Financial Well-Being

The Latest

Colorado Wants to Give Tenants Money for Paying Rent

A new statewide program aims to help renters benefit from the value they add to the buildings they live in. Here’s how the program could work, and when it could begin.

Explore Articles in this Topic

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

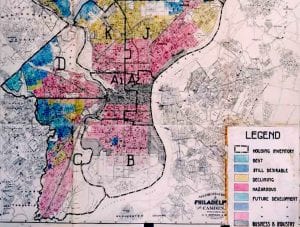

Why the Community Reinvestment Act Must Be Expanded Broadly Throughout the Financial Industry

The financial industry has been one of the main perpetrators of racial discrimination. It should be obligated to serve all communities, particularly communities of color.

Can Investing in a Community’s Growth Boost Health Outcomes?

ProMedica and LISC team up to fund place-based investments in the hope of improving health outcomes for residents. How do they do it?

Who Is Still Unbanked, And What Can We Do About it?

Seven percent of U.S. households, a group roughly the size of the population of Australia, were “unbanked” in 2015, meaning they have neither a checking nor savings account. This is the lowest unbanked rate recorded since the survey first launched in 2009

In the World of Community Wealth-Building, Ownership Has Its Privileges

What local government can do to support new, more inclusive economic models.

How Does Mobile Banking Affect the Unbanked?

The absence of bank branches and the proliferation of high-priced alternative lenders in the region only underscore the importance of access to affordable financial services.

In Pursuit of Financial Well-Being: A Conversation on Fairness, Accessibility, and Empowerment

In a world of growing financial complexity, predatory products, stagnating wages, and escalating inequality, financial insecurity is a dramatic problem. We gathered a group of leaders who are combating financial insecurity for a conversation on how it all relates.

Being “Well,” Financially

What does it take to achieve financial security for the millions of American households without it? Clearly full employment, higher wages, and a more robust safety net would be some major components. But as important as those are, they aren’t the full picture. Assets are an important counterweight to income.

Well Worth the Read

Reading What It’s Worth was like walking through one of the glorious Asset Learning Conferences that CFED organizes, equipped with a magical Harry Potter wand that allows me to stop and re-work time so I can peer into each workshop at my leisure.

Why Financial Education Should Get Political

Financial curricula for low-income households often focus on personal choices about budgeting and saving, but if they don’t also address systemic problems, exploitation, and discrimination, they aren’t speaking to their audience’s reality.

Interview with Sheila Crowley, past president of the National Low Income Housing Coalition

Crowley has led the organization through dramatic times, keeping a focus on those with the most pressing housing need when many wanted to just talk homeownership.

True Financial Capability Requires Expanding the Definition of Wealth

What is productive agricultural land and clean water worth? What are strong communal relationships worth? What is a clear connection to heritage, to culture, to past, to future, and self, worth?

Financial Counseling and Coaching Need to be Professionalized

What happens to families who are financially vulnerable and rely upon free financial counseling and coaching services to get out of debt or repair their credit score?