This article is part of the Under the Lens series

Discrimination in the Marketing & Maintenance of REO Properties

This post is part of an ongoing series based on the National Fair Housing Alliance report, “The Banks Are Back, Our Neighborhoods Are Not,” that examines ongoing discrimination in the marketing and maintenance of bank-owned foreclosed properties.

This post, and the entire series, is also posted on Race-Talk, a blog hosted by the Kirwan Institute for the Study of Race and Ethnicity.

—

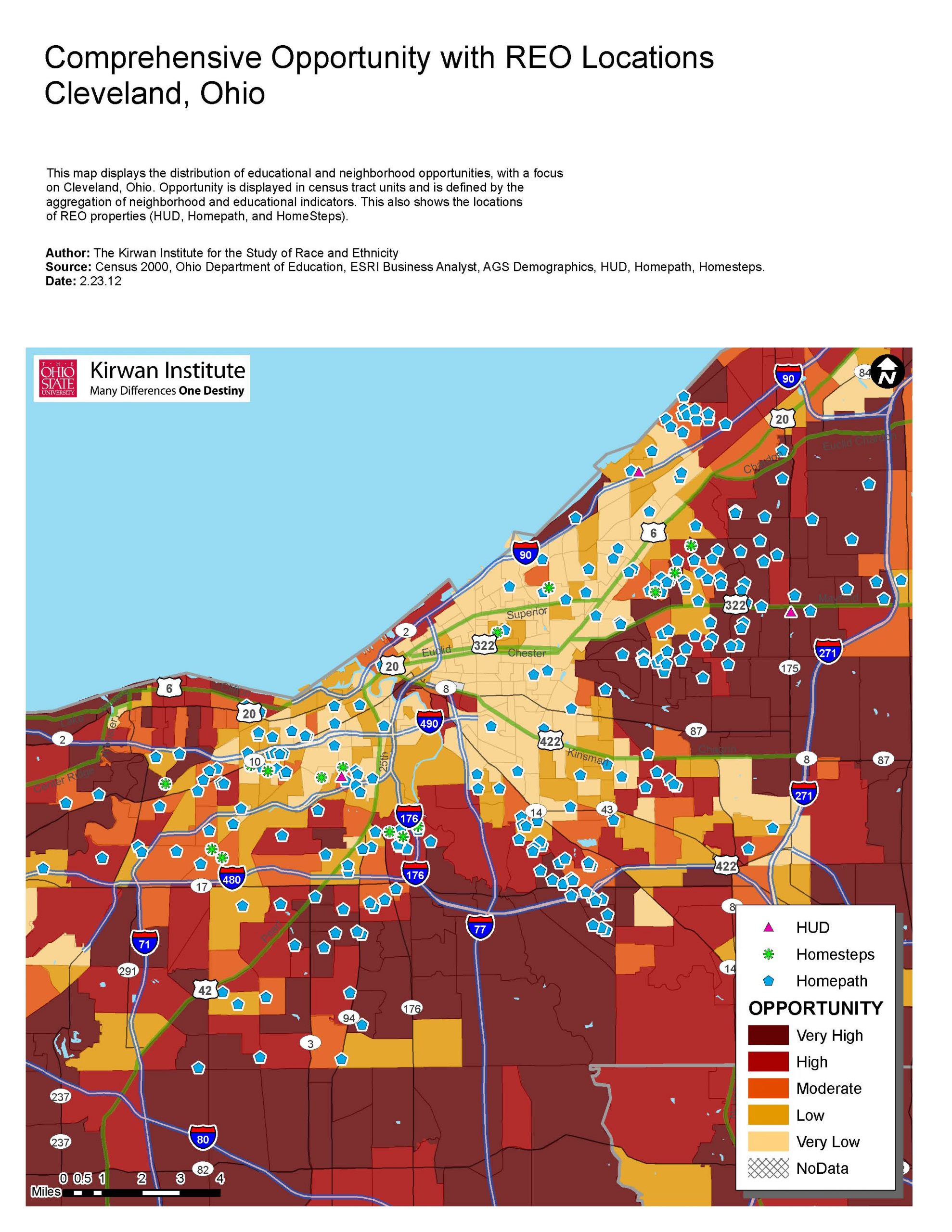

Nearly 2 million homes were foreclosed upon and repossessed in the United States last year alone with the Federal Reserve estimating that an additional 1 million foreclosed homes could be added to this inventory each year for the next several years. Real estate owned properties are located in communities throughout the country and they depress housing prices, act as a drag on the housing market, and hamper our broader economic recovery.

These foreclosed homes don’t have to be a burden on our communities. They are a precious resource and represent a once-in-a-generation opportunity to jump start the revitalization of communities that have been devastated by the foreclosure crisis—particularly communities of color targeted for abusive practices and unsustainable mortgage loans, leading to the high foreclosure rates. They can also help us make real progress toward achieving our nation’s goal of the federal Fair Housing Act: to expand housing choices for all families, giving more families a pathway into the middle class.

By exercising leadership and vision, banks can use their REO properties to help get families and communities back on their feet. Here are five steps banks should take to make that vision a reality.

- Improve maintenance and marketing of foreclosed homes. Banks’ poor management of foreclosed homes in communities of color makes those homes eyesores and hazards, minimizes the prospect that the homes will be turned around and re-occupied quickly, and depresses the values of surrounding homes, decreasing the wealth of families in those communities. Those families have already suffered a severe loss of wealth. Between 2005 and 2007, Latino and African-American families lost 66 percent and 53 percent of their household wealth, respectively, largely due to falling home values. This compares to a 16 percent drop in wealth for white households. Banks must not allow the policies and practices they use to manage the properties under their control to contribute any further to this disparity. Rather, banks must improve their oversight of the companies they hire to manage their REO portfolios and ensure that all properties are well maintained and effectively marketed, regardless of location.

- Stabilize neighborhoods. Many REOs are in neighborhoods where housing prices have already taken a severe beating due to foreclosures. Owners who need or want to sell their homes have a hard time getting a fair price because values have declined so far. The last thing they need is to have the banks sell large quantities of properties at bargain basement prices in order to get them off their books. The idea of bulk sales of foreclosed homes has stirred the interest of many investors, making this a real danger. Yet most banks are likely to hold mortgages on other homes in the same communities, and the value of these other homes will suffer if the foreclosures are dumped on the market. Banks offering bulk sales should do so at prices, and in a manner, that will prevent investor windfalls and promote neighborhood stability.

- Use these houses to give people a chance to get back on their feet. Over 4 million families have lost their homes to foreclosure in the last five years. Evidence from a variety federal enforcement actions shows that in many cases, families were steered into loans more risky and more expensive than their financial qualifications should have dictated. In other cases, people have been caught between record high levels of sustained unemployment and falling home prices that have made it impossible for them to sell or refinance their homes. As banks move to dispose of foreclosed homes, one of their top priorities should be helping these families get back on their feet, and if the families are interested and able, back into homeownership on sustainable terms. Partnerships with community-based organizations and local governments are the key to making this happen. In some cases, the mortgage can be restructured to make it affordable over the long run for the previous owner. In others, a lease-purchase program, in which a portion of each month’s rent is set aside to build a down payment, and where the rental period gives the former owners/now tenants the time to repair their credit, may be the best path to rebuilding financial security for families burdened by foreclosure. Such programs must incorporate strong tenant protections. In any case, banks should work with local partners to make sure that some families displaced by foreclosure get a chance to return to the communities to which they have ties.

- Expand housing opportunities. Many of the foreclosed properties that banks own are in communities with good schools, good jobs and transportation, good parks and recreation, access to healthy grocery stores and lots of amenities. Yet many of these communities are largely segregated, with few families of color among their residents. This is, in part, a function of the discriminatory practices that persist in the real estate industry. By taking affirmative steps to market these homes to a wide range of households, including families of color, families with children, people with disabilities and others, banks can help expand the range of housing options available to all our families and begin to make a dent in the patterns of segregation that have dogged our country for decades. In addition, some of these properties can be used to help meet the growing need for affordable rental housing among our growing population. To have a positive impact on local neighborhoods, these rental units must repaired if necessary, kept in good condition, and operated free from discrimination. In evaluating bids from investors seeking to purchase these homes for rental purposes, banks should look beyond the bottom line. Three additional considerations should be whether the bidder has a strong track record of compliance with all relevant laws, regulations and ordinances, what plans it has for marketing the homes in an affirmative manner, and how it will ensure that when the homes are sold at some point in the future, the sales are conducted in a way that does not destabilize the community.

- Prevent further foreclosures. While millions of families have lost their homes to foreclosure since 2007, some experts estimate that we are only half-way through the crisis. Millions more families are at risk. Immediate and decisive action is needed to prevent further foreclosures. Among the most important steps banks can take is to improve their mortgage servicing practices and give distressed homeowners a fair shot at saving their homes. In many cases, this includes reducing the principal balance of loans on homes that are underwater (where the house is worth less than the outstanding principal balance of the mortgage), as well as loans in default (or at imminent risk of default), to increase the chances that these borrowers will be able to make their loan payments over the long run.

Comments