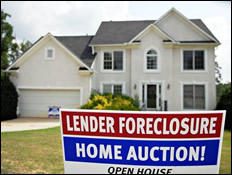

President Obama has been re-elected, and hope springs eternal. I’ve started to think about a second term housing and urban agenda. Frankly, there wasn’t much of one during his first term. There were a few reasonable efforts. The Neighborhood Stabilization Program was an honorable attempt to tackle some of the neighborhood impacts of foreclosure, although it is doubtful how much it actually achieved. The sustainable cities effort was, again, honorable, although there it remains to be seen what it will accomplish beyond providing a lot of planners with work during otherwise lean years. And, of course, there was the alphabet soup of foreclosure mitigation initiatives, such as HAMP, HARP and the like. Some people truly benefited – an educated guess would be about 1.2 to 1.5 million households since the beginning of 2008 – but it was far from the game-changer advocates had hoped to see.

Meanwhile, a lot of cans were kicked down the road. As of mid-2012, some 11 to 15 million households were still underwater. The Federal government continued to spend billions keeping Fannie and Freddie afloat, propping up a system that wasn’t working for thousands of would-be homebuyers, while putting off any serious discussion about what a future system should look like. While few people expected significant new money for housing or urban revitalization, there was little interest in taking a fresh look at long-standing programs like CDBG or Low Income Tax Credits, and seeing how they could be redesigned or reworked to become more productive and more beneficial for the people and communities they serve. Meanwhile, despite some improvement in economic and housing market conditions overall, many of our older cities are still in crisis, and their hard-hit neighborhoods are languishing.

Is it realistic to expect the Obama administration to take on these issues in his second term? Perhaps not, but I think it’s important to push on these issues. The problems are not going to go away. So, in this and a few more posts, I’m going to throw out some ideas about what a housing and urban agenda might look like, even at a time of fiscal cliffs, sequestration, and other constraints.

First, I think it’s important to separate out the different issues involved. This is my list:

-

Stabilizing the housing market and mortgage system, and making it work better for the mass of middle class and working class Americans. -

Ensuring that federal low income housing and community development programs work better for the households and communities for whom they’re designed. -

Helping older cities come back from fiscal and economic crisis. -

Revitalizing neighborhoods devastated by the market bust and foreclosure crisis.

All of these relate to one another, but they are separate issues, and call for separate agendas. I’ll start with the first one.

In addition to putting a sensible mortgage system in place, the biggest thing that we could do to stabilize the housing market is to address the problem of underwater mortgages. Here’s what I wrote in a recent issue of Planning magazine: “Congress should pass a law establishing a one-year period during which any underwater home owner, no questions asked, could get their mortgage reduced to 95 percent of the current value of their home. The lender would be compensated with a federal tax credit spread over the remaining life of the mortgage equal to half the written-off amount; in return, the government would get a silent second mortgage. The homeowner would not have to make any payments, but when the house was sold, the government would share any appreciation with the owner 50-50.”

Such a program could galvanize a market that’s already showing modest signs of recovery, and in the end, the government would get all or most of its money back. I fear, though, we have a short window to tackle that issue. As the market improves, lenders – who’ve always resisted anything that smacked of mortgage principal reduction – are going to dig in their heels even more deeply. It’s hard to imagine Congress passing a law over the opposition of the bankers and their friends, but it’s worth a shot.

As far as the mortgage system is concerned, action is long overdue. Politically, it’s a tough issue. Many on the right simply want government out of the mortgage business, under the delusion that the private market will step up and do things that no private market has ever done without public backstopping. Many on the left appear more concerned about maximizing mortgage access than about either the viability of the system, or the long-term benefit to the people they think should become homeowners. Two years ago, the Obama administration came out with a proposal to phase in a new system – while not saying what the new system would look like – over seven years, to 2018. Granted that it will take time to phase into a new system, this was little more than a sophisticated can-kicking exercise.

It’s time we had serious discussion about what a mortgage system should and should not do, and what it should look like.

To be continued.

Comments