Summer 2016

Issue #183

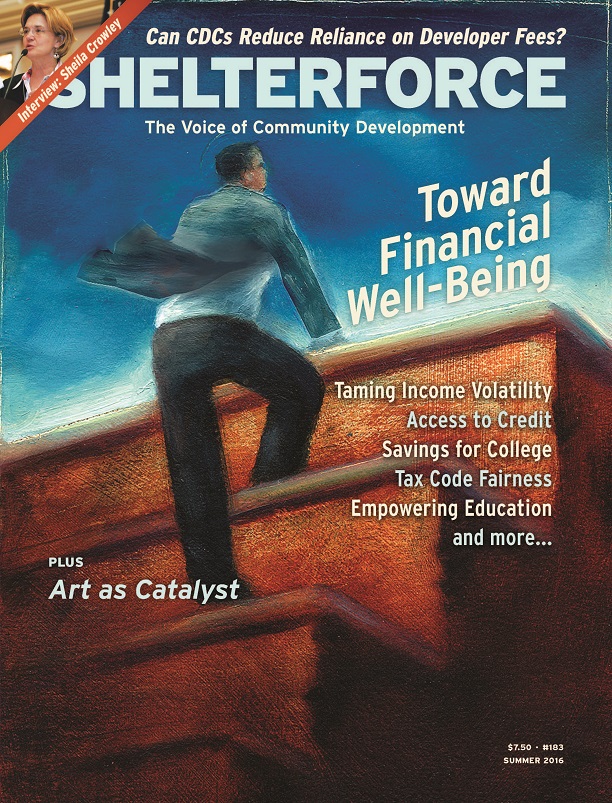

Financial Well-Being

What does it take to achieve financial security for the millions of American households without it? Clearly full employment, higher wages, and a more robust safety net would be some major components. But as important as those are, they aren’t the full picture. In this issue, we tackle perceptions that asset-building is mostly about behavioral change for low-income households, explore the problem of income volatility, look at structural issues that reproduce financial instability, and talk about some solutions and campaigns.

Getting Beyond the Developer Fee

In tough financial times, community developers are hanging on to their developer fees despite competition, but many are also diversifying their programs and revenue streams.

Interview with Sheila Crowley, past president of the National Low Income Housing Coalition

Crowley has led the organization through dramatic times, keeping a focus on those with the most pressing housing need when many wanted to just talk homeownership.

The Catalyzing Power of Art

Art can be an economic engine for neighborhoods, but sometimes locally-based artists need some support to kick their businesses into gear, and community-based organizations are stepping up.

Why Financial Education Should Get Political

Financial curricula for low-income households often focus on personal choices about budgeting and saving, but if they don’t also address systemic problems, exploitation, and discrimination, they aren’t speaking to their audience’s reality.

Financial Inclusion Begins With Our Tax Code

Changes to the tax code, and tax programs that support low-wage earners, will strengthen gains made in the asset-building field.

College Bound: A Look at Children’s Savings Accounts

Children’s savings accounts for higher education, even those that have accumulated only small amounts of money, can change expectations for low-income students and they might also provide a vehicle for larger wealth transfers.

Q: Why don’t low-income families save?

A. Actually they do! However, they tend to be saving for the short term, rather than the long term.

Getting New Jersey to Divest from Payday Lending

NJ Citizen Action says having a state pension fund invested, even indirectly, in a form of lending illegal in the state cannot stand.

Well Worth the Read

Reading What It’s Worth was like walking through one of the glorious Asset Learning Conferences that CFED organizes, equipped with a magical Harry Potter wand that allows me to stop and re-work time so I can peer into each workshop at my leisure.

Being “Well,” Financially

What does it take to achieve financial security for the millions of American households without it? Clearly full employment, higher wages, and a more robust safety net would be some major components. But as important as those are, they aren’t the full picture. Assets are an important counterweight to income.

Challenging the Almighty Credit Score

A majority of mainstream lenders base loan approvals on a hotly debated three-digit score. Are there better, fairer ways to assess risk?

The Fight for Full-Time Work in San Jose

Unpredictable hours lead to unpredictable cash flow, which is a barrier to budgeting and saving. One response to this, the Opportunity to Work Initiative, would require that San Jose employers give more hours to part-time employees before hiring new staff.

The Ripple Effects of Income Volatility

Research shows a connection between the financial instability of families and the economic health of communities.

Is Financial Unsteadiness the New Normal?

A yearlong analysis of 200-plus households suggests that we should add a third leg to the financial security stool along with income and assets: cash flow.