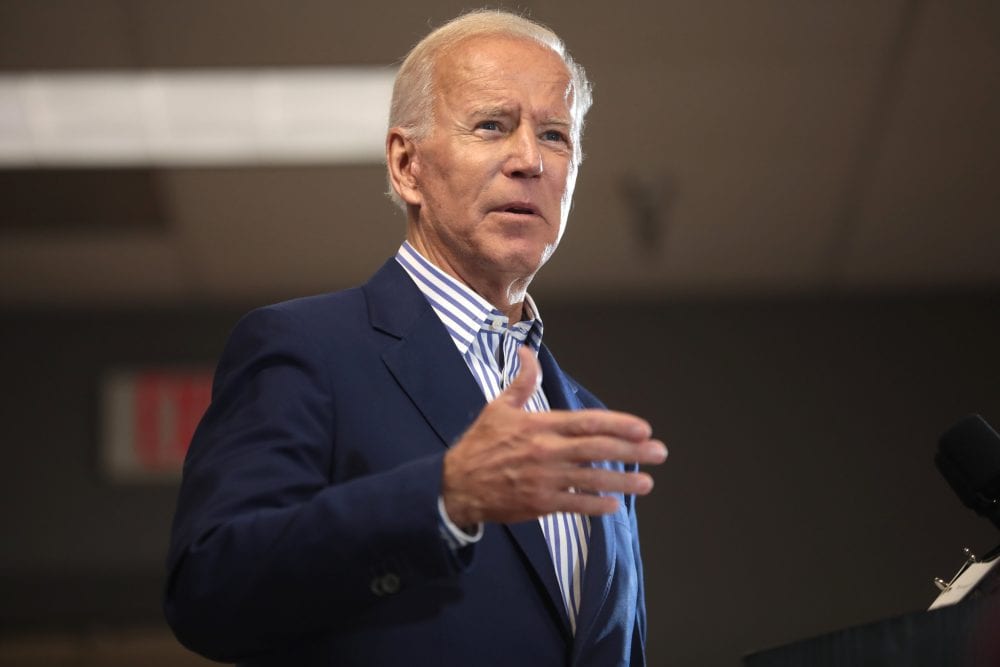

President-elect Joe Biden. Photo by Gage Skidmore, via flickr, CC BY-SA 2.0

President-Elect Joe Biden has a substantial housing plan, which clearly draws heavily from the affordable housing and community development fields. The plan is thoughtful and ambitious, calling for not only fully funding rental assistance vouchers, for example, but also adding source of income as a protected class under the Fair Housing Act, which will be necessary to make those vouchers functional. It calls for $640 billion in affordable housing production funding over 10 years, strengthening CRA, and fighting lending discrimination.

However, with COVID-19 cases skyrocketing across the country and eviction protections expiring or scheduled to expire as winter arrives, the most important housing policy question for everyone is how to prevent the rent arrears caused by the pandemic from setting off a full-scale eviction tsunami.

When the limited national eviction moratorium issued by the Centers for Disease Control and Prevention (CDC) expires on Dec. 31, accumulated rent debt from households facing medical crises and lost jobs and hours is predicted to hit between $34 billion and $70 billion. And those estimates were made before the new spike of infections and the responses to them started. As has been said since the spring, even people who have found jobs again will not be able to miraculously find extra money to pay months of arrearages.

“The most urgent issue is housing stability during the pandemic and making sure that those without homes are protected,” says Sarah Saadian, vice president of public policy at the National Low Income Housing Coalition (NLIHC). “That’s really what the Biden administration needs to do on day one. … They should be issuing a new stronger eviction moratorium that avoids a lot of the shortcomings of the existing CDC moratorium, and they need to be working with Congress to try to get a COVID relief package passed as soon as possible.”

And yet, the rent relief portion of Biden’s published COVID-19 proposals is surprisingly weak. While, of course, it’s greatly encouraging that he’s acknowledging the need for rent relief at all, his proposal suggests handling rent relief by making it merely one item on a list of allowable uses for broad state and local emergency funds. Those funds could also be spent on homeowner relief, job preservation and creation, interest-free loans for small businesses, and targeted cash assistance. Allocating the funds among those various needs would be up to governors and mayors.

Saadian says it’s dangerous to lump rent relief in with any other program. “It is strikingly important that that they specifically identify resources for renters and not just have it as a big pot of money,” she says. “We know that renters are disproportionately harmed during this pandemic. And we also know from our past experience that without a specific allocation for renters, states could divert funds away from households with the greatest needs who are at risk of evictions towards homeowners or other people with relatively higher incomes. It’s really important that any emergency rental assistance is directly tied to renters.”

NLIHC supports, for example, the Emergency Rental Assistance and Rental Market Stabilization Act (S. 3685/H.R. 6820) proposed by Reps. Maxine Waters (D-CA) and Denny Heck (D-WA) and Sen. Sherrod Brown (D-OH). The bill would provide $100 billion in emergency rental assistance, including up to six months of back rent, targeted by income and need. Payments would be made to the housing provider, but on behalf of specific tenants, and the funds would be funneled through the existing homeless-prevention program known as Emergency Solutions Grants.

Given the variation in eviction protections across states (many never issued any eviction moratoriums at all, few covered all stages of eviction), it’s certainly reasonable to be concerned that a devolved approach would leave many renters literally out in the cold. And that would not only be a catastrophe for every household affected, but given who is most at risk—disproportionately Black and Brown renters—it would also exacerbate preexisting racial health and housing inequities.

Dr. Anthony Fauci, director of the National Institute on Allergy and Infectious Diseases and a leading expert on the COVID-19 pandemic, has recently called for a uniform, nationwide response to COVID. Rent relief and eviction prevention should be included. They are not only essential measures to mitigate the economic harm done by necessary precautions put in place to try to slow the pandemic; they are also themselves public health measures, as shown by the fact that the CDC took the unusual step of using its public health powers to issue a national eviction moratorium when Congress failed to act.

After describing the state emergency funds, Biden’s COVID-19 plan does acknowledge that “the crisis will have broader economic impacts that will no doubt require further action. The steps outlined above must be taken immediately and then Congress must move to understand the broader economic implications and act accordingly.” But those on the eviction frontlines would say that dedicated rent relief should be on the immediate list.

The new administration may be swayable on this point. Housing organizers are hoping so. The housing organizers and advocates who collaboratively produced the Housing Policy Playbook, for example, are gearing up for a campaign to champion their top recommendations, which cover immediate COVID-related rent relief, in the new year. A public version of the playbook, a detailed, equity-focused proposal for what the Biden administration’s first 200 days on housing could look like that was sent to the transition team shortly after the election, will be released along with the campaign’s launch.

Surviving the Transition

But what happens before we get to Jan. 20, 2021?

There are two months until the new administration takes office, an unusual and difficult transition and lame duck Congress session is underway, and the balance of power in the next Senate is still unknown.

Meanwhile, recent rulings from the current administration have weakened the CDC moratorium drastically, saying it prevents only the final stage of eviction—the actual physical removal—and so landlords are allowed to file evictions and courts to rule on them. That means that by Jan. 1, 2021, millions of eviction cases will have proceeded to the point where families could be removed immediately, potentially in the 20 days before the inauguration, some even before Congress convenes earlier in the month.

Rent relief sooner than later would be much better than continued eviction moratoriums, and some sort of COVID relief package before the end of the year is not out of the question. Nonetheless, no one is counting on it. Efforts at the state and local level are focused on trying, with varying success, to extend their own moratoriums, implement some rent relief, and slow the eviction machine. Given the challenges of the current political environment, Saadian says, NLIHC is advocating for at least an extension of the CDC moratorium to the end of March 2021 to give the new administration and new Congress a chance to do something meaningful to deal with accumulated rent arrears.

“I think people aren’t really giving enough thought to what a huge wave of evictions will mean for our economy and for public health,” says Saadian. “This many people losing their homes in a very short period of time will have an enormous impact on the health of our nation.”

Ugh… Can I just say that I think our government is disgusting. Its actually embarrassing. So many people suffering, businesses permanently closing and nothing is being done. It’s so so sad. I am behind almost $10K in unpaid rent. We are a family of 5, with 3 children. I’m not sure what we will do if we are all evicted and put out on the street. Its really shameful that the United States Government and our President are allowing this to happen. How do I explain to my children that we can’t have a Christmas, that there will be no presents under the tree this year and that we may end up homeless.

i have tenants who are getting money and not paying rent what do you do with those people please tell me

Exactly people are getting this money and not paying anything on their rent, what the hell do the landlords do ????