disadvantage. The sources of assessment bias are many and varied, because the act of valuing hundreds, thousands, or even millions of properties at a time is complex, especially in under-resourced jurisdictions, of which the U.S. has many. And while mirroring market values is considered the gold standard, in a world of rapidly rising real estate prices, mass appeals, and a host of state-level laws that prevent assessors from ever seeing sales data, even an assessor who is fully aligned with their profession’s commitment to producing “fair and equitable” valuations may fall short of this goal. This is not an acceptable endpoint, of course, and by thoroughly understanding the sources of, and solutions to, assessment bias we can move closer to a reality in which all people are equally able to realize the American dream.

Comments