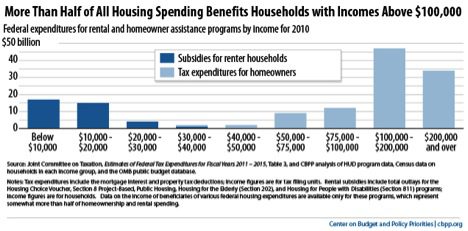

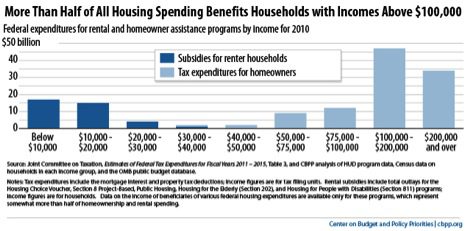

It’s time to rethink the nation’s housing policy. We’ve focused for decades on policies to increase homeownership, and most federal housing dollars benefit families with relatively little need for assistance. Overall, more than half of federal spending on housing benefits households with incomes above $100,000 (see chart).

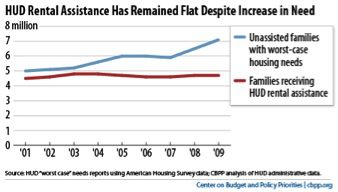

Meanwhile, the nation’s lowest-income renters are far likelier to struggle to pay for housing—and their affordability problems are growing. Current rental assistance programs reach only a fraction of families who qualify for help, but for the foreseeable future Congress is unlikely to expand these programs enough to meet the need.

A federal renters’ tax credit could help these low-income households while also beginning to rebalance federal housing policy. Here’s how it would work: Congress would give each state authority to distribute a certain amount of credits. Families assisted with credits would generally pay 30 percent of their income for rent, and property owners (or sometime banks that lend to them) would receive credits on their federal tax returns in exchange for rent reductions.

A renters’ credit capped at a total of $5 billion could:

- Assist about 1.2 million of the lowest-income renter households;

- Reduce each household’s rent by an average of $400;

- Cut the number of very low-income households paying more than half of their income for housing by about 700,000; and

- Lift 250,000 families out of poverty and lift four of five of the poorest families it assists out of deep poverty (defined as having income below half of the federal poverty guidelines).

Research shows that rental assistance can reduce homelessness, make work-promoting initiatives more effective, and improve children’s health and educational outcomes. A renters’ credit would complement existing programs, such as the Low-Income Housing Tax Credit (LIHTC, which subsidizes development of affordable housing but is rarely sufficient on its own to reduce rents to affordable levels for poor families) and Section 8 vouchers (which are highly effective but meet only a modest share of the need).

It also would allow states to provide rental assistance based on their priorities and in coordination with other state-run programs. For example, states could use credits to enable LIHTC or other housing developments to provide supportive housing to homeless veterans or to help families participating in state welfare or other jobs-promoting programs for which a lack of stable, affordable housing is a barrier to work.

It’s the right time to consider a renters’ credit. Policymakers are gearing up for a potential tax reform debate that will likely consider how to restructure tax expenditures, including homeownership tax deductions, which could make them more efficient and raise added revenues to reduce the deficit. Directing a modest share of the savings to the renters’ credit could further improve the effectiveness and fairness of the nation’s housing spending.

Comments