Belmont Dairy, mixed-income development in Belmont, Portland, Oregon. Photo credit: Breet VA via flickr, CC BY 2.0

The gap between the rich and poor—and between rich and poor neighborhoods—has widened in recent decades, exacerbating residential segregation of households by income and worsening racial inequalities. After decades in which federal and local-level housing policy decisions concentrated poverty and created the nation’s segregated landscape, policymakers continue to look for place-based solutions that leverage housing-related policies to reverse those trends and foster more mixed-income communities.

To effectively layer and integrate federal and local policies in ways that cultivate and sustain economically integrated communities, we need a better understanding—not just of intentionally built mixed-income developments, like those created under HOPE VI—but also of the demographic, economic, and policy dynamics that create “naturally occurring” mixed-income neighborhoods. In a recent What Works essay (part of a series compiled in the fifth volume in the Federal Reserve Bank of San Francisco’s What Works series, What Works to Promote Inclusive, Equitable Mixed-Income Communities), we analyzed the location and composition of these kinds of neighborhoods in the nation’s 100 largest metropolitan areas.

Before summarizing what we found, it should be noted that no single definition of a mixed-income neighborhood exists. For this analysis, we divided households into three categories relative to each region’s Area Median Income (AMI): Those below 80 percent, between 80 and 120 percent, and above 120 percent. We considered a neighborhood to be mixed-income if each of these groups makes up at least 20 percent but less than 50 percent of tract households. These parameters mean that each income group has a significant, but not dominant, presence in the neighborhood. In addition, our definition of “mixed-income” requires that the neighborhood has at least 10 percent of its population living below the federal poverty level, in an effort to identify those neighborhoods where poor households may benefit from the political and social capital that mixed-income neighborhoods are thought to provide.

Applying those parameters to assess census tract-level American Community Survey data in the nation’s 100 largest metropolitan areas, we found:

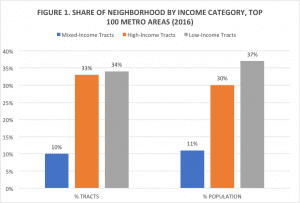

Just one-tenth of major-metro neighborhoods are mixed-income.

Of the nearly 47,000 U.S. Census tracts that make up the nation’s 100 largest metro areas, just under 5,000 met our definition of mixed-income in 2016 (Figure 1). At the same time, roughly one-third of tracts were majority low-income and another third were primarily populated by high-income households.

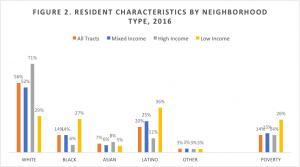

Mixed-income neighborhoods are much more representative of the racial and ethnic makeup of metropolitan America than neighborhoods segregated by income.

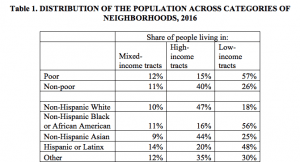

The 23 million people living in mixed-income neighborhoods make up a strikingly representative cross-section of metropolitan America (Figure 2). Similar shares of poor and non-poor residents lived in mixed-income neighborhoods in 2016, as did roughly one in 10 non-Hispanic White, Black or African-American, and Asian residents (Table 1). Hispanic or Latinx residents posted a modestly higher share at 14 percent.

The rough parity in who has access to mixed-income neighborhoods contrasts sharply with high-income neighborhoods—which tilt disproportionately toward non-Hispanic White, Asian, and non-poor residents—and low-income tracts, where most major-metro poor and Black/African-American residents live. These patterns of disproportionate inclusion and exclusion have been shaped in no small part by housing policies and practices in these regions.

The makeup of the housing stock and use of federal housing subsidies likely contribute to the economic and racial diversity of mixed-income neighborhoods.

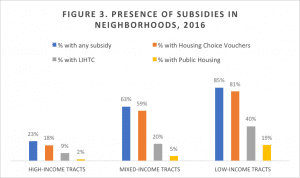

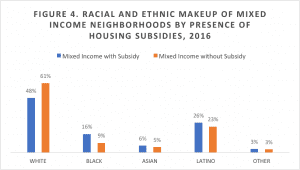

Federal housing subsidies no doubt played a role in helping the 12 percent of metropolitan poor residents in mixed-income tracts gain access to these neighborhoods (Figure 3). Moreover, mixed-income tracts that contain subsidized households tend to be more racially and ethnically diverse (Figure 4). Specifically, the share of Black/African-American residents in mixed-income neighborhoods almost doubles when housing subsidies are present.

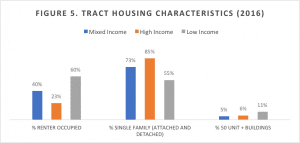

But likely a much bigger factor in mixed-income neighborhoods (and one that shapes where subsidies can be used in the first place) is the type of housing available (Figure 5). High-income tracts in the top 100 metro areas are populated predominantly by single-family homes, which are largely owner-occupied, while low-income tracts are dominated by renters and denser forms of development. It is likely that mixed-income neighborhoods support a more economically diverse group of residents because they exhibit a relatively more balanced mix of owner and rental units and a housing stock that offers opportunities for modest density.

A great deal of churn exists in mixed-income neighborhoods, while economically-segregated neighborhoods tend to be “stickier.”

Between 2000 and 2016, the number of mixed-income neighborhoods in metropolitan America increased from 3,553 to 4,911—an uptick of 40 percent. However, the topline numbers mask a great deal of churn over time.

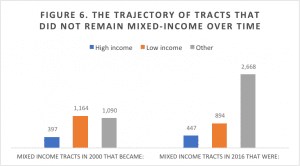

Just 18 percent (902 tracts) of mixed-income tracts in 2016 began the 2000s that way. Neighborhoods that lost their mixed-income status after 2000 were more likely to do so because they became more heavily concentrated at one end of the income distribution: Almost 60 percent of tracts that were formerly mixed-income in 2000 transitioned to either majority high-income or majority low-income by 2016 (Figure 6). Those that became high-income were more likely to be located in cities, while those that became low-income were much more likely to be located in suburbs, reflecting dual trends that typified this period: The revitalization (and gentrification) of a growing number of urban neighborhoods and the growing incidence of poverty and decline in the suburbs.

In contrast, the much smaller number of tracts that used to be majority high- or low-income but became mixed-income in 2016 suggests that the more segregated by income a neighborhood is, the “stickier” the income status of that neighborhood tends to be.

These trends suggest that point-in-time snapshots of mixed-income neighborhoods often capture a temporary neighborhood equilibrium of integration in a longer-term trajectory of income sorting.

What’s Needed

These findings tell us that to cultivate stable, mixed-income neighborhoods, we need:

- More research into neighborhoods that have managed to remain stably integrated and the factors that have contributed to stability;

- To better align and deploy federal and local policies in ways the promote more inclusive communities, from the siting and allocation of federal subsidies to local and zoning and policies that enable a more diverse mix of housing types.

- Investments paired with place-based policies that recognize neighborhood trajectories. In gentrifying areas, investments need to be coupled with affordable housing preservation, tenant protections, and anti-displacement strategies. In areas experiencing growing poverty, stemming concentrated disadvantage will require connecting housing strategies with cross-sector interventions and investments in residents and the broader community; and

- To promote social integration and greater access to opportunity structures, which will require aligning services and community resources with housing interventions. Services that seek to build a sense of community and belonging in otherwise transitioning and transient neighborhoods—whether urban or suburban—can help to build social cohesion across different groups of residents and promote longer-term neighborhood stability.

What are the Implications?

For Policy

Federal housing policy helped to create today’s landscape of economic and racial segregation, and it has an important role to play in undoing that legacy. Where housing subsidies are targeted—be it through place-based investments like LIHTC or through the expansion of choice through vouchers—helps shape where low-income households can live. We find that most mixed-income neighborhoods (63 percent) contain some type of housing subsidy—most often tenant-based Housing Choice Vouchers—and that tracts that contain subsidized households tend to be more racially and ethnically diverse. This suggests that the design of housing subsidy programs, and targeting them to local housing market conditions, can make a significant difference in supporting more integrated neighborhoods. For instance, the Baltimore Regional Housing Partnership (BRHP) has a robust counseling and housing search assistance program aimed at helping Housing Choice Voucher households locate in higher- opportunity neighborhoods throughout the region. As BRHP works with voucher households pre- and post-move, it strives to foster income mixing and guard against concentrating low- income households in particular properties or neighborhoods.

However, federal subsidies are just one policy lever that should be considered alongside a broader array of tools. Local housing and zoning policies are among the most influential factors shaping housing access. Incentivizing localities to diversify the mix of housing types in all neighborhoods can foster greater economic inclusion. Inclusionary zoning, for example, can require or encourage the production of affordable units as part of market-rate development. In addition, city- or state-level source of income discrimination protections can ensure that households with a voucher have access to fair housing choices. Policies that limit exclusionary zoning practices are also critical: for example, Minneapolis recently eliminated single-family zoning in every neighborhood to increase the supply of “missing middle” housing across the city. In Massachusetts, Chapter 40B ensures that all of its cities meet their fair share of affordable housing production by streamlining the approvals process for projects that include units targeted to lower-income households. While these are just a few examples, they point to ways in which local models can facilitate the development of mixed-income communities outside of the public housing and/or federal housing subsidy context.

For Research and Evaluation

Despite decades of research into the effects of concentrated neighborhood poverty on a variety of outcomes, and recent evidence pointing toward the importance of neighborhood context on a child’s expected earnings in adulthood, we do not know how mixed-income neighborhoods benefit poor residents. For example: are mixed-income neighborhoods good for poor children because they provide meaningful exposure to people from different backgrounds? Or because they provide access to resources and institutional capacity not present in poor neighborhoods? Or because they increase collective efficacy and political mobilization for neighborhood investments? Knowing more about how these pathways matter would fill a central gap in our understanding of the mechanisms underlying neighborhood effects. We also need more research that accounts for the fact that neighborhoods change. We find that while low-income and high-income neighborhoods tend to be “sticky,” there is a lot of churn in which neighborhoods are mixed-income over time. A deeper exploration of neighborhoods that have managed to remain stably integrated over time— and what factors have contributed to that stability—could help to more effectively direct future policymaking efforts at the local, state, and federal level.

For Development and Investment

Where development and investment happens, and what kind, can have a profound influence on neighborhood change. Particularly in the context of places experiencing gentrification and a “return to the city,” investments need to be coupled with tenant protections and strategies to prevent displacement. Affordable housing preservation—not just new construction—should be a priority in neighborhoods that are seeing an influx of higher-income residents. In San Francisco, for example, the city has established a Small Sites Program, which provides loans to nonprofit organizations to buy buildings that are at risk of being sold to a private investor and convert the units to permanent affordability.

On the other hand, in neighborhoods experiencing increases in the number of poor and low-income households, policymakers and practitioners should prioritize community development investments and programs that can stabilize and support mixed-income neighborhoods. Taking steps to promote and preserve integration in such areas can help stem the emergence of new areas of concentrated disadvantage, but will require connecting housing strategies with cross-sector interventions and investments in residents and the broader community.

For Residents and Community Members

The built environment is just one element of what it means to be “mixed-income.” Fostering housing integration, at its core, is about the hope that doing so will also promote social integration, offer greater access to opportunity structures, and ultimately improve outcomes for low-income households and residents of color. Yet, while housing policies and investments can set the stage for integration and access, housing strategies alone are unlikely to guarantee the durability and efficacy of those conditions. Aligning services and community resources with housing interventions can help ensure that low-income families in mixed-income environments have access to employment, health, transportation, and other social services that can help support individual households. Services that seek to build a sense of community and belonging in otherwise transitioning and transient neighborhoods—whether urban or suburban—can promote neighborhood stability by building social cohesion across different groups of residents.

Elizabeth’s work is always top notch, I just would like her critical analysis of the socio-economic effects of the old, narrow, limited “urban planning” model typically used throughout tbe U.S., which focuses on the built environment, using business metrics as evidence of civic “success”, but which produces a widening socioeconomic divide.

San Antonio where I live, is a case study in this regard. I contend you cannot achieve the human metrics we seek using a business model in the public sector — a sector needing its own framework defining community “success”.