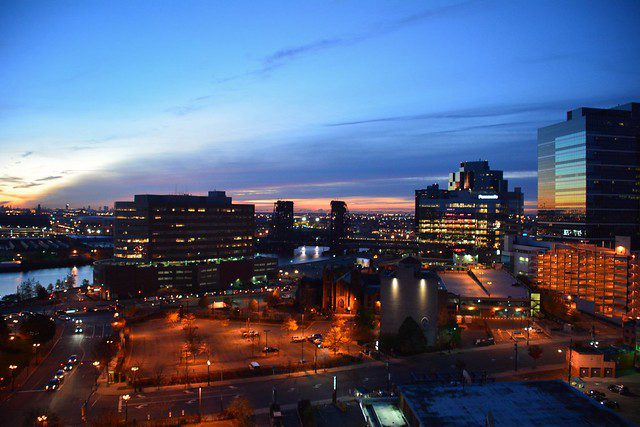

The aftermath of flooding in North Charleston, South Carolina, which was caused by over 15 inches of rainfall from Hurricane Joaquin in 2015. Photo by Ryan Johnson, via North Charleston flickr page, CC BY-SA 2.0

This week, Rep. Maxine Waters (D-Ca) advanced a bill (along with a Republican counterpart) that would reauthorize the National Flood Insurance program for five more years—until 2024. Among other things, the bill includes some changes that increase access to and affordability of flood insurance, and provides funds to improve flood mitigation and flood zone mapping. It was approved unanimously in committee, and will not go on to a full House vote.

The CDFI Fund received an unprecedented vote of confidence this week when the House appropriations Financial Services and General Government Subcommittee approved a $50 million funding increase, to $300 million—the highest funding level for the fund ever. The bill goes to a full House Appropriations vote in the coming weeks. The subcommittee also shot down an amendment that would have taken away the CFPB’s independence.

Which is good, because we still really need the CFPB. It continues to find and fine bad banks. Last week, the CFPB announced that it would be fining Freedom Mortgage bank for its’ reporting inaccurate Home Mortgage Disclosure Act (HMDA) data. When Freedom bank clients declined to list their ethnicity in their loan application, some loan officers were instructed to select “white,” whether they were white or not, in order to proceed around an application system roadblock.

Unprecedented Reforms: New York’s rent laws and tenant protections are expected to be the “strongest … in history” after the state Senate struck a deal this week on a number of reforms. Gov. Cuomo was expected to sign the bill today. Two of the biggest changes will deal with deregulation and expansion rules, according to the New York Times. (This piece in amNewYork breaks down the many reforms that are expected to pass.) Bravo! This was certainly a long time coming, and it seems like the years long fight has paid off. Of course landlords and real estate industry isn’t too happy—they’re planning on challenging the reforms in court.

Comments