Topic

Financial System

“Income is how you get out of poverty; assets are how you stay out.” How do we build policies, programs, and products that reduce systematic inequality and advance financial security for all?

The Latest

EPA Terminates Already-Awarded Climate Funding

The agency says $20 billion in green funding for low-income communities was mismanaged and issued with political bias, but so far the EPA hasn’t produced the evidence needed to legally block the grants. Three nonprofits have filed suit.

Explore Articles in this Topic

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

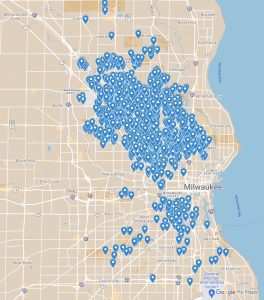

Corporate Landlords Profit from Segregation, at Cost of Black Homeownership and Wealth

As more and more affordable homes are gobbled up by corporate landlords, prospective Black homebuyers are seeing opportunities for homeownership dry up.

CDCs Are Having a Moment. Can the Momentum Last?

Over the past couple of years, community development corporations have been popping up in sometimes-unexpected places across the country. Will this increased interest in CDCs last, or is it a trend that will end when the money runs out?

When Landlords Hide Behind LLCs

It’s difficult to know who owns a property because corporate landlords and investors tend to structure their business as limited liability companies, or LLCs.

Unmasking the Property Owners

There’s a reason land ownership is a matter of public record—but at the moment the records we have aren’t actually doing the job.

Breaking NYC’s Housing Speculation Cycle

When wealthy investors treat homes like poker chips, it is the tenants who end up losing. How do we interrupt the vicious cycle of speculation and displacement?

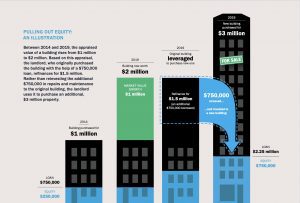

The Financialization of Housing and Its Implications for Community Development

Over the last two decades homeowners and investors have increasingly treated housing as a financial asset, like stocks or bonds. How has this changed the housing market for the worse, and how can we fix it?

What Is the Financialization of Housing?

It’s a wonky term with real-life consequences. At its most basic level, the “financialization of housing” means treating a home like a financial asset first, and a place to live second. But there are many more perspectives.

Making Money Over Making Homes

Housing has become less about shelter and more about extracting profit. How has that way of thinking changed the market and what are housing advocates trying to do about it? In our new series—Homes or Cash Cows—Shelterforce explores the financialization of housing.

Proposed CRA Rule Receives Mixed Reviews from Housers

Public comment is open through Aug. 5 on proposed Community Reinvestment Act rule changes. They are worlds better than the Trump-era proposal. Why are some advocates still disappointed?

Dear CDFI Colleagues: It’s Time to be Transparent About Salaries in Job Postings

Companies that value meritocracy perform worse with pay equity when their internal policies do not align with their public-facing statements regarding pay.

Affordable ADUs: How It’s Being Done

In the face of limited financing options, local governments, nonprofits, and social enterprises are experimenting with ways to make affordable ADUs a reality.

How Financing Barriers Keep ADUs Expensive

Most homeowners have neither the capital nor the credit to self-finance an ADU or get a loan to build one. If financing doesn’t change, ADUs will stay niche and expensive.