Winter 2011-12

Issue #168

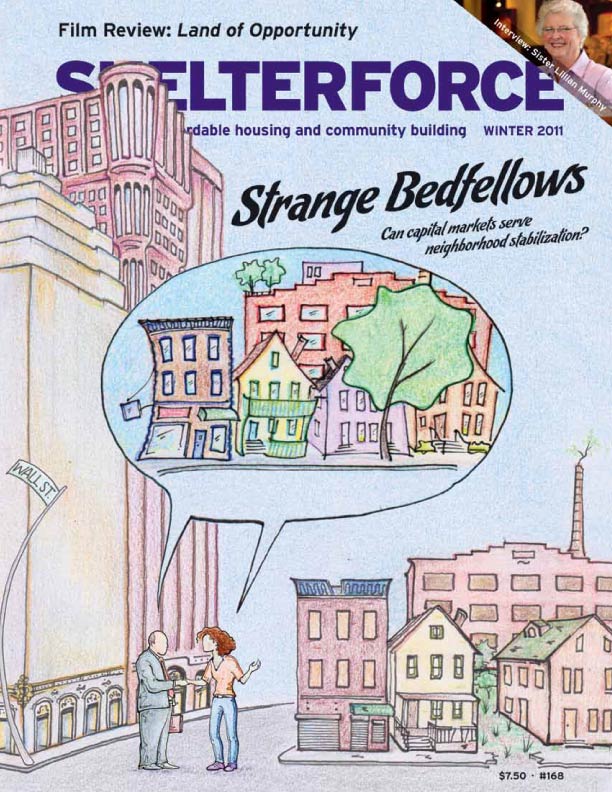

Capital Markets

For most of this issue, we look at the community development field as players in a marketplace who might have some points of commonality, or even partnership, with private equity firms, hedge funds investing in real estate, or for-profit developers scooping up foreclosed homes to turn into rentals. As this capital enters our neighborhoods, it is time to not only organize, but to also step up and participate in the market, bringing our field’s strengths, connections, and know-how to make sure new investment doesn’t just wash further equity away from the places that have suffered the most. Though we come to the table as strangers (how often do you make deals with hedge funds?), we should do it not as supplicants, but as peers, and potential partners.

Strange Bedfellows

What does it mean to stabilize neighborhoods at scale? Barring the appearance of a community development fairy godmother, it means having resources. The past several years have seen an outpouring […]

Occupy Makes Space for Community Advocates

By smashing the wall of media silence about America’s wealth and income divide, the Occupy movement has opened a dramatically new terrain for organizations campaigning for economic and social justice. […]

Taking the Long View in Texas

What kind of city does Austin want to be? According to Imagine Austin, a new comprehensive city plan, it could someday be considerably different than the one it has been. […]

Do Foreclosures Make Us Sick?

New research shows a direct correlation between foreclosure and hospitalization, adding another way that foreclosures have a disparate effect on low-income communities and communities of color. The study, Is the […]

QRM’s Downstream Effect

The discussion around how to define a qualified residential mortgage (QRM) has dragged on for over a year now, with no end in sight. But advocates haven’t let it go, […]

Breaking the Bank

On Nov. 5, 2011, Bank of America had just withdrawn their threat to levy a monthly debit card fee, the major lenders were under fire from attorneys general for abusive […]

Recovering from the Recovery

“Happening to a city near you” is the unsettling tag line for Land of Opportunity, a film that takes an intimate look at post-Katrina New Orleans and the interrelated struggles of those navigating it.

City Life and Occupy: A Developing Relationship

This past August, a broad new coalition in Boston formed to plan a massive march against Bank of America and other corporate targets on Sept. 30. A smaller group also […]

Changing the Conversation

Stretching across more than 20 U.S. cities, a new consortium called Occupy Our Homes is continuing to organize actions in neighborhoods where evictions, vacant properties, and foreclosures have had damaging effects.

Occupying Occupy: Lessons from Central Brooklyn

We who have a legacy of neighborhood action and a lived understanding of racial justice must become the next generation of Occupy.

Capital Markets and Neighborhood Stabilization

It’s not often that a nonprofit housing developer sits down with a hedge fund manager, or someone from an investment bank who is outside of the philanthropic or CRA departments.

Going Upstream

If a lender won’t or can’t modify, why wait until they foreclose? Some groups are taking matters into their own hands with note purchases or short sale programs.

Distressed Mortgages for Sale

Foreclosed properties have been flooding the auction block following the housing crisis. Less visibly, pools of distressed loans are also being sold off—and it’s a market ripe for partnership with neighborhood stabilization actors.

Interview with Sister Lillian Murphy, CEO of Mercy Housing

For Sister Lillian Murphy of Mercy Housing, your mission must not be an excuse to make bad business decisions.

A Blueprint for Responsible Homeownership

A Massachusetts loan program gives lenders skin in the game while providing tools for responsible homeownership for lower-income borrowers.

Relaxing the Credit Crunch

Three years after the financial meltdown, credit remains elusive in many underserved communities. Although the reliance on credit scores is greater now than it’s been in a decade, many housing activists and community lenders are arguing for other means to evaluate credit risk.

Banking on Neighborhood Stabilization

Even the most sophisticated private and nonprofit partnerships for dealing with vacant property will end up with some properties that don’t pencil out. Land banks can step in to keep those properties from dragging down revitalization efforts.

Tackling the Challenge of Scattered-Site Rentals

Attention is turning to single-family rentals as a way to keep a growing inventory of foreclosed properties occupied in a credit-constrained market. But scattered-site rental has long been considered a very tough nut to crack for nonprofit housing groups. How do those who make it work pull it off?

The Hard Part

Reclaiming REO at a scale that protects neighborhoods will involve a delicate dance between ground game and national reach, and between nonprofit and for-profit capacities.

Stabilizing Urban Neighborhoods: Q&A with Elyse Cherry

Boston Community Capital’s SUN program has gotten a lot of media attention. How is it working and what’s next?