It’s been less than four years since the end of the Great Recession, yet signs point to another potential bubble in the housing market. The Case-Shiller index of house prices in 20 U.S. metropolitan areas showed a 12.1 percent increase in April; it’s biggest annual gain in seven years. Furthermore, the biggest gains occurred in the same areas (California, Arizona, Nevada and Florida) that saw the largest gains, and subsequent losses, in the mid-2000s.

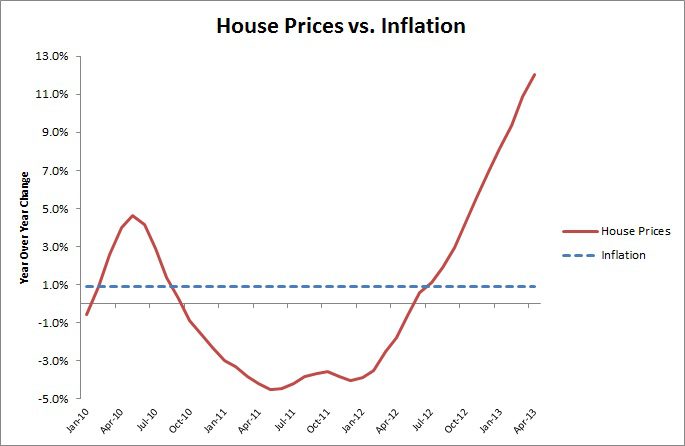

The chart below shows year over year changes in house prices far outstripping inflation since July of 2012, just like they did in the past bubble. In addition, house prices are outstripping income as well. Since 2010, house prices have increased at an annual rate of 2.3 percent compared to less than one half of one percent for household income over the same period. This trend does not bode well for the sustainability of homeownership.

It is too early to tell if house prices will continue to grow at the current pace, especially in light of recent increases in mortgage rates. However, the current run up in house prices is a reminder of the need to continue strengthening oversight of the housing industry to prevent another property crash. While lending standards have been strengthened, much regulatory work remains to be done, especially in the secondary mortgage market. Unfortunately, it will take some time before Congress passes legislation on a new housing finance system. Let’s hope a new housing bubble doesn’t blow and pop before Congress acts.

[Ed. note: We've been suggesting that a new bubble might be coming since February.]

Comments