Photo by Nimish Gogri via flickr, CC BY 2.0

Panacea? Productive? Or problematic?

As policymakers, advocates, investors, and communities learn more about Opportunity Zones, this new tax incentive could be any, or all, of the above.

It could provide a massive boost to economic development in low-income communities, kickstarting billions of dollars of investment in all types of distressed areas—urban, rural, and places in between—to produce affordable housing for residents, create jobs by enabling existing businesses to expand and entrepreneurs to start new firms, and provide opportunities that have largely passed by many parts of the U.S.

Or, it could provide an infusion of private capital without commitment to local needs, and those priorities could displace longtime residents and businesses. Some communities were so concerned about this that they asked not to be included as states chose census tracts to nominate.

Or, it might have little effect at all, as investors decide that the risks are too great for the potential returns.

The potential is there for great benefits, but it is not yet clear where, how, and to whom any benefits will accrue. People who care about connecting residents and businesses in distressed communities with opportunities need to act now so Opportunity Zones fulfill their promise.

What’s Happened So Far?

Since last year’s tax bill created Opportunity Zones, understanding has grown quickly about how this new investment tool is designed to drive long-term capital to rural and low-income urban communities. This tax incentive is intended to encourage investors to place their capital gains into Opportunity Funds—a new vehicle that will channel pooled money into equity investments in small businesses and real estate—in return for deferred, or even reduced, tax liabilities.

Each state could designate, subject to approval by the U.S. Treasury, up to 25 percent of its low-income census tracts, to become Opportunity Zones. Since the initial March 21 deadline for nominating tracts, states have gradually revealed the areas that will be able to receive money from Opportunity Funds.

So far the Treasury Department has approved Opportunity Zones for 20 states and four territories, with decisions on the remaining zones to be announced soon. Some states waiting for final word have made their nominations public.

Zack Patton of Enterprise Community Partners’ Knowledge, Impact and Strategy team has analyzed the nearly 5,000 approved Opportunity Zones and found that:

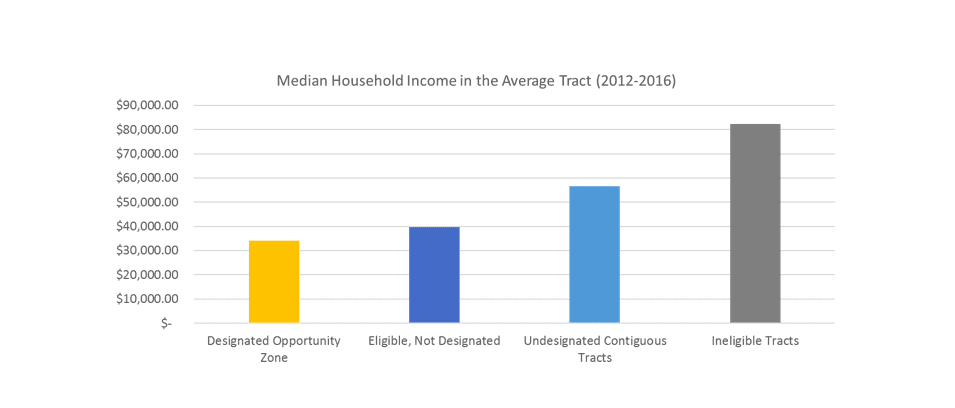

- Their residents tend to have lower incomes than those in all tracts that were eligible.

- They had lower homeownership rates.

- Their residents were more likely to be African American and Hispanic than the eligible tracts in general.

As the final Opportunity Zones are announced, it will be important to examine the characteristics of those areas as well.

What to Know and Do Now

The key question now is: how can advocates ensure that Opportunity Zones produce equitable, direct, and sustained benefit for the residents and businesses in those census tracts?

Understanding which areas have been designated. Enterprise offers a dynamic mapping tool that shows not only those areas, but also how Opportunity Zones can leverage other community development resources, such as the New Market Tax Credit and Choice Neighborhoods.

Determining local needs and priorities. Some communities have been starved for capital for many years, and Opportunity Zones might provide the investment needed to accelerate economic growth. Other Opportunity Zones are adjacent to areas that are rapidly revitalizing, and so a primary concern is too much capital that could lead to displacement of longtime residents and businesses. Successful implementation will need to capture community input—through collaboration among state and local officials and community stakeholders—and align with existing programs and plans.

Some states are already taking these kinds of thoughtful approaches. Officials in one state looked deeply at the relationship between eligible tracts and other federal place-based investment programs, enabling them to focus their designations where Opportunity Zone investments could align with existing priorities. In another state, senior officials incorporated a measure for housing stability into their process so they could target areas where, if land values increased after investments, residents would be less likely to be displaced. In a third, the state housing finance agency is exploring innovative ways to incentivize affordable housing development in designated Zones.

Shaping Treasury’s regulations for Opportunity Funds. Because this tax incentive is so new, its implementation rules are still being developed. Now is the time for advocates to affect the final regulations. It will be particularly important to weigh in based on the kind of principles our organization outlined in a March letter to Treasury:

- Define Abuse to Protect Communities and Residents: Because investments in Opportunity Zones mean taxpayer dollars are foregone, the treasury should define “abuse” as any investment getting this special treatment that does not provide a direct and sustained benefit to a community’s residents.

- Establish Informative Annual Reporting Requirements: In the Conference Report of the Tax Cuts and Jobs Act, Congress called for an annual report with metrics related to community and resident benefits in each Opportunity Zone. However, this language was not included in the bill that was signed into law, meaning that there is no legally binding requirement for Opportunity Funds to provide this kind of transparency. Without this kind of analysis, there will be no indication if the investments are benefiting or harming residents and local businesses, and so detailed reporting is vital. We recommend that Opportunity Funds be required, at minimum, to report who the fund manager is; the state in which the fund is registered; and transaction-level information such as the Zone in which the fund has invested, how much it has invested, and in what the fund has invested (e.g., real estate, business, etc.).

Opportunity Zones truly are an unprecedented opportunity, but their ability to provide the benefits our vulnerable communities deserve depends on stakeholders and communities bringing their expertise to develop effective guidance.

Thanks for this—really interesting. Wondering if there are provisions in place to ensure that the capital invested in opportunity zones goes to support affordable housing and affordable commercial space. Without those restrictions it seems that the investment may be counterproductive to the stated goal.

It’s definitely a crucial question. Right now there aren’t provisions that ensure Opportunity Fund investments produce sustained, equitable benefits for residents and businesses in an Opportunity Zone. That’s why we’re calling the Department of Treasury to use its statutory authority from Congress to issue regulations that prevent abuse, and that abuse be defined to include investments that adversely affect low-income residents — for example, by eliminating affordable homes. Our CEO Terri Ludwig noted these needs in her Congressional testimony in mid-May – see more here: https://www.jec.senate.gov/public/index.cfm/hearings-calendar?ID=2A2DE9B9-0105-4612-9C41-D9EC9257B707. Also, states could pursue these goals by creating their own Funds to finance activities like affordable housing or by directing resources and providing incentives that encourage investors to support Funds focused on that kind of development.

What is the best place to go to understand, as a housing and community development professional, how this program can actually provide capital to Opportunity Zone projects? I understand how the historic and affordable housing credits works and, to some extent, the New Markets credit, but this seems entirely different and tied up in tax complexities. Will there be investment funds created to channel these monies? Who is working on figuring out the models to monetize these tax benefits? Thanks.

You’re not alone in trying to work this through – Enterprise is having the same kind of conversation internally and with our partners. Right now we’re waiting to see how Treasury’s regulations, which they plan to issue this summer, will affect how Opportunity Funds can make investments (and therefore affect the communities they’re supposed to benefit) and what sort of developments they can support. Enterprise has been among the organizations spreading the word about how Opportunity Zones operate since the program was announced and will continue to do so as rules and regulations are issued. You can see our latest resources here: https://www.enterprisecommunity.org/policy-and-advocacy/policy-priorities/opportunity-zones-program.