Tag

Oregon

The Latest

Coastal Oregon County Tackles ‘Urban Scale’ Housing Issues

Tourist-dependent Clatsop County, population 41,000, has the highest rate of homelessness in Oregon. A project to convert a hotel into housing units for health care workers and the unhoused is a step in the right direction, leaders say.

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

A COVID Upside: It Pushed Organizations to Do Better

During the pandemic, community development organizations had to work double-time to adapt to residents’ needs. For some, that work yielded important lessons about better helping their communities, permanently.

How States Can Use Medicaid to Address Housing Costs

New federal guidance enables states to use Medicaid dollars to support housing needs.

Six Steps to Ensuring a Strong Right to Organize for Tenants

Getting solid legal protections in place will help tenants stick up for themselves more safely and effectively.

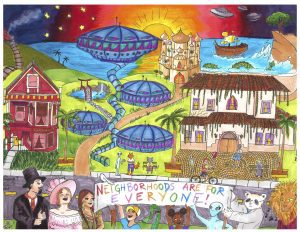

Why Oregon Created Its Own AFFH Rule

For more than a decade, fair housing advocates in the Beaver State had been looking for ways to connect housing and land use planning to promote the affirmatively furthering fair housing rule. Here’s how Oregon created its own state-level policy, and what’s to come.

Organized Tenants Are Baaaaack

After a lull in the 1990s, the tenants rights movement reemerged and has only gained strength. What caused the resurgence and what do tenants’ prospects look like?

Have the YIMBYs Evolved?

Yes in My Back Yard activists started with a simple—and some would say simplistic—argument: to solve the nation’s housing crisis we just need to build more housing, of any type and in as many places as possible. But as the movement nears a decade of existence, some of its members argue that their message has become more nuanced.

Going Statewide to Boost ADU Development

ADUs are typically regulated at the local level, but advocates argue statewide legislation is what’s actually needed to get to scale. California has been aggressively leading the way.

ADUs: Laws and Uses, Do’s and Don’ts

As ADUs gain national attention, cities are searching for the best ways to legalize their development and encourage construction.

ADUs: Defined, Disambiguated, and Debated

Accessory dwelling units are being touted as a way to provide more affordable rental units for tenants, and additional monthly income for homeowners. But some cities allow them, others don’t. So what are ADUs exactly?

Are Tiny Homes a Piece of the Affordable Housing Puzzle?

More and more tiny homes are being built across the U.S. Where are they being developed, who they are serving, and what obstacles do they face in addressing the need for more affordable housing?

Minor Defendants: Kids Are Being Named in Evictions

When landlords name minor children in eviction filings, the negative effects could haunt them years later.

Proud Ground: When Land Is Expensive, Look Outside the City

This community land trust focuses its efforts on helping people of color purchase homes across five counties.