My first reactions to Richard Florida's recent attempt to tip the sacred cow of “eds and meds” (universities and hospitals) economic development were quite similar to what Steve Dubb wrote for us in response: (1) the statistical comparisons were a straw man, having the causality backwards and (2) community wealth building advocates in our field are not so much focused on building new hospitals, they are focused on turning the existing spending of these institutions into better engines of commnuity wealth building through local hiring, local contracting, local purchasing, and enlightened self-interest support of local community development. Read Dubb's excellent piece for his full argument.

But I do think Florida's willingness to explore the question is a great prompt for thinking through exactly what we do and don't expect from our eds and meds—and from any other economic development strategy or investment.

Building community wealth by turning existing eds' and meds' spending more local is an import substitution strategy, to use the economic term. It's taking money that comes into the community and keeping it recirculating there longer before it leaks away. It's the same strategy as “buy local“ movements on the consumer side—take the money that is already being spent in your community, and spend it with a business where the profit stays local instead of winging away to a corporate headquarters across the country (and ideally ones where the business model involves more of the money goes to workers and local suppliers and less to distant suppliers also). This recirculation is more likely to lead to improvements in the local community and to money being respent to benefit other local businesses and workers. It's a very powerful tool, and one that has vastly more potential to be tapped.

But given that cities and even regions are not self-sufficient, import substitution does need to be paired with an export strategy—something that brings new money in to region from the outside to replace the amount that still heads out through trade with non local actors. There are “export” properties to both eds and meds too: Top university centers consider themselves exporter of highly educated professionals. Many universities have specialized reseach departments that are designed to foster a cluster of private businesses.

There are local governments who are seeing their “medical corridors” as something to attract, cluster, develop specialities and research centers in, compete with other regions on, and serve a wide catchment area. Certainly that was what we heard as a core economic development strategy at the Neighborhood Funders Group in Jackson, MS, last month. And then we also heard from some speakers talking about similar investments in New Orleans, a mere two hours away. I think Florida is right to question how far this will work for everyone. Every region probably needs something of a higher tech medical care center, but for research and the most specialized care, there is going to be a competition.

Most regions will have and benefit from strong eds and meds sectors that are carrying out an “anchor mission” as Dubb calls it, strengthening community wealth through directing their spending locally. But they can't and won't be the driving export industries for everyone.

A Three-Legged Stool

I think it's important to distinguish between export and import substitution in making economic development decisions in order to think about the balance between them, make sure both are happening, and identify success measures appropriately.

(Also, when you have to identify whether a particular investment is an export strategy or an import substitution strategy, it also highlights that race-to-the-bottom subsidized company stealing or “subsidize us so we can pay our workers poverty wages and you can cover their food stamps and Medicaid“ Wal-mart type development don't actually result in a net increase of resources circulating in a community, and are therefore in fact long-run economic anti-development.)

I think of the third leg of the economic development stool as investments that create an enabling environment for both export and import substitution strategies to thrive—infrastructure improvements, quality of life that makes people want to live there and potential clients/students/tourist want to visit, equity investments that ensure a region's whole workforce can contribute, real support and standards for local business development and growth, etc. These investments too can be thought of with an eye to their export or import substitution effects (local hiring rules; transit creates local jobs vs car and fuel purchases send money out of a community).

PS: A Note on Clustering Nonprofits and Government in Urban Cores

Eds and meds tend to be nonprofit institutions that don't pay property taxes. This can be good in that there is a leverage point for saying to them that they are receiving community benefit and therefore have a community mission to fulfill. The power of a truly engaged community anchor is huge, and can be worth that tax-exempt status.

But the effect of a disengaged one is also big: if they are not consciously turning their spending power toward supporting their community in those different ways I would argue (and have argued) they actually function as a subsidy given by the city to its region, which benefits broadly from the services provided and jobs created without having to give up any property tax revenue or provide any city services/infrastructure to get them.

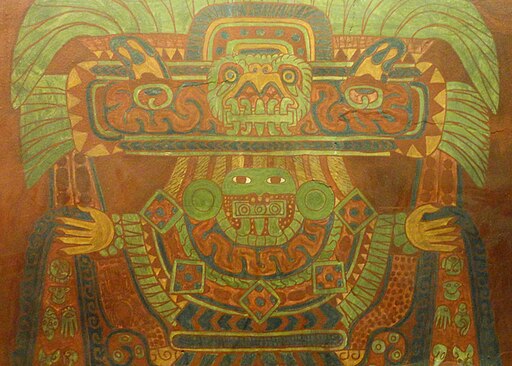

Photo by Silk Road Collection, CC BY-NC-SA.

Comments