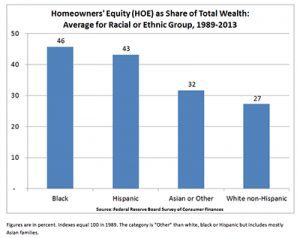

Homeowners’ equity—the market value of residential real estate minus the value of home-secured debt—has long been the largest single component of wealth for Black and Latino families. On average during the last quarter century, homeowners’ equity accounted for nearly half of Black and Latino wealth, compared to about one-third for Asian and other families, and about one-quarter for white families (see graph below). During peaks in 1989 and again around the recent financial crisis, homeowners’ equity accounted for more than half of the wealth of the average Black and Latino family.

Despite its prominent role in Black and Latino balance sheets, homeowners’ equity contributed less than other assets to wealth accumulation during the 1989 to 2013 time span covered by the Survey of Consumer Finances. The same was true for white and other families, who benefited from proportionately larger investments in non-housing assets.

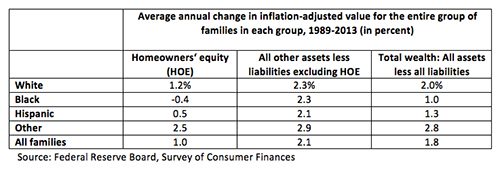

The drag exerted by poorly performing housing wealth on total wealth accumulation is starkly illuminated when comparing major racial and ethnic groups. During the 1989 to 2013 period, the average annual increases in the inflation-adjusted value of homeowners‘ equity and of all other asset types were as follows:

Homeowners’ equity wealth increased at only 0.5 percent per year after inflation among Hispanic families and actually declined, on average, by 0.4 percent per year among Black families. White and other families, by way of contrast, experienced significantly higher average rates of homeowners’ equity increase.

Excluding homeowners’ equity, rates of wealth accumulation were comparable among white, Black, and Hispanic families (although families in the other category achieved a significantly higher average gain). The final column reveals that it is the heavy concentration of Black and Latino wealth in housing, and homeowners’ equity’s poor average returns, that caused their average overall wealth gains to lag significantly behind those of whites.

The relatively low cumulative increase in wealth between 1989 and 2013 can be attributed to large declines after 2007, which is associated with the financial crisis and Great Recession. In fact, by 2004, Latino and Black families had experienced greater average overall wealth increases than white and other families since 1989. The devastating collapse of housing markets after 2007 hit Black and Latino families particularly hard because so much of their wealth was tied up in housing.

Drawing lessons from the last quarter century, our proposed three principles of sound financial management for families of color are:

1) Maintain adequate liquidity

2) Diversify assets broadly

3) Keep debt under control.

Homeownership can make following all three of these principles more difficult, especially for economically and financially vulnerable families. Concentration of assets in housing has contributed to lower and more volatile wealth accumulation for average Black and Latino families over time and therefore should be avoided.

………………

The views expressed here are mine alone and are not those of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Note: All data is from the Federal Reserve Board’s Survey of Consumer Finances, a large triennial nationally representative sample of households. The racial and ethnic categories used throughout this article are 1) non-Hispanic white, 2) non-Hispanic African-American or Black, 3) Hispanic of any race, and 4) other, which includes people of Asian heritage as well as Native Americans, Pacific Islanders, Native Hawaiians, and other groups not included elsewhere.

The underlying problems have been decline in wages, the exploitation of debt as people seek to survive and maintain lifestyles, and the deregulation of consumer protection in the debt industry, including a reduction in the power of consumer, as opposed to business, bankruptcy. Throw in the inadequate response to the foreclosure crisis, an inadequate social safety net for the lower ends of the economic scale, and the concentration of housing production in the higher end of the economic scale.

I’m glad folks are starting to understand, a least in a small way, that housing as a financial asset for low/mod families is a mirage in a lot of areas. While the message of housing as the ticket toward the American dream and asset accumulation is still very strong, the reality is that for most low/mod income families, their home is and will be a financial liability.

In urban areas like the one I work in, homes have not appreciated in value over time, they have depreciated. Homes that low/mod families can afford are in neighborhoods with poor schools and unsafe streets. Homes that need a lot of costly repairs and where resale is a difficult proposition. And because of the financial crimes perpetrated on Black and Latino families during the run-up to the housing crisis (though no one in power ever treated it like a crisis, except to bail out the criminals), they are saddled with homes that may never recover their original purchase value, let alone become an asset.

Still, instead of giving the keys back to the bank and letting them hold the liability (which millions should have done!), families are determined to save their homes from foreclosure. Why? It will drain your limited resources for the next 40 years. It’s not 1950, so rather than pushing this failed mythology of home ownership as a ladder of asset development for everyone (I’m looking at you community development/housing agencies), let’s become better advocates for the financial realities of the families we are supposed to be serving.

This revealing analysis indicates some of the factors behind the epidemic of poorly maintained, deteriorating homes in lower income (not just Black or Latino) communities. Families own their homes and want desperately to remain there despite being overwhelmed by costly repair needs, even though their determination may not be supported by cold economic reasoning.

One response of the non-profit charitable community has been programs to provide financial and hands-on assistance to make repairs. The awareness of the need for this seems to be growing, with national organizations such as Green and Healthy Homes Initiative and others. Federal programs for weatherization and heating assistance have for many years been critical in helping keep people in their homes. There are many small local groups that provide this kind of help.

Unfortunately, the resources available to us who do this work do not approach the scale of the problem, and the programs that do exist have trouble coordinating our efforts. Collaborations exist, such as the Sustainable Home Improvement Partnership in Pittsburgh. We need support, encouragement, and clear headed evaluation of our programs. Look us up.

While homeownership, to the extent that lower income and minorities can do it, may tie people to underwater homes in areas that are deserts for jobs, food and schools, the alternative is rental from either local slum landlords or multinational hedge funds that bought up all the foreclosed-on homes that the lending industry refused loss mitigation on, and the government wasn’t tough enough to enforce. As a result there was a large wealth transfer to the finance industry and its hedge funds who end up the winners, not just during the predatory lending period but during its aftermath. Homeownership may not be a great investment, but if done properly it brings more security to your life than being a renter, particularly if you can fund the expenses. Housing advocates need to do more getting funding for coops to rent houses and similar organizations to rehabilitate and sell to low-income homeowners the properties that the purchasers from FHA, FHMA and the private market are abandoning, and enable people to preserve them.