Why the Community Reinvestment Act Must Be Expanded Broadly Throughout the Financial Industry

The financial industry has been one of the main perpetrators of racial discrimination. It should be obligated to serve all communities, particularly communities of color.

Banks Can Earn CRA Credit for COVID Response—But Who’s Benefiting?

All banking activities, regardless of whether they benefit middle- and upper-income or low- and moderate-income people and communities, could count in the next round of CRA exams. This would further disadvantage communities that are already disproportionately impacted by the pandemic.

Could Lack of Impact Assessment in OCC and FDIC Proposal Break CRA?

Proposed changes to CRA by the Office of the Comptroller of the Currency and the FDIC conflict with the best practices of community development.

New Writings Suggest Incremental Change Is Best Path for CRA Reform

These writings suggest that careful reform of CRA regulations can build upon the progress in lending and investing if the reforms are incremental instead of “transformational.”

Don’t Diminish the Importance of Homeownership in CRA Reform

A significant reduction in attention paid to home mortgage lending on CRA exams would be neither economically efficient nor equitable.

The CFPB Needs Sunlight: Keep Easy Access to HMDA Data

The Consumer Financial Protection Bureau’s reassurances on continued public access to Home Mortgage Disclosure Act data are not very reassuring.

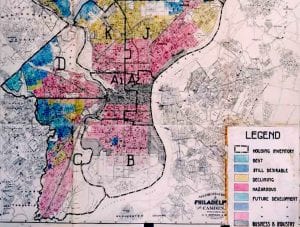

Facing Down Segregation—Half-heartedly or With Steely Determination?

A new book explores the history, impact, and policy solutions to racial segregation.

Where Banks and the Public Agree on CRA . . . and Disagree

Despite a CRA exam pass rate of 98 percent, the major thrust of bank comments is that they want easier exams with fewer moving parts and less uncertainty.

Warren Housing Bill Presents a Clear Choice on CRA

Senator Elizabeth Warren and the Office of the Comptroller of the Currency have offered contrasting visions for the future of CRA. How do they differ, and what would the implications for historically disinvested communities be?

An Old American Struggle, Always New

Color and Character is an introduction to the seminal and unresolved struggle over integration and racial equality in America.

Advocacy for Social Change: Coalitions and the Organizations that Lead Them

Many books discuss the corrosive effect of money in politics and lobbying organizations, but few are devoted to how those representing the have-nots organize on a national level to fight for laws and regulations that seek to empower communities.

Data Drives the Movement for Economic Justice

A government report concludes that residents of low- and moderate-income Census tracts have as much access to bank branches as residents in middle- and upper-income tracts in rural areas and large metropolitan areas. Yet access to bank services for low- and moderate-income consumers is still being lost. Why is that?