This article is part of the Under the Lens series

The Racial Wealth Gap—Moving to Systemic Solutions

To kick off the release of our new Under the Lens series, The Racial Wealth Gap—Moving to Systemic Solutions, Shelterforce’s Miriam Axel-Lute chatted with Anne Price, president of the Insight Center for Community Economic Development, about what typical conversations about closing the racial wealth gap often miss and the dangers of over-emphasizing more homeownership as a solution. For more, read (or listen to) Anne’s article “Doing ‘The Right Thing’ Won’t Close the Racial Wealth Gap” and keep an eye out for the upcoming weeks of the series by subscribing to Shelterforce’s weekly newsletter.

What follows is a lightly edited transcript of the Facebook Live conversation.

Miriam Axel-Lute: Hello, everyone. Welcome to our launch of Shelterforce’s new series The Racial Wealth Gap—Moving to Systemic Solutions. We’re so excited you could join us on Facebook. I want to introduce you to Anne Price of the Insight Center for Community Economic Development. I first encountered Anne’s work when I was reading a report she wrote. I loved what she had to say so much that we took an excerpt and asked if we could reprint it. It ran under the headline of “Stop Talking About the Racial Wealth Gap.” I have to say, Anne, now I keep making you talk about the racial wealth gap or asking you to, so are you mad at me yet? That is what we’re going to do today.

Anne E. Price: No problem. Love to talk about it.

Great. Why don’t you start off by telling me—you’ve been looking at this, studying it, working on it for a long time. What are some of the most common approaches out there that people put forward for addressing the racial wealth gap, and why are they missing the mark?

Thanks for that question. When I started this work, the name “the racial wealth gap” had just really come into being. It really came out of work that experts were doing about 11 or 12 years ago. [They] said, “We have a problem we need to solve, and that problem is racial wealth inequality.” That name was born, and it’s really been very branded. There are a couple of things I think about when I hear folks talk about the racial wealth gap and more particularly when they say “We’re going to close the racial wealth gap.”

I think it’s really important to understand what we’re talking about when we say we’re going to close the racial wealth gap. Oftentimes, we conflate individual-type solutions with a deep-seated structural issue. You can’t talk about closing the racial wealth gap with a financial literacy program, with the homeownership program. It is deeply structural. We know this has been 400-plus years in the making. It’s not going to be solved easily. I think what we need to do is really talk about the goals that we have at hand.

Some of those goals are like, “We want to put an asset into a family’s hands. We want to help people get an asset.” That’s an approach, but it’s not about closing the racial wealth gap. Oftentimes, I think what we get wrong is the fact that we confuse an individual-behavioral approach with a deeply structural one that will take a myriad of policies and approaches to help us get to that finish line. I think that we get obsessed with homeownership and entrepreneurship to the point where it blinds us to the true root cause of this problem.

I remember being very struck the first time we spoke [when you talked] about how we misunderstand how wealth works on an individual level, which leads us to possibly not focus on even the most useful programs for an individual, let alone at a structural level.

Yes, you’re absolutely right. I mean, I think we still sometimes lose sight of how wealth is created, and we think about this as if we get an asset in someone’s hands, there you go, wealth has been built. Wealth is intergenerational. I always say it’s like the roots of a tree. We can’t necessarily see them, but they are the foundation. Wealth is passed down from generation to generation. Just because someone has one asset doesn’t necessarily mean that they have wealth, [and] it doesn’t mean that’s an asset can be readily passed down and generate wealth for another generation.

A perfect example is we don’t really acknowledge the numerous policies that our government put in place to enable white people to build wealth. It’s policy after policy, and I know that a lot of listeners have heard some of those policies. Whether it is the Homestead Act when people are basically given free land (that about a quarter of the population still can trace their roots to), or whether it is the ability to move into the suburbs into homes that will certainly build value and something that you actually can build wealth from. All of these were enabled. I think about it in terms of the latest COVID packages that we saw, when we’re spending trillions of dollars. Well, imagine if only one group got those dollars.

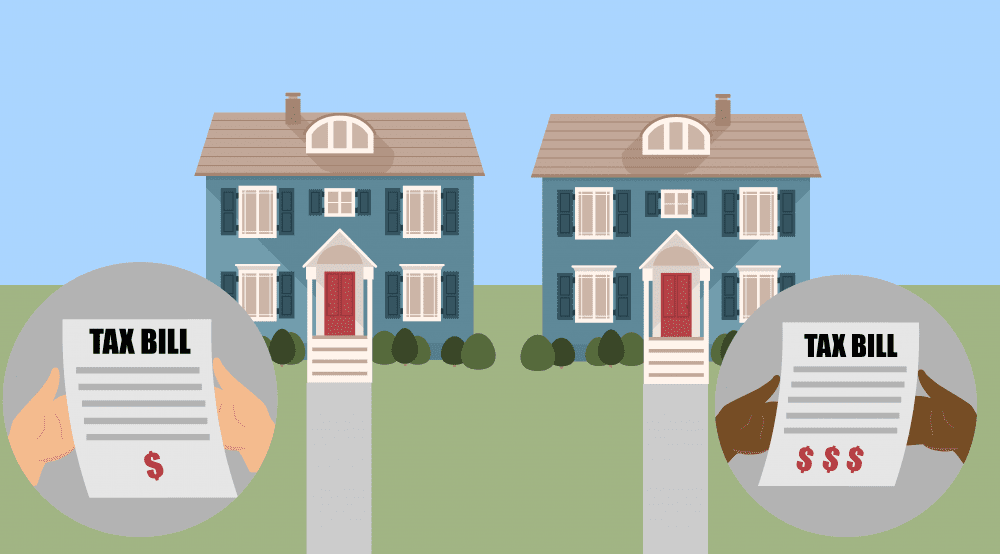

Then they got them again and then they got it again, another generation got it, then another generation got it, almost exclusively. I think what really deeply concerns me is what we say, particularly to Black Americans: “You go out and you buy a home, you build your wealth,” but we don’t talk about the fact that their path, our path, is very different than the path that whites have taken. We can increase that homeownership rate, but it doesn’t mean necessarily that we’re going to build wealth. It’s not the same tool. What we’re saying is, “You go figure that out, and you build it.”

We have invested beyond measure funds for white folks over generations. That’s where we get into this, “Wait a minute, let’s really talk about how people got wealth in the first place, why they’re able to maintain it, and then pass it down.” Once we can get that clear understanding, then maybe we can have a different conversation.

One of the things that I frequently don’t see being addressed is not only did the government hand white folks all of this support but also the wealth that was built didn’t just come from having a home. It came from hoarding opportunity in a neighborhood that others weren’t allowed into and making that a scarce resource, which is not something that we want to replicate today, even if we could. That particular great jump in housing equity that happened in the mid-20th century is just not a repeatable or desirable phenomenon.

We most certainly know that home values, there’s a myriad of factors, but the fact that your neighborhood could look a certain way. The analyses have already been done. Breaking down education, breaking down income, breaking down everything being equal. We know that homes owned by Black folks are devalued, that very same home, because of its location, is devalued. The value comes from whiteness and that’s something that we can’t grapple with. It is created. As long as that neighborhood can maintain a certain demographic, homes can retain value.

We know that this is also human behavior. We’ve seen it in research that shows that once a neighborhood starts to get more people of color, somewhere around 10 percent, white people don’t want to live in those neighborhoods anymore because they see it as a means to have their homes be devalued. Let’s not say that because a Black person gets a home that automatically it will accrue value. I’m in an outrageous housing market. I’m in the Bay Area, I’m in Oakland. The median home price is about 1.2 million. We talk about people, friends who have 1,100 square feet, their homes worth over $1 million. It’s bonkers.

When you think about who has access to homes of that value…you got in early, but what’s the ability now for someone to come in and buy a $1.2 million home, a starter home? When I think about my hometown where I was born, I could outright just go buy two homes. There’s no value in the West Dayton [Ohio] neighborhood where my family started, where my parents got their start. We know that all those things matter. It’s not an automatic wealth generator as soon as you purchase a home. And we don’t talk about under what conditions can you build wealth through homeownership? What has to exist? We need to talk about that more.

Why do you think we don’t talk about it? Is it just hard to admit that we’re still a racist society?

[Of course] at some level people will say, “Why can’t we do this to the same means? Why now, when Black folks could really begin to buy homes in the way they can today, can they still [not] purchase those homes that can accrue value in the same way that white folks can?” There’s so many things that come into play, property taxes, appraisal, lending discrimination, municipal fees—a range of things that create barriers, that extract and siphon wealth from families, that actually are not happening in predominantly white neighborhoods.

We don’t want to talk about segregation. We don’t want to talk about bias. We don’t want to talk about the fact that these types of roadblocks still exist and while we try to knock down one, there’s seven others that still create substantial roadblocks for folks. It’s a dream—we call it the American dream—this idea that if you could just buy a home everything is going to be all right. It’s hard for folks to not think about homeownership in those ways. That’s our narrative. That’s our dominant American narrative. It fits with any immigrant group coming in.

It doesn’t mean that Black folks don’t have that same idea. Why can’t we have a piece of that dream? I think it bumps up against our ideas of what it means, our identity as Americans [is] tied up in that ideal of homeownership. There’s a lot of reasons why homeownership is critical. Well, sometimes we just think that wealth is an automatic thing, [but] you could buy a home and still not build wealth. But it still provides other things that are important to you, your sense of community, you’re close to your family members, or a certain place that you want to see your children grow up.

There are other important things that we can still talk about. I think when it comes to wealth, it’s almost like we shut the conversation down before we can actually get into what it looks like—particularly because we know housing markets are local or regional—what it truly looks like, and what are those barriers? How do they play out? We don’t talk about why it takes eight years longer for a Black family to actually get the downpayment on a home. Why they can’t rely on some of the same means that white families can, why their homes are taken at higher rates, they don’t live in those homes through mature adulthood, a whole host of things that get lost in our conversation.

When you say homeownership (it’s either that or entrepreneurship) is the way and the means, it’s actually harmful. It’s harmful to make those blanket statements. It’s OK to say, “How do we think about the ability to build equity, that can actually be a wealth generator?” Just like we do with entrepreneurship. We know that business owners when they come with wealth, they can build wealth more readily. They can weather storms, they can grow.

Wealth begets wealth. I always say a home requires wealth. It requires wealth to put a downpayment on a home, it requires wealth to maintain a home. It just doesn’t come as this blank canvas. We need different conversations, Miriam. We really do.

What harm do you see coming from that emphasis on homeownership? I know when [HUD] Secretary [Marcia] Fudge was new, you tweeted at her “This focus is harmful, this false premise.” What harms do you see flowing from our assumption that homeownership will just build wealth?

We’re willing to believe something that data and research shows is not necessarily true. We’re willing to take that data and research and push it to the side. Like I said, in certain circumstances, people can build equity and wealth, but when we look at the numbers, when we look at all those things I talked about—I know that Andre Perry has done a great job at Brookings—let’s break this down and look at holding everything equal. I’m not saying that some people can’t build wealth that way, but I think to say we are going to try to solve a problem, that is harmful because it’s not looking at all the other factors that come into play.

Wealth doesn’t come through one asset. We know you need a portfolio, we know you need steady income, we know you need consistent income. We know you need those things, and we know that a diverse portfolio [enables] you actually to build wealth and utilize it to weather catastrophes, and to build on itself to gain more wealth. To say that we can do this through a single vehicle, but only for Black people now, because we know that that’s not a vehicle for white [people]—it’s not just a home. White people tend to have more assets.

Let’s look at our labor market inequities, different labor market trajectories, income and pay discrimination. When you look at every job, break it down—STEM jobs, engineers, what [job it is] doesn’t matter—we know that there’s differences. To say that that’s the vehicle, that almost puts the onus on Black people themselves to fix, because there’s very few structural fixes right now that will take us over the top. That is harmful, and I think that [when] people say, “You know what? We’re going to invest in homeownership,” it’s over.

We don’t look at extractions, the flip side of accumulation. At one end someone might have an asset and the other end their wealth is being siphoned in other ways. We’ve got to hold these two together, particularly for a group of people who are targeted for extraction. That is the makeup. That is a business model, to say we are going to extract wealth from Black and Brown people. We know those are vehicles. We can look at for-profit colleges, that’s a wealth extractor that’s targeted. I just think that the harm is thinking about simplistic one-dimensional solutions, seeing one asset as a vehicle to close racial wealth disparities. That keeps us from actually solving the problem. That’s why I think it’s harmful.

Indeed, and you’ve just laid out for us, although I didn’t feed you that, the first part of our series is going to look at extraction. Then we’re going to [dive] into a number of these different angles on what’s going on with homeownership and how it should be looked at and approached differently.

So what should we do? Obviously, diversify and it’s going to be structural, it’s not going to be easy. Let’s talk about what, if we had our hands on the levers of power, what would be the steps that would be needed?

I typically don’t just advocate that we need better research, but we do. I’m just going to start there because there’s so much about the dynamics of wealth that we don’t understand. We don’t have disaggregated data [and] that’s why you will always see this being a binary Black and white conversation, because that’s where the data is most robust. We have some data and when we start slicing and dicing it to get a better picture around gender, for example, [or] education, it’s harder to do. We can’t get that data. Basically, the data for Asian Americans is abysmal, and let’s not even talk about Indigenous folks.

We don’t have an understanding, and when localities say, “I want to know what this looks like. What does it look like in St. Louis? What does it look like in Kansas City?” we know that because markets are local, because of the way policies are implemented, the way that state policies may influence wealth-building opportunities, we see staggering differences. In Boston, we saw white and Black differences of $236,000 versus 8 median wealth—it looks far different than in LA. We don’t even have that data really. That was special data runs.

We need a better understanding of the dynamics of wealth, but we need to think about a number of structural solutions. When people say they’re going to close the racial wealth gap, I chuckle. I’m like, “Wow, so you support reparations?”

Because we’ll never get there without at least reparations and then some. That will change the whole conversation right there. If you’re not talking about reparations as a solution, I don’t know if we’re going to close the racial wealth gap. You might be talking about a different problem you’re trying to solve.

When I think about what localities are doing and they want to say, “How do we solve this problem? We can’t fully solve it. Of course, we need federal policies,” but there’s investments they’re already making in certain areas. There are ways in which they’re already starting to tackle certain things that influence wealth. I was talking to a group of funders who were focused on homeownership and entrepreneurship and then I heard about this amazing work they’re doing around eviction prevention, keeping particularly Black folks in homes. That could go further than helping five businesses.

There might already be approaches, approaches that we have to think about, in terms of how extractive measures or mechanisms are being mitigated. We look at criminal legal fines and fees. We look at consumer protections. You look at a range of factors that could contribute to the flow of resources coming in and out of a household. I think there are probably 10 things that can happen that would play a role. I think what we’re missing in this, and what I’ve been screaming at the rooftops, is we don’t have a vision. [You can’t] do everything, but you can do a lot of things, so what’s the vision?

We’ve got to understand how does wealth look in an area and what are some levers that can be pulled to actually make an impact? A visible impact, not with 5, 10, 20 families, but with a broader community. What would be a city’s vision for holding that? I don’t see vision. I see an automatic going to a set of stage solutions and a loop back around. I don’t see intersectional approaches. I don’t see people focusing even on gender. When we think about the wealth that women hold, the role that they play in their households. The fact for some groups, solo parenting among women is higher, wealth levels are lower.

We are not taking a comprehensive look and we’re not saying, “What do we actually want to see happen? What do we want to actually see change? What’s in our locus of control that we can actually see some impact?” You have to have a vision for that. Our vision is lost in three categories: education, entrepreneurship, and homeownership. And financial literacy. The four go-tos.

I was struck by the Othering and Belonging Institute talking about the phrase “targeted universalism” and how talking about a gap is not very inspiring, but talking about what we want everybody to have in order to thrive and then targeting what different groups need to get to that same standard might be more inspiring as well as more nuanced and possibly less divisive. Should we be getting rid of wealth gap [framing] entirely and moving toward that sort of vision?

The thing about it is, is that you can’t skirt race.

No, not skirting race. Absolutely not.

When something is made to seem like it’s more palatable, I always think, is it a means to skirt race? Because the thing that we don’t think about in terms of wealth, very specifically, is anti-Black racism and how it’s been a main factor, not just in the wealth that Black people hold, but other groups as well. How those policies in themselves have led to extraction. What are they based on? What narratives underneath serve those kinds of investments? I just think that when we talk about targeting there’s a lot of issues there. If you talk about wealth, you can’t skirt the issue around race. I think that makes it different.

I’m very much about putting anti-Black racism upfront and naming it. We can’t go forward if we don’t do that. The biases I talked about, and homeownership… what’s driving that? The narratives around Black criminality, period. There [are] things that we have to name to know that they are actually drivers of inequality. Then yes, I do believe that focusing on the most marginalized can help all groups, but we’ve got to have a foundational understanding of what that means. Because when it comes to wealth, everything doesn’t line up the same.

I’m saying that [what’s needed] may look very specific for Mexican Americans in LA [and different] than it does in Knoxville, Tennessee. It is very nuanced in that way. On the frame of it, I think that the idea of focusing on the most marginalized is important. I think that naming what is a driver, like anti-Black racism, and saying, “Well, how are we going to grapple with this?” is important. Because when we talk about the most marginalized, we still will go back to race, period, we will, and that is fraught. Look at the conversations we’re in right now. There’s nothing more fraught than that. Look at the conversations we’re having about CRT. We can’t skirt this.

I think that we have to then determine—there are issues about public funding and how it could be targeted. There’s a whole host of things. It’s fraught, it’s not easy. I do think that to talk about the most marginalized, we’ve got to talk about gender and race, and put that at the forefront. That’s always challenging.

Absolutely. Well, we’d like to take on that challenge. We hope we’ve taken one step into that with this upcoming series, which we’re excited to launch with your article that went live today. I encourage everybody to read the rest of it, give us feedback, pushback, challenge, discuss, read some more. We’re looking forward to hearing what you all have to say.

Thank you so much, Anne, for joining me and letting people in on what we’ve been chatting about. We will see you all another time.

Thank you so much, Miriam.

Comments