Tax-writing committees in both houses of Congress are developing legislation to reform the tax code that may be seriously considered over the next year. They should use this opportunity to rebalance federal housing subsidies to better align spending with need.

In 2012, the federal government provided $270 billion in tax breaks and direct spending to help families buy or rent housing. But the bulk of this went to homeownership subsidies—like the mortgage interest deduction—that mainly benefit higher-income families, who typically can afford homes without help.

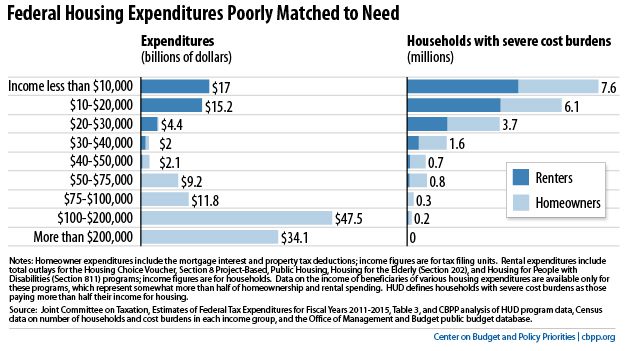

In fact, the federal government spends more on the 5 million households with incomes of $200,000 or higher than on the more than 20 million households with incomes below $20,000, even though lower-income families are far more likely to struggle to afford a mortgage. (See graph.)

The number of low-income families—especially renters—paying very high shares of their income for housing has grown rapidly, placing them at risk of homelessness and diverting resources from other basic needs. Rental assistance programs like “Section 8” Housing Choice Vouchers are highly effective in helping families afford housing. But Congress has not expanded these programs to keep pace with need and the sequestration budget cuts are causing sharp reductions in the number of families assisted.

Congress should take two steps as part of tax reform to rebalance the nation’s housing policy:

• Replace the mortgage interest deduction with a less-expensive, better-targeted credit. This would trim subsidies for higher-income families while expanding them for middle- and lower-income homeowners, many of whom receive little or no help from the existing deduction.

• Create a renters’ tax credit. Congress could use some of the savings from reforming homeownership or non-housing tax subsidies to fund a new renters’ credit that would address part of the unmet need for housing assistance among the lowest-income renters. A renters’ credit capped at $5 billion, for example, would help about 1.2 million vulnerable households, reducing their rent by an average of $400 a month.

If you add in 2012 budgeted loan purchases (Fannie and Freddie), loan guarantees (FHA) and mortgage-backed securities authorizations (Ginnie Mae), it is over $2.2 trillion, with about 8% going to support renters. I don’t know about the breakdowns by income, but my guess is it dramatically skews the expenditures chart more toward the $100K and over group.