This article is part of the Under the Lens series

Discrimination in the Marketing & Maintenance of REO Properties

This post is part of an ongoing series based on the National Fair Housing Alliance report, “The Banks Are Back, Our Neighborhoods Are Not,” that examines ongoing discrimination in the marketing and maintenance of bank-owned foreclosed properties.

This post, and the entire series, is also posted on Race-Talk, a blog hosted by the Kirwan Institute for the Study of Race and Ethnicity.

—

When the housing bubble burst more than four years ago, many banks and federal regulators argued that the impact would be limited and the damage contained to the subprime market. Famous last words. Now we know the full story: unregulated finance companies and malfeasant brokers peddled toxic loans designed to earn the originator a quick buck at the expense of unsuspecting homeowners, investors, and taxpayers. The damage has spread well beyond the subprime market and helped to usher in the worst recession of our generation. The majority of financial trickery was at the hands of lenders that operated outside the scope of federal oversight. The Federal Reserve could have reined them in, but reacted too late. This trend persisted under Bush and Obama when both administrations missed opportunities to get ahead of the market crash and the ensuing tidal wave of foreclosures.

Last week the National Fair Housing Alliance (NFHA) released a report on the treatment of REOs—real estate owned, meaning foreclosed properties owned by banks—in nine cities. Their research found that REOs in predominately minority neighborhoods were scarred with the signs of neglect and blight while those in predominately White neighborhoods were well maintained even though they are serviced by the same company. The impact goes beyond the aesthetic. Abandoned properties are estimated to reduce neighboring home values by an average of $7,200 and cost cities millions in maintenance and lost tax revenue. The disparate treatment by servicers comes on the heels of unfair targeting of these same communities by deceptive lenders. Black and Hispanic families were more than twice as likely to be sold subprime loans, even though they had the credit to qualify for regular prime loans. The foreclosures that followed have wiped out 58% of Black and 66% of Hispanic wealth. Now neglected REOs are threatening to set our neighborhoods and families back even further.

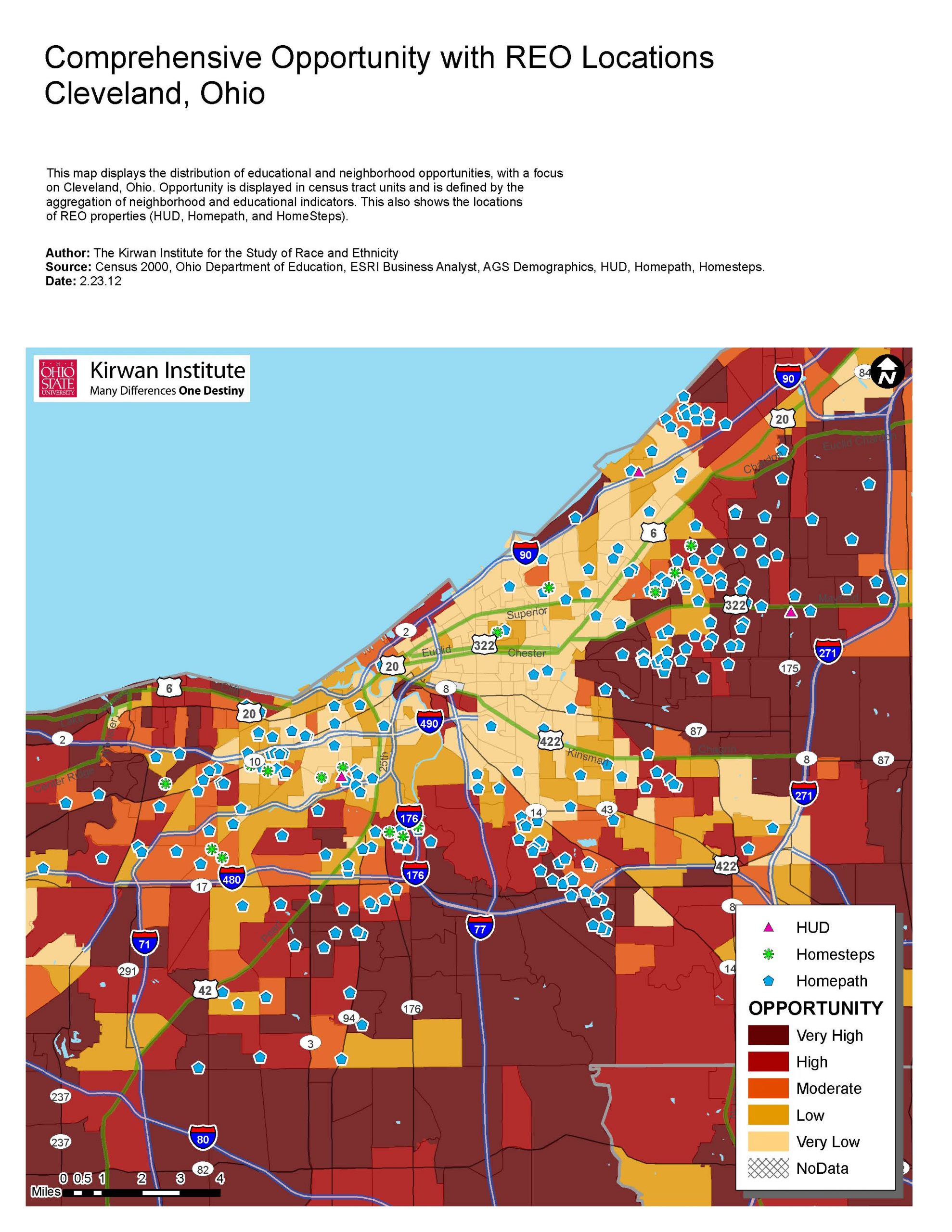

When done right, REOs can be a neighborhood asset. Creative re-use of REO properties can fuel community revival and expand housing opportunities for a broad range of families. Because many bank-owned REOs are in neighborhoods close to good schools, jobs, transportation, recreation, healthy foods and other amenities, they provide a unique avenue for expanding access to opportunity for all families while also breaking down barriers of segregation and isolation. Banks should work with mission-driven local partners like Chicanos por la Causa in Phoenix, which is acquiring REO properties and converting them into ownership opportunities for families that have completed their housing counseling program. Another NCLR Affiliate in Stockton, Calif., Visionary Homebuilders of California has established a lease-purchase program for reclaimed REO homes where renters work with a financial coach and work their way toward an opportunity to buy the home. NCLR is exploring ways to expand these kinds of programs to other cities throughout the country.

In a recent speech, Federal Reserve Chairman Ben Bernanke stated that over the next couple of years an additional one million foreclosed properties a year could be added to the REOs held by banks, guarantors, and servicers. Beyond the fact that mortgage servicers are legally required to maintain the properties they own, it would go a long way to healing their relationship with those communities if they also participated in and supported those innovative programs to repurpose properties with the community’s social goals in mind. To get there, regulators, starting with the Federal Housing Finance Agency, must set and enforce strong standards to make sure servicers treat all borrowers and all communities fairly, including standards for maintaining and marketing foreclosed homes. The Department of Housing and Urban Development and the Department of Justice should fully investigate the disparities uncovered in the NFHA report.

If no action is taken, abandoned and vacant properties will continue to drag down home prices and infect neighborhoods with crime and blight. But with a little creativity and cooperation, REOs can become a driving force in neighborhood stabilization. Homeowners cannot afford for banks and regulators to miss another opportunity like this.

—

This series is a collaborative effort under the Compact for Home Opportunity/Home4Good campaign and builds on the disparities illiustrated in the National Fair Housing Alliance report, “The Banks Are Back, Our Neighborhoods Are Not.“ Those disparities are used as an entry point to discussing the issues of REO properties and equal opportunity that surround it.

Blog series contributors include Alan Jenkins of the Opportunity Agenda; Jillian Olinger of the Kirwan Institute for the Study of Race and Ethnicity at the Ohio State University; Debby Goldberg of the National Fair Housing Alliance; Miriam Axel-Lute of the National Housing Institute; Liz Ryan Murray of National People's Action; and Janis Bowdler of the National Council of La Raza.

Comments