For many months, a broad coalition of housing, consumer protection, and civil rights groups has been calling on President Obama to replace Edward DeMarco, the acting head of the Federal Housing Finance Agency or FHFA, which oversees the mortgage giants Fannie Mae and Freddie Mac.

DeMarco, a holdover from the Bush administration, has stubbornly blocked reforms that could prevent foreclosures, protect the public, and speed our economic recovery. In particular, DeMarco has ruled out the option of adjusting the principal on Fannie- and Freddie-held mortgages to fair market value, despite clear evidence from his own agency that doing so would save public funds as well as families’ homes.

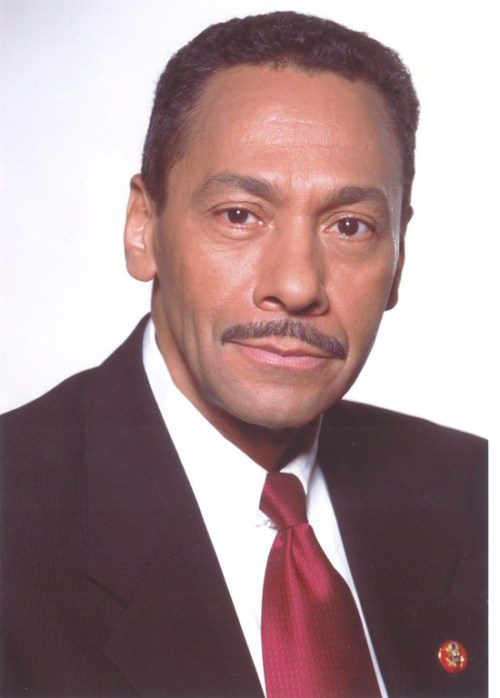

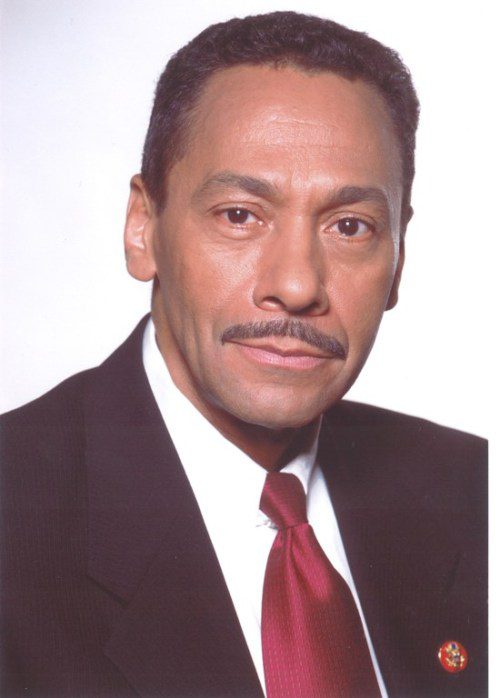

But earlier this month, President Obama answered the call by nominating Congressman Mel Watt (D-N.C.) to replace DeMarco at FHFA.

Watt has a long history of promoting economic opportunity, demanding fair rules, and opposing predatory lending practices. At the same time, he has maintained positive relationships with many of the banks, developing a reputation for evenhandedness and action based on firm evidence.

The nomination of Watt comes at a crossroads moment in the mortgage crisis. While home prices have begun to inch up in some areas, a new report, Wasted Wealth, finds that over 13 million homeowners are still “underwater,” meaning that their homes are worth less than they owe on their mortgages. Those owners are stuck between a rock and a very hard place. If they run into trouble paying their mortgage due to unemployment, hardship, or the still-weak economy, they can’t even sell their homes to satisfy the debt.

At a broader level, this trend translates to a staggering loss of economic security and “wealth,” meaning the difference between family assets and family debt. It means shattered dreams of sending kids to college, decimated nest eggs and retirement plans, millions of American families on the verge of unnecessary foreclosures, and in some cases, homelessness and destitution.

The same patterns are holding back our overall economic recovery. When millions of families are struggling to make artificially high mortgage payments and keep a roof over their heads, they are neither saving for the future nor adding to the nation’s economic growth through consumer spending, investment or entrepreneurship.

Many regions are highlighted in the Wasted Wealth report, like Cincinnati, which lost over $400 million in wealth due to the foreclosure crisis in 2012 alone. Behind those numbers are voices like that of Cincinnati resident Zack Aliberti. “Vacant homes affect more than just the families, they depreciate the property value of all houses in the area. After time with no occupants, the neglected homes become rotted out; the landscaping is ignored, and it becomes an eyesore and safety hazard.”

Pastor Charles Boles tells a similar story about his community in Detroit: “Homes valued for $50,000 are now being sold for as little as $4,000. It depreciates the market value for homeowners in the entire area. The impact is financially crippling.”

The report also details homeowners’ painful stories of battling with banks to save their homes. Joella Jones-Redmond of Oakland, with her husband fighting cancer and his mother also ailing, applied for a loan modification almost a dozen times, only to be told each time by her bank that she has no proof of hardship. “I can’t imagine how many families in my neighborhood are in the same shape, but I know it is many.”

In reading their stories, it’s important to remember how we got here: A decade of abuses by banks and the financial industry, enabled by inadequate rules and enforcement. The banks’ risky practices reached across the nation and touched communities of all backgrounds.

But certain communities were hit particularly hard. While most Americans struggling with foreclosure or underwater loans are white, communities of color have been disproportionately victimized, including through predatory lending and discriminatory practices. As a recent report from The Opportunity Agenda details, the U.S. Justice Department and other agencies have uncovered massive patterns of racial discrimination by the nation’s largest banks that have victimized tens of millions of homeowners. That’s a major reason why, according to the Wasted Wealth report, zip codes in which people of color make up a majority experienced 1.7 times the average lost wealth as in largely white zip codes.

Fortunately, it’s not too late to turn things around, and that’s where Watt comes in. The Wasted Wealth report notes that a principal correction program at FHFA could produce annual savings of $7,710 per underwater homeowner and boost the U.S. economy by $101.7 billion. It would save families’ homes and reduce the harm to communities across the country.

Watt’s record strongly suggests that he would consider this and other tools for getting American homeownership back on track. First, though, he must be confirmed. The Senate should move quickly to consider Watt’s nomination, and to fill this important position with someone who will stand up for the American dream.

Comments