Tag

foreclosure and financial crisis

The Latest

Organized Tenants Are Baaaaack

After a lull in the 1990s, the tenants rights movement reemerged and has only gained strength. What caused the resurgence and what do tenants’ prospects look like?

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

Gabby, Ryan, and Home Opportunity for All

Not even Olympians are immune from America’s homeownership crisis. The Associated Press reported this week that the parents of U.S. Olympic swimmer Ryan Lochte are facing foreclosure in Florida, while […]

Geithner Steps Up in Defense of Principal Reduction

Yesterday, Treasury Secretary Timothy Geithner took a bold step toward guarding families’ homes from unnecessary foreclosure. He wrote an open letter in defense of principal reductions—a vital option that reduces […]

It’s Time for Home Opportunity

Dramatic developments this month have underscored our nation’s progress, as well as our continuing peril, when it comes to Home Opportunity—the deeply held idea that everyone should have access to […]

Eminent Domain to Stop Foreclosure: Clever, but Not the Only Solution

This article first appeared on Huffington Post. The heat wave may have broken, but the news is still hot on the latest scheme to deal with underwater mortgages: getting them […]

Interview with Senator Robert Menendez

Shelterforce talks with Sen. Robert Menendez about the ongoing federal response to the housing crisis, the Sustainable Communities Initiative, the Occupy movement, and more.

Q: Did the housing crisis prove low-income people can’t be successful homeowners?

No! Two at-scale, long-term lending programs show that if the process is done right, low-income homeowners can be as successful as prime borrowers–or more.

FHA Expands Disposition Program

HUD announced today that it will make 3,500 distressed loans available through its Distressed Asset Stabilization Program—part of an expansion to the FHA disposition program that sells pools of defaulted mortgages headed […]

Ending “Dual Track” in California

Last week, the California legislature passed the California Foreclosure Reduction Act, finally putting an end to the unfair “dual track” system that allows banks to process foreclosure papers while also moving […]

Don’t Quit the Dream: A Vision for Homeownership Beyond 2012

After years marked by stalemate and indecision, 2012 has delivered a glimmer of hope for families and the housing market. The Justice Department kicked off the year with a historic […]

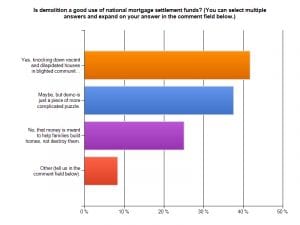

Is Demo a Good Use of AG Settlement Funds?

While the $25 billion national mortgage settlement is widely viewed as a “first step” toward fixing a larger system that resulted widespread foreclosures and $700 billion lost in home value […]

Six Steps to Stabilize High-Foreclosure Neighborhoods

1. Don't Let the Lenders Lie. When lenders and servicers say they can't modify the principal on a loan because it's in a security and their securitization agreements don't let […]

On the Front Lines: Solutions for Overleveraged Multifamily Properties

As foreclosures drive multifamily assets to market in New York City, drawing a glut of speculative investors in the process, a new program from Enterprise looks to retain these homes’ affordability and stability.