From National CAPACD:

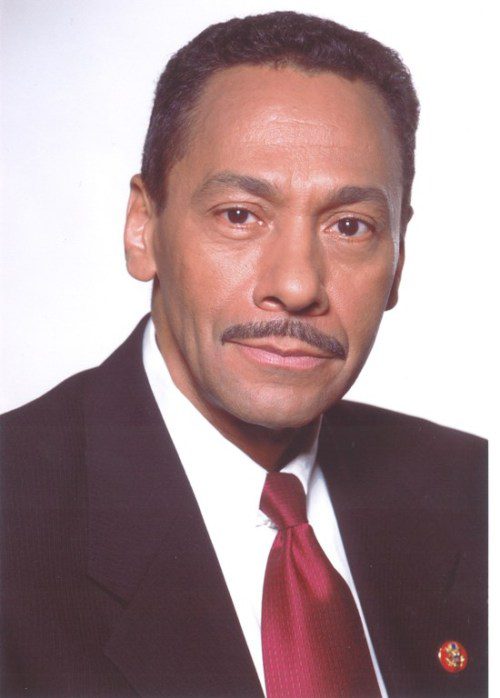

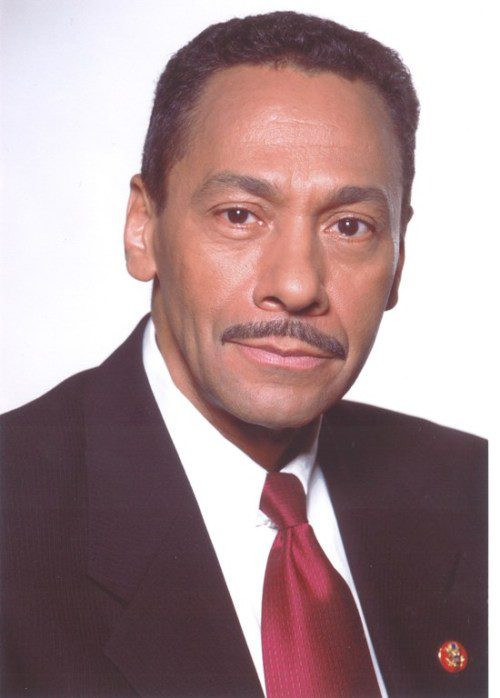

“This confirmation is encouraging news for many low-income Asian American, Native Hawaiian, and Pacific Islander communities still struggling in the wake of the recession,” said Lisa Hasegawa, executive director of the National Coalition for Asian Pacific American Community Development, “With a strong track record standing against predatory lending and supporting affordable housing opportunities in low-income communities of color, we are confident that Representative Watt will be an advocate for millions of Americans still seeking mortgage relief.”

And from Alan Jenkins at The Opportunity Agenda:

“Mel Watt is the leader struggling homeowners need to help rebuild the massive wealth lost during the recession. The FHFA Director has the power to help rebuild local economies and communities through direct action and administrative reforms—and we’re confident Mel Watt will do just that. With Congress potentially years away from significant housing finance reform, the FHFA should take an active approach to restoring the dream of affordable home ownership.”

Organizations have been working for years to recall DeMarco and have charged Watt with changing things up.

NCRC wants Watt to:

-

- Expand programs and policies that give more families a fighting chance to remain in their homes.

- Release the affordable housing assessment dollars due to the Housing Trust Fund and Capital Magnet Fund.

- Reinvigorate the affordable housing goals, so that families in the communities that we represent once again have access to conventional mortgage credit.

Sheila Crowley at the National Low Income Housing Coalition says:

“I urge Mr. Watt to act swiftly to enforce Fannie Mae and Freddie Mac’s statutory obligation to fund the National Housing Trust Fund. The National Low Income Housing Coalition and many other observers agree that the conditions under which this obligation was suspended in 2008 no longer apply. In the ensuing years as the housing market has recovered such that Fannie and Freddie are now making record profits, the shortage of housing for the lowest income people has only become more severe. The need for the National Housing Trust Fund has never been greater.”

What’s on your wish list for Watt to accomplish? Tell us in the comments!

I hope Mr. Watt will recognize the duty of FHFA and the GSE’s to affirmatively further fair housing. Two concrete ways he can do this:

1. Require the GSE’s to rebalance their investments in LIHTC projects, and increase their use to expand housing for families with kids in high opportunity, low poverty neighborhoods served by good schools;

2. Require the GSE’s to facilitate the sale of single family REO properties in similar neighborhoods for re-use as affordable rental housing, especially family sized homes with 3 bedrooms or more.

Principal reductions to modify mortgages to affordable levels. Revelations have demonstrated that banks have deliberately dragged their feet on mortgage modifications but the federal players such as GSEs have been the worst offenders.

The GSEs also should revamp their disposition of foreclosed on properties to get them into the hands of new homeowners or community oriented landlords, so that land speculators, hedge funds and slumlords do not become the beneficiaries of the financial crash