Republican Platform: Taxpayer dollars should not be used to bail out borrowers and lenders by funding principal write-downs.

Democratic Platform: Too many people still owe more on their homes than they are worth.

And so, with detached whimpers have both parties dismissed the fact of Underwater America. The Republicans take a whack at lenders and borrowers while the Democrats refer to “too many people” (um, that would be 11 million people) owing more on their homes than they are worth. Neither platform uses the words “underwater” nor are “upside down” and the Democrats still playing the morality card by insisting on refinancing for “responsible” homeowners—whoever that is.

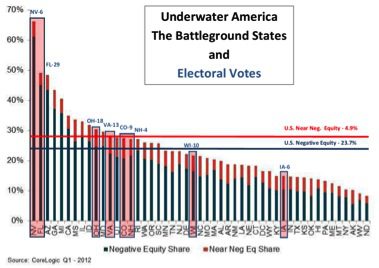

What is even more remarkable about these mumbled asides from the Duopoly is that we are assured that this contest will turn on the electoral votes from the so called battleground states. Looking at how those precious contested states breakout in the spectrum of “underwaterness,” principal correction should be at the tippy-top of the list of contentious, explicit policy issues.

In the eight battleground states (nine, if you add North Carolina) six have severe challenges facing hundreds of thousands of homeowners. Families that cannot move to a stronger local economy for a new job, cannot refinance, and cannot rely upon their homes for assistance on tuition, unexpected medical bills, retirement savings, and etc. Only Wisconsin and Iowa fall well below the national average of afflicted households. So looking at the six contested states that are still awash in insolvent homeowners, (Nevada, Florida, Ohio, Virginia, Colorado and New Hampshire) there are a total of 79 electoral votes in play.

According to CoreLogic, the six problematic battleground states include 3.5 million households that are held hostage in their underwater homes.

|

|

Neq Eq. % |

Neq Eq. % |

Neg Eq. Households |

Near Neg. Equity Households |

Total N. Neg & Neq Equity |

Affected Persons 2.5/HH |

Electoral Votes |

|

Nevada |

61.2% |

4.9% |

339,977 |

27,416 |

367,393 |

918,483 |

6 |

|

Florida |

45.1% |

45.1% |

1,901,726 |

168,927 |

2,070,653 |

5,176,633 |

29 |

|

Ohio |

24.6% |

5.8% |

529,834 |

125,901 |

655,735 |

1,639,338 |

18 |

|

Virginia |

22.3% |

5.8% |

293,879 |

75,766 |

369,645 |

924,113 |

13 |

|

Colorado |

20.7% |

6.9% |

237,019 |

78,616 |

315,635 |

789,088 |

9 |

|

New Hampshire |

21.7% |

5.5% |

47,304 |

11,595 |

58,899 |

147,248 |

4 |

|

Wisconsin |

16.6% |

5.2% |

110,004 |

34,524 |

144,528 |

361,320 |

10 |

|

Iowa |

10.3% |

4.5% |

38,555 |

16,957 |

55,512 |

138,780 |

6 |

|

Battleground State Totals |

|

|

3,498,298 |

539,702 |

4,038,000 |

10,095,000 |

95 |

|

United States |

23.7% |

4.9% |

11,373,801 |

2,345,052 |

13,718,853 |

34,297,133 |

435 |

And yet, to listen to the presidential rhetoric, these “too many” people, are still mostly invisible people.

It’s not hard to figure out why neither campaign wants to go near this issue. The Republicans don’t have a clue about how to help millions of middle class constituents because to do so would mean thinking in terms of the public interest. But Republicans only believe in the private interests. And besides, what about all those irresponsible predatory borrowers? Don’t want to help them. And the Democrats? Well they are still cowering in the shadow of their own alleged principles—supporting the collective good and protecting a strong middle class. Sounds great, but who wants to stand up to the juggernaut economic forces that are actually shredding the economic institutions and cultural norms that support a middle class?

(Click to enlarge)

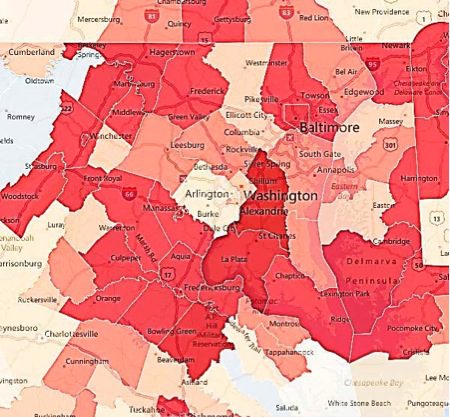

Sometimes maps tell us things that no other type of information can make as clear. When you combine a map with data that measures conditions with numbers, they can be very disturbing indeed, both confronting and confirming what we thought we already knew.

Take for example the map of the greater Washington D.C. area, above. What the shading on the map is measuring is how many homes in the D.C. area are underwater. The darker the shading, the more people who are stuck paying on a home that isn’t worth as much as they owe. What about the light areas, mostly Fairfax County in Virginia and northern Maryland and Washington DC? These are special communities where “negative equity” isn’t as much as a problem as it is in the rest of the country.

So what this map suggests is that if you’re a professional government bureaucrat or legislator or bank lobbyist and you live in the tonier (and whiter) areas in and around Washington, you’re just not suffering like everyone else. Oh, you might know about the mortgage and foreclosure crisis, but, well, you don’t really know about it at all. It’s just something that happened to other people in out in the rest of the country. It’s hard and unfair but mostly it’s just happening to other people.

And that explains how and why the Inside the Beltway types—the bankers and assorted “federals”—have reacted ever since the crisis hit: slow and mean and stupid. It’s not hurting us, here inside Fort Beltway, and slow and mean and stupid is good enough for them, who live beyond the fortress walls.

Another problem is simple foreclosure fatigue. People want good news and our media is desperate to dish it out. The Cleveland Plain Dealer ran a online version of its front page story last Sunday headlined: “Cuyahoga County home prices start rebound in some cities” and the lead sentence was: “More than six years after home prices began an unprecedented decline, Cuyahoga County's housing market may have finally hit bottom.” But for those who took the time to read the piece, it was not about good news, quite the opposite. But two days later the Plain Dealer runs a top of front page headline: “Chagrin Falls home values leap to keep pace with sales.” Sounds great, but again, to actually read the story, it was mostly about the alleged corrupt appraisals conducted by Cuyahoga County’s former auditor. And Chagrin Falls is a tony exurb with about half a percent of the county’s total population. Hooray for leaping values!

By now it’s clear to all that the facts about Underwater America get obscured under incessant happy talking headlines fed to media by a large and well organized cadre of real estate boosters.

It’s discouraging but true: nothing will raise the specter of Underwater America in the public consciousness if we don’t do it ourselves. The base for such an effort is 3.5 million strong in the battleground states alone. It’s a long shot, but it should be clear by now it’s an even longer shot to assume the political campaigns will do it if we don’t make them.

Comments