The Answer

The Answer is a one-page response to questions many of our readers find themselves being asked over and over, whether by colleagues, potential partners, funders, policymakers, or the public. It’s easy to download and print and it’s free to distribute with our credit on it.

Let us know how you are using The Answer, and also to get your suggestions for other questions to address.

Email The AnswerThe Latest

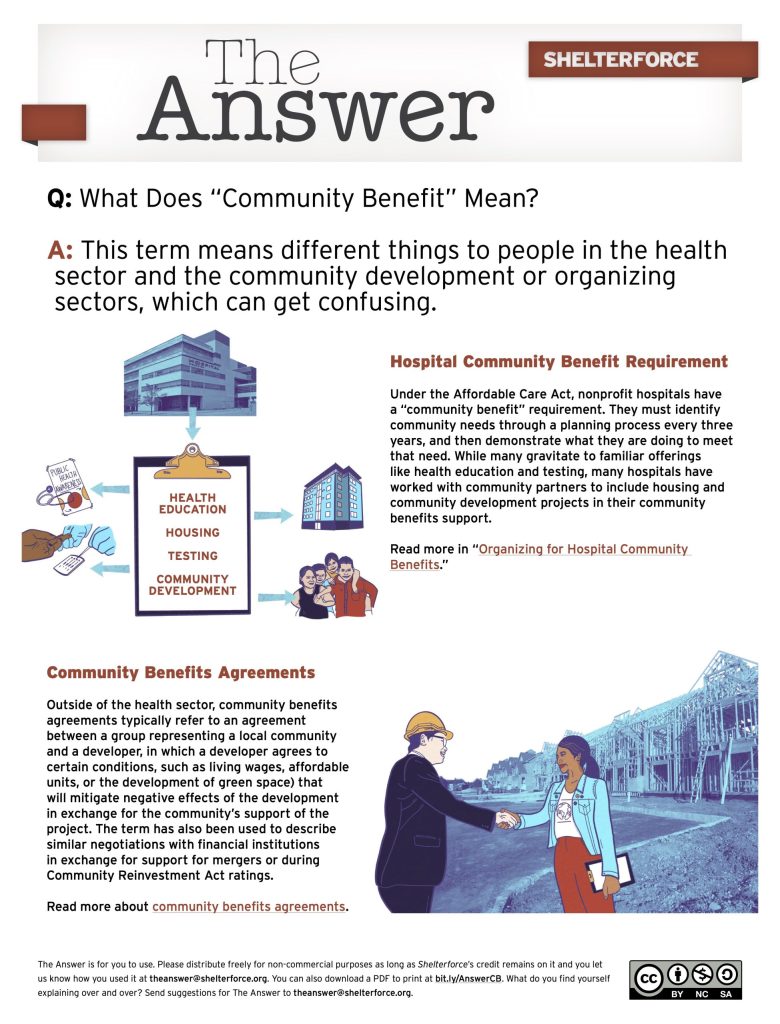

Q: What Does ‘Community Benefit’ Mean?

A: This term means different things to people in the health sector and the community development or organizing sectors, which can get confusing.

Search & Filter Within this Topic

filter by Topic

filter by Date Range

search by Keyword

Q: Do Section 8 Voucher Holders Increase Crime in a Neighborhood?

A: No! This is a perennial fear, but research shows that additional voucher holders don’t change the crime rate at all. However it does show that . . .

Q: Is a Land Bank the Same as a Land Trust?

A: Nope. They are totally different, though complementary tools. This chart will walk you through the differences.

Q: Are Manufactured Homes a Bad Form of Affordable Housing?

A: Not any more! There are many myths out there about manufactured (or “mobile”) homes, but in fact they can be a very important source of quality affordable housing…

Q: Why doesn’t the market produce enough affordable housing where people want it?

A: The market is supposed to meet demand, but the importance of location, location, location, plus other factors, keep this from working for affordable housing.

Q: Does Affordable Housing Development Lower Nearby Property Values?

A. No. No. No. Are 56 studies enough no for you?

Q: What’s the Point of Shared-Equity Homeownership in Weak Market Areas?

Shared-equity homeownership is best known as a tool to fight displacement in hot-market areas. But in fact, it has many advantages in weak-market areas too.

Q: Does Shared-Equity Homeownership Build Assets?

A: Yes! And keeps them safer than traditional homeownership does.

Q: Did the housing crisis prove low-income people can’t be successful homeowners?

No! Two at-scale, long-term lending programs show that if the process is done right, low-income homeowners can be as successful as prime borrowers–or more.