On Independence Day, people across the nation engaged in truly American activities—watching fireworks, marching in main street parades, and grilling food in back-yard cookouts. Owning a home may be the most quintessentially American institution of all. But homeownership doesn’t mean the same thing for every homeowner.

Housing tenure in the United States is often viewed through an “either/or” lens, in which a household either owns or rents their home. In actuality, there are three basic forms of housing tenure: 1) renting; 2) owning with a mortgage; and 3) owning without a mortgage—often referred to as “free and clear” homeownership, in which a homeowner has no mortgage debt. [Editor's Note: There is also shared equity homeownership.] A slightly closer look at data from the 2010 Census provides some nuance into mortgage-free, or what could be called “true,” homeownership, especially in rural communities.

In nominal terms, the United States is largely a nation of homeowners. According to the 2010 decennial Census, 65.1 percent of U.S. homes were owner-occupied in 2010—slightly down from the 2000 homeownership rate of 66.2 percent. Homeownership levels are even higher in rural and small town America where nearly 18 million, or 71.6 percent of all households own their homes. Homeowners in rural and small town communities also have higher levels of mortgage-free homeownership than their suburban and urban counterparts. Nearly 42 percent of homeowners in rural and small town America own their homes free and clear of mortgage debt, compared to roughly 27 percent of suburban and urban homeowners.

The higher rate of mortgage-free homeowners in rural and small town areas is likely attributable to several factors. First, there are a large number of manufactured homes in rural areas. Manufactured homes, typically financed through personal property loans, have shorter loan terms than standard mortgage financing. These finance elements combined with relatively low purchase prices result in a substantial number of debt-free manufactured homes.

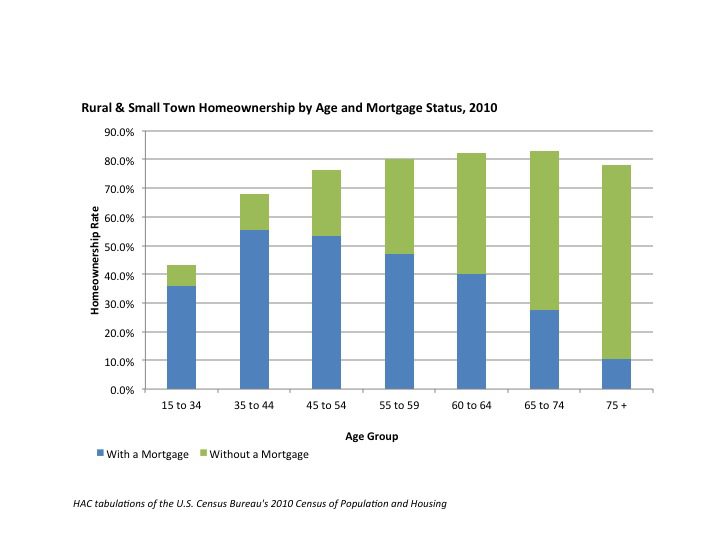

Demographic and age factors also affect the mortgage status of rural homeowners. The population is older in rural and small town communities than in the nation as a whole, including more senior households. Typically, homeownership rates increase with age. For example, only 44 percent of rural and small-town householders below age 34 own their homes, compared to an 82 percent homeownership rate for rural householders age 65 and over. As homeowners age, mortgage debt also declines. Over three-quarters of rural homeowners age 65 and over own their homes free and clear.

While more rural households own their homes free and clear, it is also important to note the equity they accumulate is likely to be less than that for homes in urban or suburban areas because rural houses are generally less expensive. In rural and small town communities, over 40 percent of homes are valued at less than $100,000, compared to 23 percent of homes nationally. Factors such as distance from employment opportunities and amenities contribute to the lower value and appreciation of homes in many rural and small town markets.

Home values and assets may be lower in rural areas, but the level of mortgage-free homeowners is not an insignificant statistic. Following a decade of lax financing standards and unconstrained housing consumption, millions of homeowners across the nation are “underwater” with substantial, and in some cases, unsustainable levels of housing debt. While the housing crisis has not spared rural America, many rural and small town homeowners are buoyed by relatively large levels of equity in their homes. For most Americans, a home is still the largest asset they will ever own. Despite stagnant and declining home values nationally, asset and investment accumulation through homeownership is still a considerable economic factor for many rural residents.

Owning a home has traditionally been a foundation of the “American Dream,” conveying prosperity, financial security, and upward mobility. The housing crisis and flagging economy have taken some of the luster from homeownership, and have called into question key elements of our nation’s long-standing housing systems and policies. There are signs of a shift away from “homeownership for all” policies, and a more balanced focus that includes rural renters is definitely needed. But sustainable, affordable, and wealth-accumulating ownership should “truly” be a goal when assessing our nation’s homeownership policies and priorities.

Comments