CDFIs

The Latest

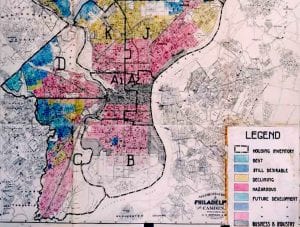

How the New CRA Rule Will Help, and Where It Falls Short

The assessments that evaluate a bank’s lending practices have improved, but there are several missed opportunities for reform. For one, the new rules won't incorporate a racial analysis into lending examinations.

Explore Articles in this Topic

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

Help for Small Businesses

What kinds of emergency measures are advocacy organizations proposing to make sure that when small businesses can open again, they’ll be financially able to do so?

Only Halfway to Economic Democracy

Few books make me so angry that I must resist throwing them across the floor. One such book, published in 2002 (and since updated) was Greg Palast’s The Best Democracy […]

How Successful is Your County in Accessing Community Development Funding?

some communities in the United States seem much better than others at attracting grants and financing for community development—even after adjusting for their relative needs. Here are some of the surprising trends:

Is Success Making CDFIs Too Risk-Averse?

Shelterforce’s Miriam Axel-Lute in conversation with Ed Gorman of NCRC on whether community development financial institutions (CDFIs) are taking enough risk, and therefore, falling short of their mission.

Can Using a Racial Equity Lens Increase Capital in Communities of Color?

If CDFIs adopted traditional appraisal standards to determine loan amounts, they’d make very few loans in the communities they were founded to serve.

Tracing the Roots of CDFIs: A review of Democratizing Finance

This book is a major contribution to increasing knowledge and awareness of how far the community development finance movement has come in 30 years.

CDFIs Stepped Up During the Shutdown

CDFIs across the country were trying to do what they could to ease the effects of the recent government shutdown. Here is just a partial list.

In Memoriam: Jeremy Nowak

Jeremy Nowak, a founder of Reinvestment Fund and founding board member of the Opportunity Finance Network (OFN), passed away on July 28. Nowak was, as anyone who knew him would […]

CDCs and Nonprofits are Indeed Leading Affordable Housing Innovation

Blaming community development corporations (CDCs) for the high cost of affordable housing construction is not only misguided, but it ignores the work of CDCs and nonprofits that are leading efforts to reduce costs in the key areas of financing, construction, and land costs.

Back in the Game: CDFIs Help 1- to 4-Unit Rental Housing Rebound in Chicago

After the housing crash, Chicago’s 1- to 4-unit rentals weren’t bouncing back in many neighborhoods. Three CDFIs came together to make it happen.

Persistently Poor Regions Would Welcome a Little Gentrification

It is often said that you get what you pay for. Clearly, too little is being paid to create positive change in America’s most vulnerable places.

When a Person’s Character Trumps Their Credit Score

Some CDFIs approve loans based on a person’s character instead of their credit score. But they only recommend

doing so when you know the applicant.