WASHINGTON, DC—House Financial Services Chairman Barney Frank (D-Mass.) today announced a bill, slated for an April vote, that aims to impose tougher penalties on securitizers who have sold bad loans, along with other restrictions that said would limit the “possibility of incentives to brokers to steer people to higher interest rates.”

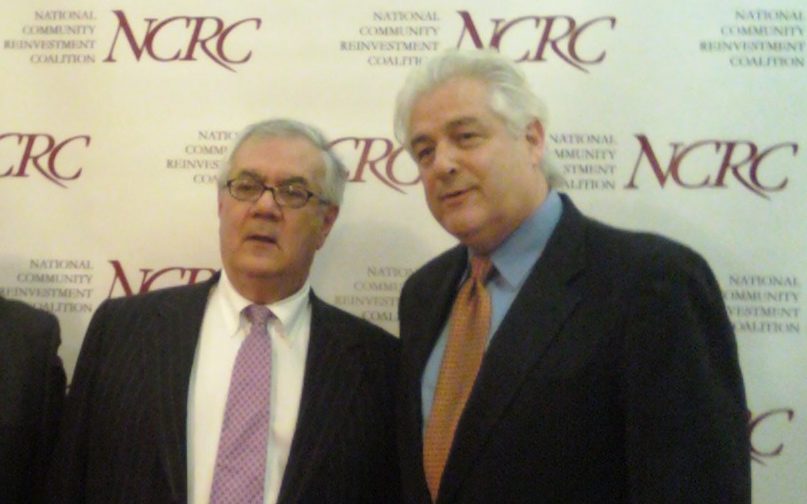

Speaking at the 2009 National Conference of the National Community Reinvestment Coalition, Frank also called for increased legal assistance for individuals whose homes are in foreclosure and who are involved in disputes with their lenders.

Frank pointed to increased willingness to act on the legislation in the Democratic-controlled House. In 2007, he said, though the Democrats were in power then following the 2006 midterm elections, reform within the housing industry failed: “We didn’t have the political will – That’s changed.”

The legislation, Frank said, will also stipulate that mortgage lenders absorb the first losses on any loans they sell off for securitization: “No one should be able to securitize 100 percent of anything — no one should be allowed to make loans, and then sell all of it.”

Frank also acknowledged the benefits of CRA while criticizing its detractors:

Republicans are saying that we are here because of the CRA — we want to help low-income people — that’s their argument. But if only institutions covered by the Community Reinvestment Act made mortgage loans, we would not have a crisis.

We are going back to a reform agenda and they are terrified of that. They’ve got this myth blaming us — the coalition of people who care about social justice — for their failures of extreme deregulatory philosophy. They had 12 years to implement that philosophy, we’ve had two years to try to undo it. They are desperately trying to shift the blame and we’re not going to let them do it.

Comments