While the $25 billion national mortgage settlement is widely viewed as a “first step” toward fixing a larger system that resulted widespread foreclosures and $700 billion lost in home value in 2011 alone, we're now seeing plans that seek to use funds from the settlement in high-impact ways. In Ohio, for example, the state has started administering funds to municipalities to demolish more than 10,000 homes across the state. The $75 million program is part of a total of $335 million in settlement funds issues to the state.

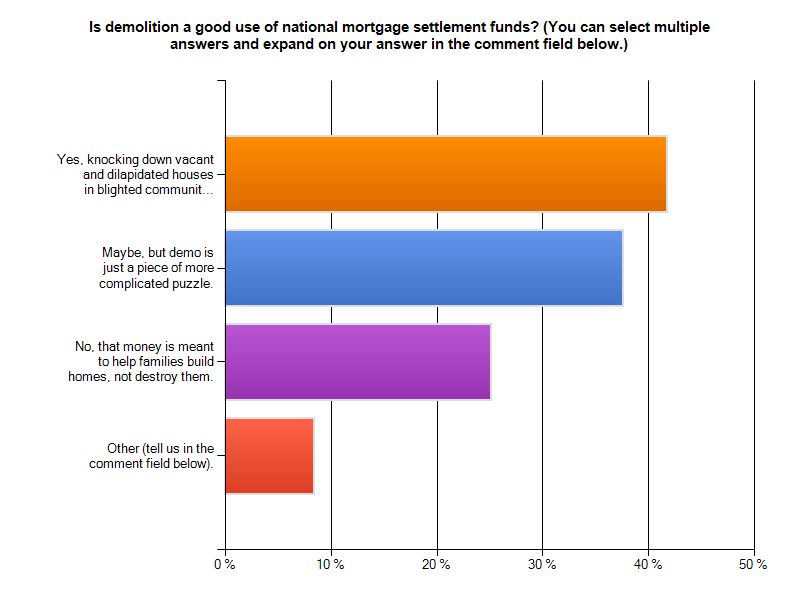

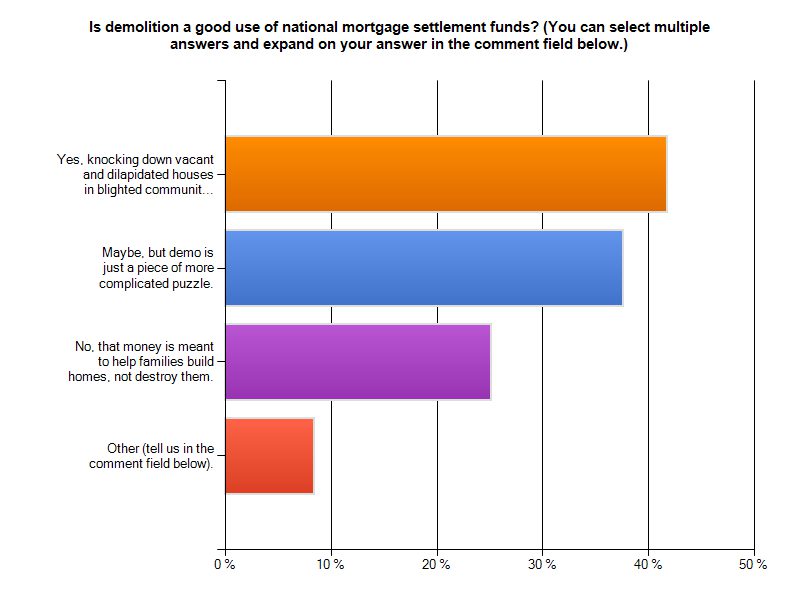

But demolition is part of a larger strategy that is more viable in Cleveland, Detroit, and Buffalo than it is in other localities affected by the foreclosure crisis. So we asked you: Is demolition a good use of national mortgage settlement funds? Click on the chart below for results and see selected reader responses at the jump.

Yes. Demolition is difficult to fund. In Ohio is money is greatly needed and is an excellent use of dollars intended to be flexible enough to meet local needs. Abandoned homes breed crime, blight and health hazards, while dragging down the value of homes in the surrounding neighborhoods. Foreclosures created the problem. Settlement money is meant address problems caused by foreclosures. It's that simple. — Frank, Washington, DC

Yes—in really distressed communities with consistently high rates of population loss and property abandonement demo is a cost that must be incurred. However, the demolitions need to be part of realistic strategy as to where new investment is to be prioritized and how cleared land is to be held and repositioned for some future use. — Anon.

Maybe, but it's just a piece of the puzzle. Clearly, there are some properties that should be demolished using settlement funds—and often these are properties (both single-family and multi-family) that were part of a mortgage fraud or improvident lending transaction. However there must be a strategy that includes rehab of those properties that can be reasonably saved (and which will create jobs). Creating vacant land and ulitmately new construction is not dissimilar from the “urban removal” strategies of the past, and I fear the end result of a tear-it-down strategy will be a loss of affordable housing units and replacement by higher-cost units that will drive yet another housing bubble 15-20 years from now. As an industry and a country, we tend to ignore and not learn from the past—the housing bubble and burst in southern California in the early 90s should have taught folks that housing prices don't continue to appreciate without a concomitant decline. Using settlement funds to implement a thoughtful strategy about neighborhood recovery that includes preserving units that could be affordable along with clearing the way for new units opens up other possibilities—things such as community land trust expansion, new forms of cooperative housing, or other housing solutions that a combination of vacant land and capital could address. —Jake, Chicago

No, there are so many homeless people. The greenest building is the one that's already built. Such an opportunity to do deep energy retrofits. —Patricia, Cleveland

It's not too late to weigh in on this issue. Comment in the area below or click here to take the poll!

Comments