As a parent, I try to teach my children that “I told you so” is rude, and generally unhelpful in building relationships.

But in the world of politics, policy, and advocacy, it’s often important to come back to a controversy when the evidence is in and point out which set of assertions in a debate was proven right. You probably want to do it in a more polite and respectful way than my six-year-old is likely to lead off with, but not doing it at all amounts to giving those who were promoting unsound, or blatantly false, arguments a free pass to do it again.

When lies and common misunderstandings go unchallenged, they get repeated. Sometimes repeating a lie is intentional, propagandists’ proverbial “big lie”—something outrageous that is repeated often enough to be believed.

A common falsehood being repeated ad nauseum these days is the idea that low-income people are categorically unfit for homeownership, but talked lenders into giving them unsound loans that would ruin both themselves and the financial markets.

This idea is great for those who want to distract attention from financial institution misbehavior and limit the imposition of new regulations on them, but it’s disaster for real households struggling to retain or achieve homeownership. We debunked this idea in the debut of our column The Answer using data about what happens when you give low-income households sound loans and appropriate support.

Often, misunderstandings actually are spread by those with good intentions. This issue’s Answer takes on the idea that shared-equity homeownership prevents asset building. This is a legitimate, if inaccurate, worry. Often those who resist shared-equity homeownership for this reason are reacting to a very real history of equity theft and discrimination that prevented from homeowners of color or low-income households from realizing the same kind of wealth increase from their homes as white middle class families benefitted from. But it would be a shame to keep families from having access to an option that provides not only asset-building, but more secure asset-building, because of this fear.

Sometimes more selfish motivations are involved, without intentional lying. It’s human nature to latch onto arguments that support or justify our less noble, and sometimes less conscious, fears. Two fascinating articles in our latest issue look at the arguments expounded by opponents of specific affordable housing developments that then did go on to be built. Writing about Mt. Laurel, NJ, and four 40B fair share projects in Massachusets, the authors compare these assertions with what actually happened. Without giving too much away, the predicted negative effects do not come to pass. At all.

While plenty of data crunching has shown that well-maintained affordable housing doesn’t bring with it the rash of ills so many fear, it’s hard to translate those abstractions into a particular, detailed zoning fight. Comparing similar, concrete before and after scenarios might help in a different way to counter the assertions of NIMBY activists.

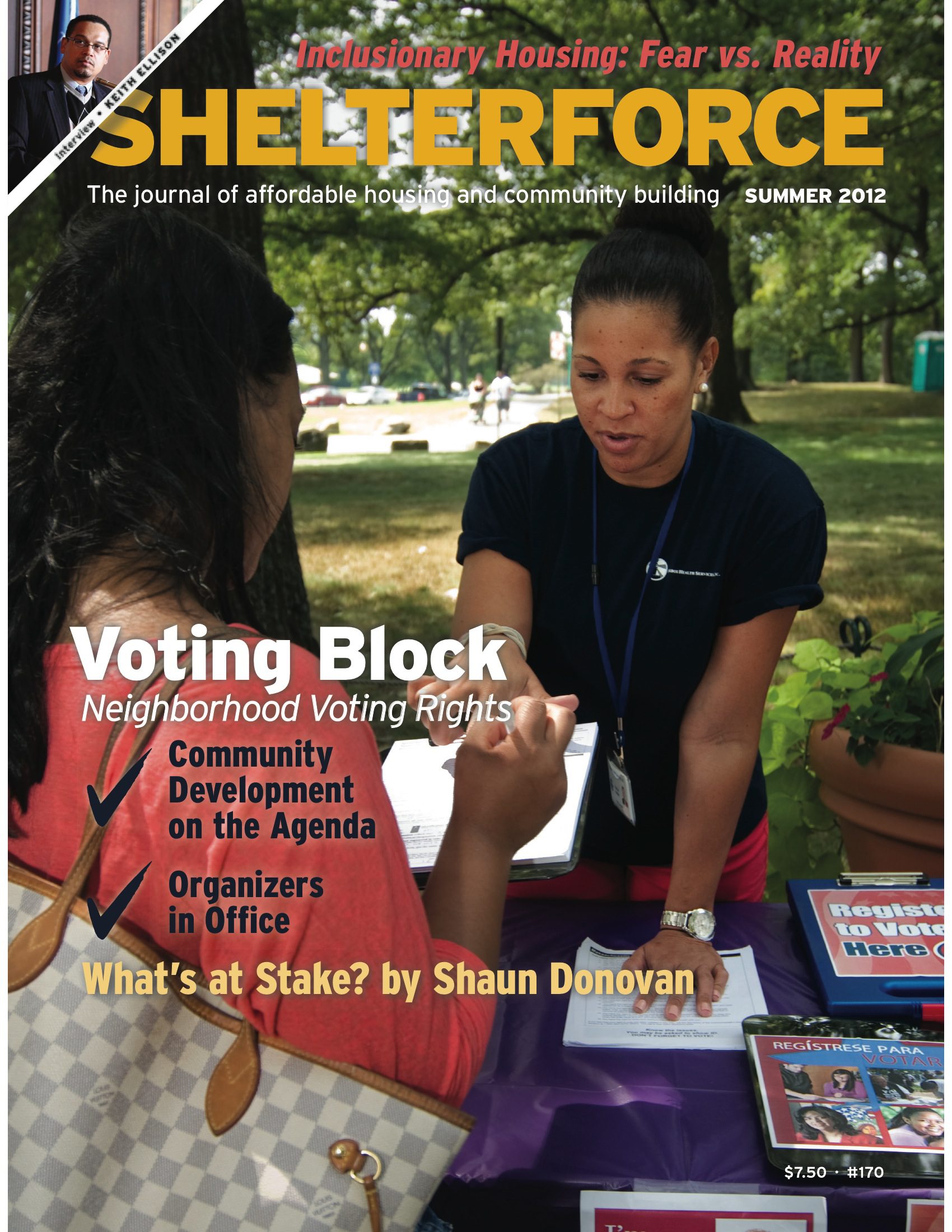

One of the biggest Big Lies of the moment is the idea of rampant voter fraud that needs to be checked through measures like voter ID laws, which disproportionately suppress turnout among voters who tend to be more progressive—women, people of color, the working poor, new citizens, the young, the old. As Avi Green and Gabrielle Tarini note in their article Get Back the Vote, actual studies of highly contested elections show that voter fraud is rarer than people being struck by lightning. On the other hand, some 21 million citizens don’t have current ID. The downsides to voter ID laws are so disproportionate to the supposed cause as to be mindboggling. There are groups out there fighting the good fight, but it's a hard one.

Even so, as I wrote in a column for my local paper on the voter ID requirement for our city school board elections, there would be a way to both address voter fraud and support voter rights and turnout: You can't get away with pretending to be another voter if that voter shows up and votes under their own registration. So the win-win approach is aiming for full voter turnout: Make Election Day a national or state holiday. Support paid time off for voting, GOTV campaigns, expanded polling hours, ride to the polls programs, Rep. John Lewis’s Voter Empowerment Act, early voting programs, ways to make voter registration address and name changes easier, and anything else we can think of to make voting something that everyone eligible can do and does do, every time.

Joining the fight to maintain voting rights and voter power in your neighborhoods and constituencies may seem like an additional burden on an already overfull and underfunded plate—but it’s the foundation to getting your issues on the political agenda, preserving the advances being made at the federal level, and electing officials who understand your work and will help your neighborhoods from the inside. If you’re not an organizer you don’t have to reinvent the wheel either—connecting with Nonprofit Vote can help you figure out how to easily and legally work with your staff, members, clients, and constiuents to turn out the vote.

And don't be afraid to say I told you so.

Comments