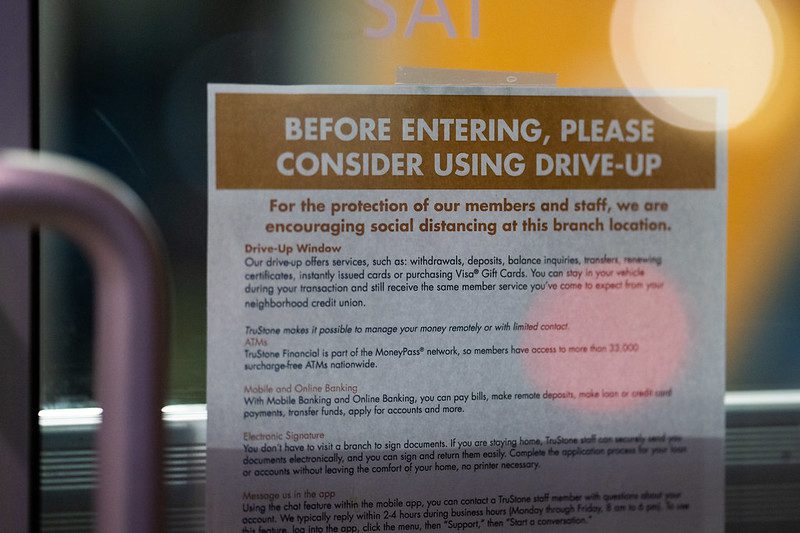

A sign at the entrance to TruStone Federal Credit Union in Minneapolis, Minnesota, encourages banking customers to use the drive-up to limit contact during the COVID-19 coronavirus pandemic. Photo by Tony Webster via flickr, CC BY-NC 2.0

The federal bank agencies—the Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), and the Federal Reserve Board (FRB)—issued helpful guidance March 19 indicating how banks can earn Community Reinvestment Act (CRA) consideration for activities that aid borrowers and communities afflicted by the pandemic. However, if the agencies do not clarify who can benefit, bank activities under CRA may end up not focusing on low- and moderate-income (LMI) communities, including communities of color that are devastated by COVID-19.

The Joint Statement on CRA Consideration for Activities in Response to COVID-19 indicated that banks can receive favorable consideration on their CRA exams if they waive fees, including overdraft fees; modify loan terms and conditions on existing loans, including offering forbearance; and issue new short-term loans to help customers with unexpected expenses. In addition, the guidance stated that banks could receive CRA points if they offer community development financing for expanding digital access to communities, increasing access to health facilities, food supplies or services, or for economic development activities including sustaining small-business operations.

The March 19 statement prompted banks to engage in a variety of needed activities. The difficulty, however, is that the current regulations provide CRA consideration to a broad range of income groups, including middle- and upper-income (MUI) customers and communities, in the wake of natural disasters. As of this writing, the Federal Emergency Management Agency (FEMA) has declared COVID-19-related disasters in every state.

In response to Hurricane Katrina in 2005, the agencies added the criterion of natural disaster to the regulatory definition of community development. Banks can receive CRA credit if they engage in community development activities in areas impacted by natural disaster. The activities can benefit MUI as well as LMI households and communities.

People of all incomes and in all areas are afflicted by COVID-19. However journalists and academics are uncovering evidence that the pandemic has disproportionately impacted people of color and LMI communities since they are more likely to have jobs that must be performed physically on-site or jobs that are likely to be terminated, and they are likely to reside in housing and neighborhoods that are more vulnerable to health emergencies. An Interagency Q&A hints that more weight will be given to activities that benefit LMI people and communities impacted by natural disasters. However, the National Community Reinvestment Coalition has not seen the recommended actions in this Q&A implemented to any significant extent in CRA exams.

A further blurring of the focus occurred in response to Hurricane Maria in 2017 when the agencies relaxed assessment area restrictions. The disaster did not have to affect statewide or regional areas surrounding a bank’s assessment area (areas on CRA exams with bank branches) for the bank to receive CRA credit. In other words, a bank located anywhere in the country could receive credit for financing recovery efforts in Puerto Rico and the Virgin Islands. Was this a one-time only application or will this be repeated now? What would this mean in the context of COVID-19 since all states have received major disaster declarations?

The upshot of a loose application of the natural-disaster criterion is that all bank activities and financing, regardless of whether they benefit MUI or LMI people and communities in any location (whether inside or outside assessment areas or possibly nationwide) would count on banks’ next CRA exams. This would clearly disadvantage LMI communities, which are disproportionately impacted by COVID-19.

When the agencies amended the CRA regulations after Hurricane Katrina and relaxed assessment area restrictions after Hurricane Maria, they did not anticipate a nationwide pandemic. The loosening of income restrictions can perhaps be justified if a disaster affects a state or a region, but becomes less justified or even counteracts CRA’s historic focus on LMI people and communities when a pandemic afflicts the entire country.

We need a clarification.

Banks should score better on the “response to community needs” qualitative criteria on CRA exams, and probably on their overall rating, for the time period encompassing 2020 if they:

- operate more effective forbearance programs than their peers and can show—with data—that they targeted LMI customers and people of color.

- focus their small-business financing as part of the CARES Act Payment Protection Plan loans on smaller businesses and those owned by women and people of color.

The agencies should make it explicit that banks will score better on CRA exams, all else being equal, if they are more effective in targeting COVID-related relief efforts to the most vulnerable customers and communities.

Ironically, the OCC and FDIC’s proposed changes to the CRA regulation that pre-date the pandemic would likely diminish, if not eliminate, the qualitative criteria, including responsiveness to needs. In addition, the interagency statement’s emphasis on waiving fees would probably not count under the OCC and FDIC’s proposal, since that proposal suggests eliminating the service test, which examines the availability of affordable bank products.

The agencies must continue to step on the CRA gas and not let up after the issuance of the March 19 statement. They need to clarify that the definition of a national pandemic as a natural disaster will not diminish CRA’s focus on LMI communities. And they must emphasize that COVID-19 relief efforts, especially those subsidized by public funding, must target vulnerable communities including low- and moderate-income communities and communities of color.

Comments