This article is part of the Under the Lens series

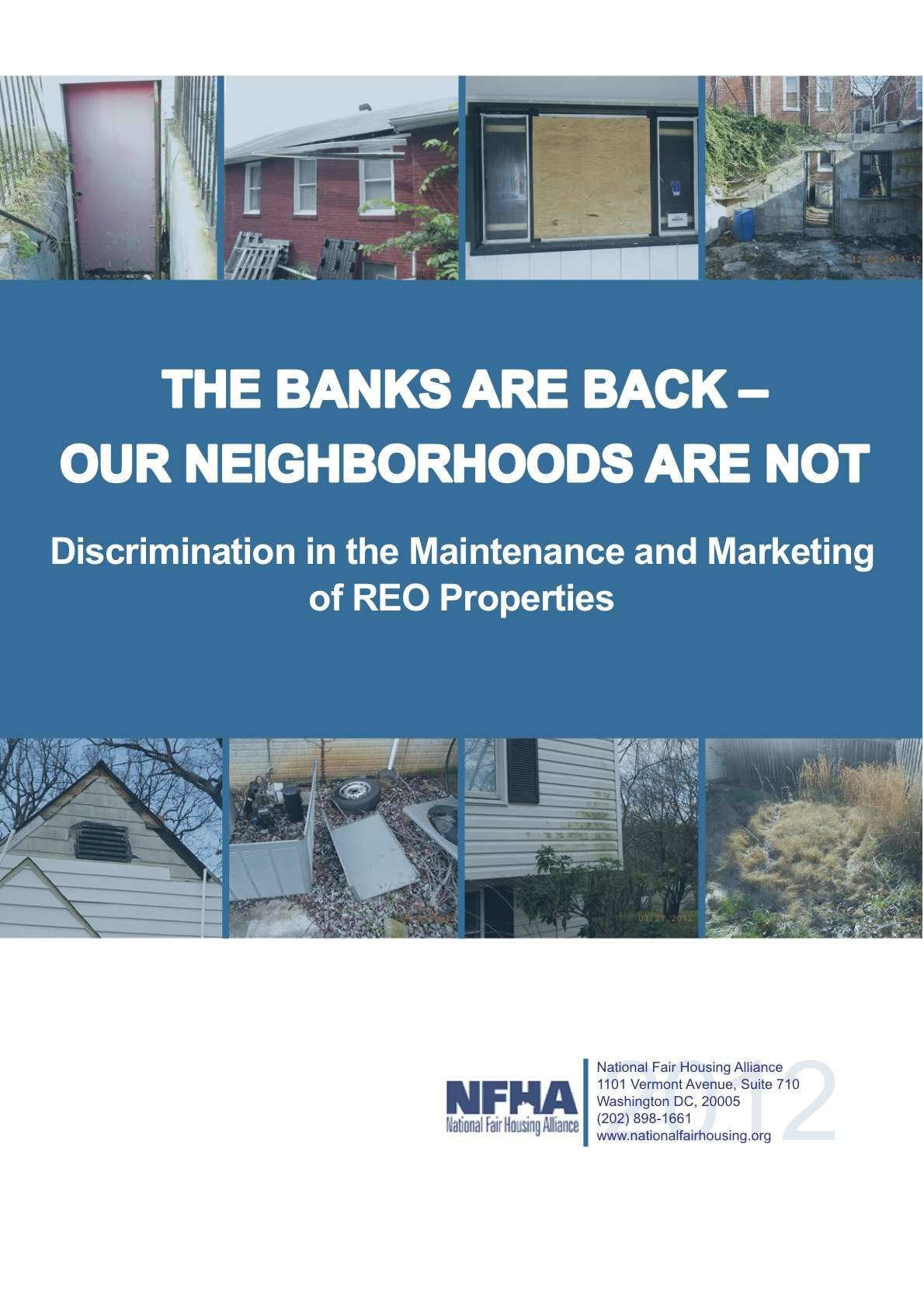

Discrimination in the Marketing & Maintenance of REO Properties

Recently the National Low Income Housing Coaltion, as part of a blog series looking at discrimination in the marketing and maintenance of bank-owned properties, suggested that FHFA's REO-to-rental pilot program could serve as a gateway to address afforability by tying future REO-to-rental iterations to National Housing Trust Fund dollars:

We recommended that REO sales be paired with National Housing Trust Fund dollars to make some of the properties affordable to extremely low income households. Finally, we recommended that landlords and property managers must contractually agree to meet certain housing quality standards for all properties, whether or not a particular unit is subsidized.

But, as the post goes on to note, the pilot program is done an an “extremely small scale, with fewer than 3,000 properties included.” The program isn't meant to address affordability, but should it?

We posed this question to readers last week and most respondents thought future iternations of the program should address affordability, even if this trial does not. Most who thought REO-to-rental should, at some point, address affordabilty felt that this could be one of several tools to create more affordable housing. Here are some selected resopnses:

“This is an incredible opportunity to increase the supply of affordabel rental housing; a supply far too small to meet the growing demand for affordable units across the country.”

“Because it is and should be still the role of government to serve citizens who have less opportunity. This is the perfect chance to give a “bail out” to the American people vs. the banks.”

“Yes, but it should be done as one factor, not the only one. There should be a longer recapture period or affordability period because three years is too short. Public funds have been used to bail out Fannie and Freddie. There should be a public good created that has a lasting effect—namely long-term affordability.”

What's your take?

Comments