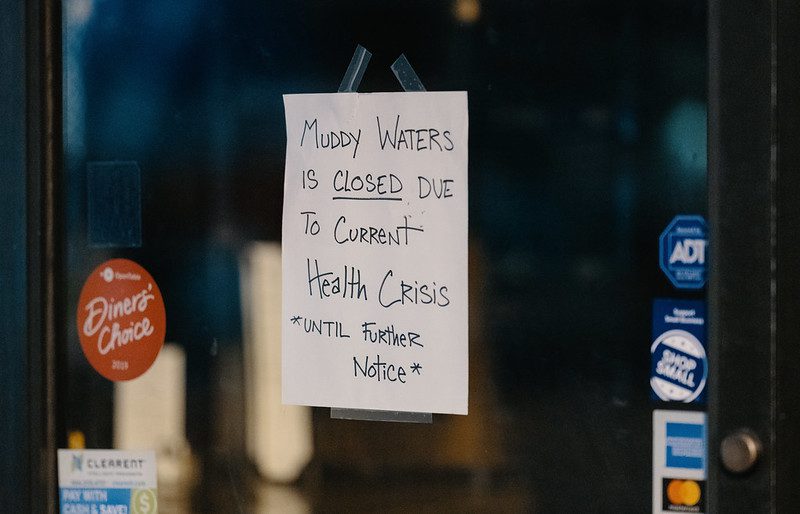

‘Closed Due to Health Crisis.’ Photo by Tony Webster via flickr, CC BY 2.0

A radio host recently compared the situation in which some small businesses are compelled to stay open to a wartime draft—the global COVID-19 pandemic has separated the “essential” from the “non,” and many small businesses nationwide other than pharmacies, restaurants (for take-out only), and grocery stores have had to close abruptly. The uncertainty that goes hand-in-hand with this fluid health crisis is only amplified for small-business owners, whose issues must be triaged with a multitude of others. It is especially amplified for immigrant-owned businesses, business owners of color, and businesses operating in low-income communities, all of which were still on weakened footing from the 2008 recession.

Surveys indicate that many small businesses will not be able to weather this storm—in one conducted by Goldman Sachs, just over 50 percent of respondents said they would only be able to operate for three more months, and 53 percent said their employees did not have the ability to telecommute. That same survey reported that over 70 percent of respondents felt they had little to no voice influencing policy.

Nationwide, however, small businesses are the lifeblood of communities and local economies, and so the recovery of communities will depend on the ability of small business to recover.

There is movement toward creating the mechanisms for that recovery. Last Friday, the president signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a package of economic relief and stimulus benefits for individuals and businesses that is unprecedented not only for its size, but its scope.

The U.S. Small Business Administration will manage the administration of the federal programs benefitting small businesses under the CARES Act. The largest program looks to be the Paycheck Protection Program (PPP) for businesses with under 500 employees, which provides forgivable cash-flow assistance loans if they maintain their payroll for up to 8 weeks during COVID-related business disruption (meaning that the loan can possibly become a grant if a business follows the stipulations). PPP loan amounts vary according to organization size, but for-profit businesses, nonprofits, tribal entities, and some self-employed individuals are all eligible, with covered expenses including payroll, medical and sick leave, continuation of employee health benefits, rent, and utility payments. In order to bring back employees who may have been let go early in the crisis, PPP loans are also retroactive to February 15, 2020 in hopes that those staff can be brought back onto payrolls.

Two other small-business programs under the CARES Act are the Small Business Debt Relief and Economic Injury Disaster Loans (EIDL)/Emergency Economic Injury Grants. The debt relief loans are for small businesses applying for or with existing non-disaster SBA loans, and will cover those loan payments for up to six months. The EIDL loans are for small businesses and private nonprofit organizations that have been affected by COVID-19, and the grants—an emergency advance from the total EIDL loan amount of up to $10,000—do not require repayment.

The federal tax filing deadline has also been extended for individuals and businesses to July 15, along with sales tax payments.

Local Efforts

New York City mayor Bill De Blasio said the city would likely not be able to immediately meet demand to an emergency zero-interest small-business loan program set up for businesses with fewer than 100 employees. He also noted that a grant program to cover 40 percent of payroll costs for two months for businesses with fewer than five employees had already received over 450 applications. Other cities including San Francisco and Bellevue, Washington, are offering similar grant programs, but organizations like The Association for Neighborhood & Housing Development (ANHD) assert that the needs of immigrant-owned businesses, business owners of color, and businesses operating in low-income communities goes deeper than loans, or even grants.

ANHD presented a comprehensive list of demands to support New York City residents during and after the COVID-19 pandemic. Its list for small businesses includes an extension of city small business loan and grant periods to enable employers to provide paid sick leave to their employees. For delivery businesses, ANHD’s demands also include the suspension of city fines and summonses for delivery persons and street vendors. And because immigrant-run small businesses account for 48 percent of New York City’s local economy, ANHD demands COVID-19 related resources be distributed in multiple languages.

Jamie Weisberg, senior policy analyst at ANHD, noted that most small businesses in New York City are commercial tenants, not owners, and so “the most immediate impact for them is an inability to pay rent and utilities, along with payroll.” In a blog post this week, Weisberg also called on commercial banks to continue to fulfill their obligation to low-income communities and communities of color under the Community Reinvestment Act.

Historically, community development financial institutions (CDFIs) have provided resources like capital and technical assistance to the businesses in these communities, which are undoubtedly only at the beginning of an unprecedented challenge.

The CDFI Response

As mayors and governors began mandating social distancing rules for the public and closures of non-essential business, individual CDFIs responded on behalf of their clients.

Opportunity Finance Network, the national association of CDFIs, had asked Congress to allocate $1 billion to the CDFI Fund in its pandemic stimulus package in anticipation of increased demand for CDFI support, but the bill did not include any additional funds. The CDFI Fund operates under the U.S. Department of the Treasury, and disperses federal funds to the mission-driven financial institutions that serve historically underserved communities. Existing deadlines for CDFIs applying for financial assistance from the CDFI Fund haven’t changed thus far, though the CDFI Fund has updated its FAQ document to reflect an understanding that applicants’ capacity and needs are changing rapidly.

In a survey of its members shared on Monday, The Native CDFI Network found that 86 percent of its member institutions said they provide loans to clients with businesses that will be affected by the pandemic, nearly 90 percent said they were already affected, and just over half said clients had already reached out with requests to restructure their loans. Additionally, over 60 percent expressed a desire to develop strategy for negotiating with creditors for payment modifications.

Within their own forums, CDFIs are looking to one another for advice and support on not only how they will scale up loan and service provision to existing and new clients, but how they’re adjusting their own operations. For example, Community Loan Fund of the Capital Region in Albany, New York, announced last week that it was in the process of setting up an emergency loan fund for clients especially affected by the pandemic and would be getting funds for already approved loans distributed quickly.

Despite the lack of CARES Act support in this federal funding phase, CDFIs will be getting some help to support their borrowers. On Friday OFN announced that it is working with Google to launch the Grow with Google Small Business Fund to support small businesses impacted by the COVID-19 crisis. The fund will pass $125 million through CDFIs to hard-hit small businesses in disadvantaged areas in the form of low-cost loans with the interest deferred for the first year. Google has also given OFN a $5 million grant to help CDFIs expand their capacity to respond to the crisis.

Other funds are aimed directly at nonprofits and small businesses. On Monday, LISC announced the LISC Rapid Relief and Resiliency Fund. The fund will “assist small businesses to stay afloat and to support community organizations to meet unprecedented client demand,” and will offer both grants and “patient, flexible loan capital.”

Also on Monday, New Jersey Community Capital, a statewide CDFI, launched the Garden State Relief Fund, which will offer low-interest, no-fee loans to New Jersey businesses and nonprofits with 3 to 50 employees.

Cooperatives

The work of policy advocacy groups undoubtedly played a part in seeing that the stimulus bill recognizes some workers in the economy who have previously been left out. In a statement last week, the Democracy at Work Institute (DAWI), a worker cooperative training and advocacy organization, called for special protections for worker cooperatives, many of which fall within sectors that are disproportionately affected by health exposure risk and complete work stalls—including child care workers, home health aides, house cleaners, and some retail positions, which are often low-wage and without health insurance or paid leave.

“Sole proprietors and worker-owners at cooperatively owned businesses are not eligible for unemployment, along with gig employees and, of course, undocumented workers,” said ANHD’s Weisberg late last week, just before the CARES bill was signed into law. “These businesses and workers were already in a precarious position even before the outbreak, and it’s even more the case now.”

The stimulus package offers the opportunity for ESOPs and cooperatives to apply for the emergency grant advance and EIDL loan program. (Separately, it enables self-employed individuals, including gig workers, to apply for unemployment benefits).

Community banks and CDFIs are gearing up for the flood of questions and technical issues that small businesses will have when these new programs go online.

Comments