This article is part of the Under the Lens series

The Racial Wealth Gap—Moving to Systemic Solutions

Photo by flickr user futureatlas, CC BY 2.0

Note: This post was originally published on brookings.edu.

For most of the 20th century, the U.S. has relied on homeownership—subsidized through federal tax policy—as a means of wealth-building. While homeownership can be an effective asset-building mechanism, it also poses some financial risks to households. Specifically, housing is not diversified or liquid, and the returns on investment vary widely across geographic markets and timing of purchase. Moreover, because of racial discrimination in housing and mortgage markets over many decades, a reliance on homeownership continues to exacerbate the wealth gap between Black and white families.

A more balanced set of policies could both increase financial security (particularly for low- and moderate-income households) and shrink the racial wealth gap. These alternative strategies would not replace homeownership, but instead overcome the limitations of homeownership, especially by providing greater liquidity and diversification. But before we get into the alternative strategies, let’s take a look at why they are needed.

The Challenge

Even before the COVID-19 pandemic, too many U.S. households had almost no financial cushion. Having at least some readily accessible savings allows people to meet unexpected financial demands: the loss of a job, an urgent health care need, or everyday occurrences like home and car repairs. As of 2019, 40 percent of households could not pay for a $400 emergency without borrowing—let alone withstand several months of a broad economic slowdown.

Wealth is not distributed evenly across all households. The wealth gap between non-Hispanic white households and Black households is large and persistent. According to the 2019 Survey of Consumer Finances, the median white family had eight times the wealth of the median Black family, and five times the wealth of the median Latinx family.

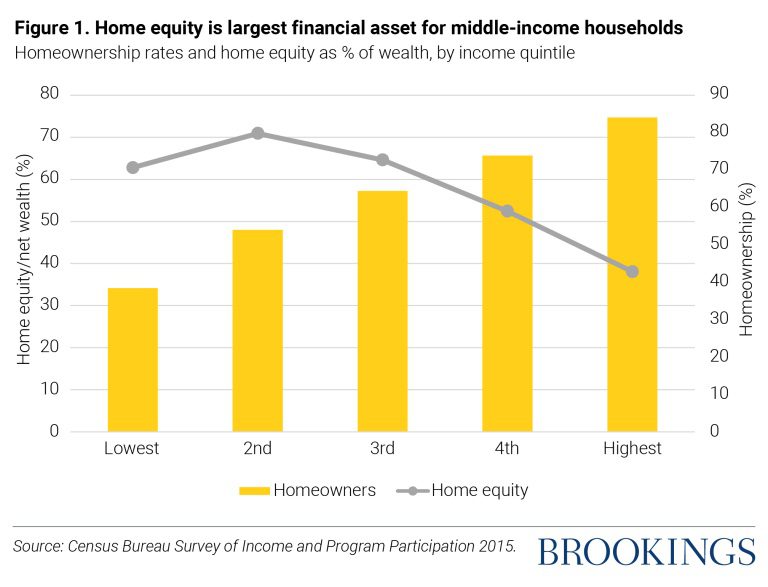

Since the mid-20th century, the U.S. has primarily relied on homeownership as a strategy for middle-income households to build wealth. For households in the three middle-income quintiles, home equity is the largest single financial asset, representing between 50 percent and 70 percent of net wealth. But relying on homeownership as the primary source of wealth has inherent riskiness for households, and continues to drive the wealth gap between Black and white households.

- encouraging short-term, liquid savings through employer-matched savings programs

- replacing the current mortgage interest deduction with a targeted first-time homebuyer tax credit

- providing subsidies for longer-term asset-building through individual development accounts (IDAs) and child development accounts (“baby bonds”).

Providing greater public support for alternative wealth-building strategies is not intended to discourage homeownership, but rather to complement it and to address its limitations.

Limits of Historic and Existing Policies

The nation’s historic reliance on homeownership for wealth-building creates risks for individual households and exacerbates the racial wealth gap. Current homeownership subsidies—particularly the mortgage interest deduction—are poorly designed to achieve social goals.

Homeownership carries financial risks

Homeownership has several key features that make it attractive as a wealth-building tool. Understanding these features is useful in designing effective alternative strategies. Because of the structure of U.S. mortgage markets, households can borrow most of the upfront costs at relatively low interest rates to leverage their initial investment. Paying down a fully amortizing mortgage over 30 years allows homeowners to build wealth through forced savings, without needing to consciously set aside unspent income each month. Fixed-rate mortgages provide certainty over monthly housing costs for a very long time, creating a hedge against future rent increases.

On the other hand, homeownership has some risks and limitations as a wealth-building strategy (Table 1). One of the key principles of financial advice is to invest in a diversified portfolio, spreading savings across a range of industries and firms (for example, through mutual funds rather than individual stocks) to reduce the risk of large losses.

Buying a home is the opposite of diversification. For families without large amounts of wealth, homeownership concentrates a family’s resources in a single physical asset, industry, and location.

Real estate’s location-specific nature translates into an asset class that can create both big winners and big losers. Housing price appreciation has varied widely across U.S. communities over the past 20 years: Homeowners in the San Francisco Bay Area have reaped windfall gains, while homeowners in Cleveland have—at best—kept pace with inflation. Even within the same community, the timing of purchase matters. Many homeowners who bought in 2005 and 2006—near the peak of the housing boom—experienced precipitous price declines that left them underwater (owing more on their mortgage than the house was worth) for a decade.

Even for homeowners who have built up equity in their homes, extracting cash to cover short-term needs can be complicated. A house is not a piggy bank; although home equity loans and cash-out refinances can allow owners to tap into their equity without selling the home, these tools involve transaction costs, and are not universally available.

Housing market discrimination adds to the racial wealth gap

Beyond risks to individual homeowners, the larger social concern is that decades of discrimination in housing and mortgage markets have contributed to substantial wealth gaps between Black and white households. The homebuying process creates numerous avenues for potential discrimination, often in ways that are difficult to prove. Real estate agents choose which homes and neighborhoods to show potential buyers, “steering” Black and white clients toward neighborhoods that match their own race and thus reinforcing racial segregation. For most of the 20th century, banks could legally discriminate against Black mortgage applicants—a practice supported by the federal government’s redlining policy. More than 50 years after the 1968 Fair Housing Act, evidence of housing discrimination can still be found in mortgage lending.

Barriers to Black households buying homes have created a cumulative wealth disparity over time. White homeowners have been able to pass along wealth to their children—for instance, by assisting with downpayments—while Black households have been systematically shut out of this intergenerational wealth-building. Black and Latinx families are less likely to own their homes than white families with similar incomes. When Black families do buy homes, they often buy lower-valued homes in neighborhoods that experience less price appreciation. In 2015, the median non-Hispanic white homeowner had $100,000 of home equity (home value less outstanding mortgage balance). The median Black homeowner had slightly more than half that much equity, at $56,000.

Even if the U.S. managed to eliminate racial discrimination in all housing transactions—which would require substantially more resources and political will for fair housing enforcement than the country has yet shown—that by itself would still do very little to reduce the wealth gap created over the past 200 years.

Homeowners are more politically and socially engaged—for better or for worse

One rationale offered for subsidizing homeownership is that homeowners create positive spillover effects in their communities. For example, some research has found that homeowners maintain their homes in better condition than renters do, which translates into higher property values for their neighbors. Similarly, other studies find that homeowners invest more in their children’s education, are more likely to vote, and generally engage more in civic organizations. But the empirical evidence in support of these claims is mixed, and suggests that the costs of public subsidies are much larger than any social benefits.

Moreover, greater political engagement by homeowners relative to renters is not an unmitigated blessing, because it exacerbates social and economic inequality. At the local level, homeowners often organize against changes that they perceive as threats to their property values, even if those changes offer broad social benefits—for instance, building housing for low- and moderate-income households. Participation at community meetings tends to be dominated by older, white, and male homeowners, regardless of larger community demographics. Simply put, homeowners’ incentives to protect their personal financial assets may not align with larger societal goals.

Current homeownership subsidies are poorly designed

The primary tool to encourage homeownership—preferential treatment under federal tax policy—is inefficient, regressive, and expensive. The mortgage interest deduction (MID) allows homeowners to deduct interest paid on a mortgage from their income subject to federal income taxes. Benefits only accrue to households that itemize their deductions, with the largest benefits going to high earners (who have higher marginal tax rates) and households with very large mortgages (who have high incomes and live in expensive housing markets). Even before the 2017 Tax Cuts and Jobs Act, most middle-income households outside expensive coastal areas received little or no benefit from the MID. After the Tax Cuts and Jobs Act doubled the standard deduction, the share of households who itemize has shrunk substantially, while the benefits are even more concentrated among high-income households.

This structure means that the MID has virtually no benefits for first-time homebuyers, and therefore does not increase the country’s overall homeownership rate. However, it does encourage high-income households to purchase more expensive homes and take out larger mortgages (up to the $750,000 cap), relative to the value of the property. The distribution of benefits is highly regressive, overwhelmingly favoring high-income households. And the MID is expensive: In 2019, homeownership subsidies, including the MID, cost the federal government an estimated $196 billion.

Policy Recommendations

To help households build more balanced and liquid savings portfolios, policymakers should pursue two approaches. First, redesign homeownership subsidies in the tax system to better support moderate-income first-time homebuyers. Second, develop and encourage wealth-building mechanisms outside of homeownership, including short-term and long-term assets.

Target homeownership subsidies to moderate-income first-time homebuyers

Federal tax policy could more effectively help moderate- and middle-income renters afford to purchase their first home. A number of scholars have offered proposals for how to do this; they differ somewhat in the details, but mostly share the general structure of targeting assistance at first-time buyers, rather than delivering annual subsidies to existing homeowners.

One example, proposed by economists William G. Gale, Jonathan Gruber, and Seth Stephens-Davidowitz, involves two changes to current tax policies. First, convert the MID into a one-time refundable tax credit for first-time homebuyers, with larger credits for lower-income households.

Second, to offset any disincentive this might create for renters to save toward a downpayment, the federal government could create a new matched savings program, with preferential tax treatment and designated uses of funds. (This could be paired with individual development accounts, discussed below.)

These two prongs—helping households build a pot of savings to apply toward a downpayment and offsetting the initial cost of purchasing a home through a refundable credit—would better support moderate- and middle-income households, at an annual cost of about one-fourth of the expenditures on the MID ($16.8 billion compared to $72 billion, in 2006 dollars).

Address the racial wealth gap through individual and child development accounts

The adage “money breeds money” highlights a key obstacle to closing the racial wealth gap. The typical white family under age 35 has wealth of about $24,000—an initial sum that can be invested for the future. The typical Black family under age 35 has wealth of about $600—a sum less than typical monthly rent. Latinx families of similar age fall in between, with median wealth around $11,000.

Families with little wealth are more vulnerable to negative economic shocks and may have to incur costly debt (like credit card balances) just to pay current expenses. Moving Black families without savings onto an upward trajectory will require an initial endowment of “seed capital,” most likely from public subsidies. Scholars have suggested two proposals to do that, one focused on adult savings and the other on children.

Individual development accounts, or IDAs, are specialized savings accounts that help households accumulate funds for designated nonretirement goals. To date in the U.S., these have mostly been attempted as small-scale pilot programs, although there have been proposals for universal programs. For low-income households, contributions to these accounts are matched by public subsidies. Funds could be withdrawn without penalty for designated uses, such as postsecondary education, starting a business, purchasing a home, or home repairs. Researchers who evaluated the pilot programs conclude that IDAs can increase access to homeownership and nonretirement financial asset-holding among renters. For small-scale programs, administrative costs were relatively high ($60 per participant-month). Total program costs would depend on how many households were eligible to participate and the savings match rate.

The 2020 Democratic presidential primaries drew new attention to child development accounts, sometimes referred to as “baby bonds.” Based on research by economists Darrick Hamilton and William Darity Jr., the federal government could establish savings accounts for every child born in the U.S, with the size of the initial subsidy determined by the family’s wealth. Similar to IDAs, funds could be withdrawn once the child reaches age 18 for qualified uses, including education, starting a business, or the downpayment on a home.

Using wealth instead of income to determine the initial subsidy has two advantages. First, wealth more accurately indicates the level of family resources available. Second, while a baby bond program would be prima facie race-neutral, because of the substantial wealth gap between Black and white families, most Black families would receive larger initial endowments. Depending on the specific design, Hamilton and Darity estimate that three-quarters of newborn children could receive some funding through a child development account, with an average value of $20,000 and a maximum of $60,000. Based on their assumptions, the program would cost roughly $60 billion per year (in 2012 dollars).

Help all households build short-term liquidity through employer-matched savings accounts

Home equity, IDAs, and child development accounts are all intended as long-term investments, similar to retirement accounts such as IRAs and 401(k) plans. One can’t withdraw funds from these accounts without incurring transaction costs, effectively deterring households from depleting their nest egg early. But all households—homeowners as well as renters—would benefit from having some savings that are more readily accessible to help cover short-term expenses like emergency car repairs or urgently needed health care.

Wealth disparities between white, Black, and Latinx families are also apparent in the amount of emergency savings they hold. Nearly 99 percent of white families have some liquid assets; the value of those assets is about $8,100, compared to $1,500 for Black families and $2,000 for Latinx families.

Behavioral economics offer some insights into why most people save less than they intend. It is human nature for people to highly value short-term happiness, while having trouble envisioning the longer-term costs of inadequate savings (poverty in old age, for instance). Lessons from behavioral economics have influenced the design of retirement plans and led to higher enrollment rates; they could also be used to establish successful programs encouraging savings for shorter-term needs.

One model proposed by household finance experts is an emergency savings plan administered through employers that operates in many ways like a 401(k). Workers would be automatically enrolled in the plan, a technique used by retirement accounts to encourage higher participation (but they could elect to opt out). Under the plan, a designated percentage of the worker’s weekly (or monthly) paycheck would be deposited in a savings account, kept separate from both the worker’s regular direct deposit and any employer-sponsored retirement plans or health savings accounts. Separating funds into different pots helps people’s mental accounting; regular pay deposited into a checking account is for typical expenses, while funds in an emergency savings account are for unexpected “rainy day” expenses. Individual employees’ contributions could be matched by their employers, with the incentive that financially secure workers will be more productive. Allowing savings to be deducted from taxable income—similar to 401(k) plans and employer-provided health insurance—would further encourage participation.

While some version of this could be designed with minimal public subsidies (depending on tax treatment of savings), once the mechanism exists, it could also be adapted to include subsidies (public matches to individual and/or employer contributions) for low-income workers. Offering a publicly run version for self-employed workers, small businesses, and others whose employers do not offer the program is another potential extension (conceptually similar to the state-run health insurance plans under the Affordable Care Act).

Better for Renters and Owners

For decades, the U.S. has heavily relied on homeownership as a strategy for household wealth-building. This offers some useful features—notably, a forced savings mechanism and hedging against rents rising faster than income. But there are also limitations from both an individual and social perspective. Housing is undiversified and illiquid, and thus risky for households. Decades of racial discrimination in housing and mortgage markets have largely excluded Black and Latinx households from homeownership. Excess reliance on home equity also incentivizes homeowners to fight against investments (such as affordable housing) that would have widespread social benefits.

A more balanced set of federal tax policies could support first-time homebuyers—including populations that the housing system has historically discriminated against—while allowing both renters and owners to develop savings through alternative vehicles.

|

Help keep us strong by becoming a Shelterforce supporter. |

Thank you for this excellent article. We are all affected by a birth-to-death advertising campaign to buy junk we don’t need, wear clothes to define us, and buy vehicles we cannot afford. Weaning people off short term gratification purchases and onto the deeper empowerment of having no debt and watching a savings plan grow would be priceless!

Using the IDA idea as a ‘carrot’ for motivating recipients of subsidized housing households to become self-sufficient would also have powerful, long term psychological and economic value.

The problem I see needing a solution is that when a Section 8 household lands a job, they must report an income increase. Their rent subsidy, being determined by income, is immediately reduced by any increase in income from the new job. The outcome is no net gain in household income and a loss in time spent at home with their children. This becomes a disincentive to connect work with getting out of subsidized housing and building a better future.

One solution could be to keep the subsidy amount level and put a portion or all of the increased earned amount into an IDA that is matched up to a certain amount and for a determined period. This would start building an emergency fund, then as it grows, a fund big enough to have both an emergency fund and also cover the expenses required to rent a market rate property. Hopefully the savings die is cast and when mixed with other incentives, as you suggest, would build an emergency fund and a down payment on a house.

The point is to change attitudes toward what wealth is and to encourage wealth building through a regular savings plan. As you point out, sometimes we need some help to make the mental conversion from defining wealth as a a shiny $40k depreciating truck stuck in the driveway with staggering monthly payments – to a glowing $40k bank account that will take you almost anywhere.

The group left out of this conversation, as usual, are disabled persons who also need programs which allow them to save for an unexpected emergency and encourage long term savings for a home down payment. This could be accomplished with a subsidized IDA and deeper mortgage first time buyer assistance. The liquid wealth held by these households, many of them single persons, is very similar to black households. There is, undoubtedly, a racial wealth gap but there is also a Disabled Wealth Gap. Disabled persons are just as likely to experience a unexpected expense, many times it is the cost of medical care. Even after Medicare many expenses remain out of pocket for this group. They deserve hope of a better future instead of dread related to questions about how they will be able to pay for assisted living, etc. should they require it. A section 8 household is usually income steady with no employment but many states still count IDA’s as a countable liquid asset against the SNAP food assistance program and medicaid eligibility. The Federal government needs to create new supports for these persons, especially with HUD and USDA (food). Housing Choice Vouchers subsidize rents but are very difficult to use for first time homeownership. The current mortgage interest deduction is useless for a disabled person whose social security is low and not taxed. A credit would not be realized. Until we include everyone in the conversation about a wealth gap, public policy does not keep pace with reality.

All very good points Hannah! Noting for potential future coverage.

As Mr. Murnen notes, we have an economic system controlled by the .1% with the help of the 1% to 10%, who depend on having low paid disposable labor to make stuff for them, but also are beaten over the head with advertising to buy the stuff, resulting in excessive debt and occasional purges of debtors and other vulnerable people. They have the power to decide who benefits from investment and fund the political system, which earns votes by inducing conflict through various culture wars over personal differences that exploit fear and grievances. Homeownership is one issue among many and achievable tweaks might help some but will not deal with the real problem. Environmental limitations, the occasional crashes of the market, and events like pandemics aggravate the problems, Ultimately the enormous differences in wealth and power must be reduced, education, employment and wealth must be provided and there must be institutions that allow people to have some power over their lives..