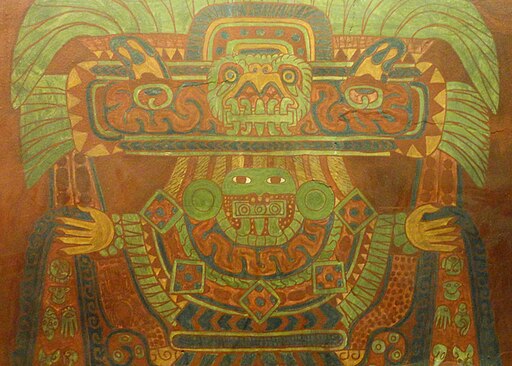

Image by transpixt via flickr, CC BY-NC-ND 2.0

“He’s great. She’s not so great.” So says a commercial that aired during the 2017 Superbowl from the online lender Social Finance Inc. The commercial’s premise is odd in the arbitrary manner in which it considers some young urban professional is “great” and others are “not so great.”

Why would a lender admit that it would capriciously evaluate people? How is this smart marketing, and how does it attract potential applicants?

Social Finance Inc. (SoFi) is cultivating affluent millennials as its clientele. Its main products are student refinance loans for millennials with considerable debt, mortgage loans, and financial investment advice. It has now applied to the FDIC for an industrial bank charter so that it can open a bank and attract deposits that could provide a substantial source of funding for its student refinance and mortgage loans.

The policy question here is whether the FDIC should approve SoFi’s charter application.

The answer is that the charter application is “not so great.” Let’s explore why.

The Community Reinvestment Plan for Their Proposed Bank Is Insulting

As part of its application for an industrial bank charter, SoFi is required to propose a Community Reinvestment Act (CRA) plan. The plan describes how the new bank, SoFi Bank, would serve low- and moderate-income (LMI) borrowers and communities.

SoFi is proposing to serve LMI borrowers with a secured credit card. This card has a credit limit of $200 to $500—not enough for even moderately expensive emergencies like car repairs or medical procedures not covered by insurance. The interest rate on this card would be north of 20 percent, according to the application. Meanwhile, personal loans or credit cards that SoFI currently offers its more affluent clientele offer higher loan amounts at cheaper rates. It is almost as if SoFi is designing a product designed to repel, not attract LMI borrowers.

SoFi’s product development for LMI borrowers rests on untested and stereotypical assumptions that LMI people are not creditworthy. The application states “it is felt (italics added by me for emphasis) that revolving credit cards are not an appropriate credit instrument for an LMI community focus.”

How does SoFi know this? Has it done careful research, or even consulted its peers about serving LMI borrowers with credit cards? A significant segment of the LMI population—just like other segments of the population—are creditworthy and can handle a variety of responsible credit products.

SoFi also proposes a vaguely defined program of financial education and volunteerism to assist LMI communities. The National Community Reinvestment Coalition (NCRC) assessed the hours SoFi was planning to commit to these efforts and designed a financial education program that would more meaningfully enable LMI people to build wealth. In particular, SoFi boasts that it refinances student loans of post-secondary students, saving them thousands of dollars. NCRC thus proposed adding protections for SoFi’s student lending program and targeting its financial education to LMI students at colleges and vocational schools. A number of these students struggle under burdensome debt levels and could benefit from financial education and carefully designed loan programs.

SoFi is practicing product segregation. It wants to serve affluent people with its best products and shunt LMI people into inferior and high-cost products that do not meaningfully serve credit needs. Redlining is a geographical-based form of product segregation. Federal bank regulatory agencies must not allow online lenders to create virtual redlining.

SoFi creates structural constraints in its application in order to resist serving LMI people. It proposes that its bank assessment area or geographical area on its CRA exam consist of the greater Salt Lake City metropolitan area, although it states that most of its clientele are in the 10 largest metropolitan areas. Using some creativity, SoFi could develop a CRA plan that targets LMI students in post-secondary education institutions in these metropolitan areas and then declare the metropolitan areas as CRA assessment areas. Moreover, SoFi is excluding its non-bank lender from its CRA plan. That is how SoFi achieves product segregation, reserving its best products for the rich and confining its lesser products for those with modest incomes.

Fair Lending Concerns

Online lenders including SoFi dispense with the usual creditworthiness data reported by the credit bureaus and instead use untested algorithms for assessing creditworthiness. Trade publications document that some of these algorithms give high weight to graduation from elite universities in underwriting decisions. It is simply not known how SoFi’s algorithm works because neither its application nor its website provides any detail. SoFi’s record, however, is cause of significant concern. The average income of a SoFi customer is $144,000 and their average credit score is 733. SoFi casually refers to its customers as “Henrys” or “High Earners, Not Rich Yet.” Well, there is nothing casual about compliance with fair lending laws.

Safety and Soundness

Yet another serious issue with applications for industrial bank charters is safety and soundness. The parent company of an industrial bank is not subject to direct oversight from the FDIC. Therefore, the FDIC would not be able to conduct compliance exams of SoFi Bank’s nonbank parent and would not be able to assess either safety and soundness or compliance with fair lending law. During the height of the financial crisis, the FDIC imposed a moratorium on industrial loan bank charter applications. Today, it would seem that online lenders pose unresolved risks and cannot be granted industrial bank charters until these risks have been investigated and resolved.

Conclusion

Online lenders have been banging at the door of the bank regulatory agencies, desiring to obtain the benefits of bank charters, including access to deposit funds and federal insurance. These lenders, however, must be reminded that bank charters are a privilege, not a right. Until they show seriousness about the obligations of a bank charter—serving all communities consistent with safety and soundness—they must remain outside the doors of the banking world.

100% true. I’m surprised they point-blank tell you to try again if you relocate to a new area.

Here is the text from SoFi if you’re rejected at the quote check:

“We encourage you to apply again if your situation changes at a later date. Examples include getting a promotion, starting a new job, graduating from school, paying down other debt, relocating to a new area, or earning a new degree. “