CDFIs

The Latest

EPA Terminates Already-Awarded Climate Funding

The agency says $20 billion in green funding for low-income communities was mismanaged and issued with political bias, but so far the EPA hasn’t produced the evidence needed to legally block the grants. Three nonprofits have filed suit.

Explore Articles in this Topic

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

How Fast Could Financial Regulations, Treasury Programs Change Once Trump Takes Office?

Affordable housing and neighborhood investment programs are closely tied to banking and the Treasury Department. What is the incoming administration’s attitude toward some key financial regulations, and how easy would it be for them to enact changes?

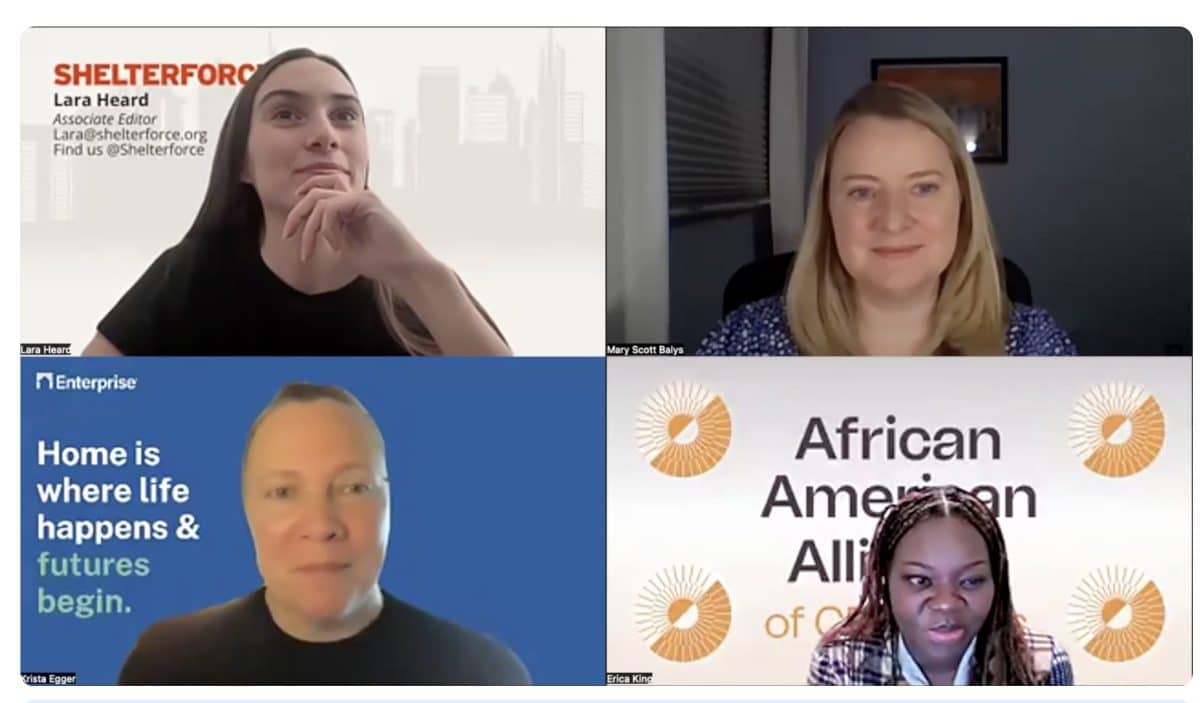

The Greenhouse Gas Reduction Fund, a Shelterforce Webinar

What is the Greenhouse Gas Reduction Fund and how will it benefit affordable housing residents and community development organizations?

Are Race-Based Lawsuits Affecting Community Lenders?

Shelterforce spoke with community-lending leaders and experts about the current mood across the sector. What, if anything, are organizations planning to do to avoid becoming the next target?

How the New CRA Rule Will Help, and Where It Falls Short

The assessments that evaluate a bank’s lending practices have improved, but there are several missed opportunities for reform. For one, the new rules won’t incorporate a racial analysis into lending examinations.

Shelterforce’s Top 10 Stories of 2023

What were the biggest Shelterforce stories of the year? We count down the top 10 of 2023.

Let’s Act Now to Stop Racism in Real Estate Appraisals

In 2022, a government task force released an action plan about combating bias in the appraisal industry. How can CDFIs fight back against the damage caused by under-appraisals?

CDFIs Shouldn’t Act Like Banks, But Too Often Do

When receiving bank funding, CDFIs often limit their investments in accordance with bank restrictions. How can reforms to the Community Reinvestment Act help center the needs of underserved communities?

Major Changes Coming for CDFIs

Requirements to be certified as a community development financial institution (CDFI) will soon change—and some lenders that qualified before might no longer.

CDCs Are Having a Moment. Can the Momentum Last?

Over the past couple of years, community development corporations have been popping up in sometimes-unexpected places across the country. Will this increased interest in CDCs last, or is it a trend that will end when the money runs out?

Dear CDFI Colleagues: It’s Time to be Transparent About Salaries in Job Postings

Companies that value meritocracy perform worse with pay equity when their internal policies do not align with their public-facing statements regarding pay.

Credit Where Credit Is Due: Expanding Access to Capital for BIPOC Developers

The dual financial system affects not only Black and Brown consumers, but Black- and Brown-led firms. In the past two years, CDFIs have focused on shifting access to capital for developers.

How CDFIs are Helping Small Businesses Create Good Jobs

Community development financial institutions lend to micro- and small-business owners, but the jobs those businesses create are often minimum wage, part time, or otherwise low quality. What makes a job a good job, and what are CDFIs doing to help small-business borrowers create good jobs?