This article was first published on Where We Go From Here, a Substack newsletter, and is reprinted with permission. It’s Part 2 of a 2022 article, “Ownership Matters.”

On a panel at Housing California’s conference in March, a group of legislative directors was asked about the current session in Sacramento. When prodded for something that pops out as interesting or unexpected from the session, Shanti Singh, the legislative director of Tenants Together, raised her hand.

“There are three different bills targeting investor ownership of single-family homes,” she noted.

These bills are notable enough that they got their own section in Muhammad Alameldin’s 2024 California housing legislation primer, “Preventing Institutional Acquisitions of Single Family Housing.”

He summarizes the three bills as follows:

- AB 1333 (Ward) aims to address the practice of bundling property sales and would prohibit owners of residential properties with one to four units from selling multiple properties in a single transaction to institutional investors that have a portfolio of over 1,000 units.

- AB 2584 (Lee) would impose restrictions and penalties on business entities that own more than 1,000 single-family residential properties from acquiring additional homes for the purpose of renting them out.

- SB 1212 (Skinner) proposes an outright ban on real estate investment entities from purchasing or leasing single-family homes or duplexes.

There has been a tendency to dismiss these bills, as you can see from many of the folks quoted in Ben Christopher’s March piece in CalMatters. Some in the real estate industry see the corporate ownership issue as a “boogeyman,” or one that doesn’t apply to California because our housing prices are too high to fit most investor acquisition strategies. Some think that the overall number of investor-owned homes isn’t seen as high enough to warrant intervention.

There is also the issue that the mechanisms that bill authors propose likely won’t work. Motivated investors will likely find ways around them. They may not be legal in some cases. They may have unintended consequences, harming mission-driven nonprofits who have learned to use REITs and other investor-ownership tools. Homeownership is still seen as a problem by some in the affordable housing world, including by people in the industry who themselves are homeowners. Many pro-housing voices imagine a world in which all political will is directed toward production and only production.

I hope I can help convince folks that these bills matter—not because I think they necessarily can work (the ban on bulk sales should be able to work), or because they will pass. (They may all be dead by the time you read this piece.) They matter because the issue matters. Who owns our homes is an absolutely essential part of housing policy, and an even greater part of housing politics.

If you want mass housing, mass affordable housing, and even lots of secure and stable rental housing, addressing the ownership of homes has to become a greater priority. Even if these bills don’t get us to where we need to go, or are not politically or legally or technically viable, they represent something important. Their authors and supporters need to be supported in working in this space. I’m all for housers to say “Yes, but not this way,” but we need to stop being dismissive of something so central to our housing system.

The Foreclosure Crisis and Single-Family Rentals

It’s hard to believe, but it’s been 15 years since the foreclosure crisis brought attention to what has become a major trend: larger and larger investor organizations buying single-family homes to use as rental properties, what in housing-speak are single-family rentals (SFR). Back in 2009 and 2010, as the U.S. pushed toward 10 million foreclosures, investors built a new industry overnight by buying homes in bulk. Major players like Blackstone built brands like Invitation Homes into national companies.

The rise of this phenomenon is something I’ve been tracking and trying to understand ever since. Working with Desiree Fields and Rajkumar Kohli, we documented how this initial mass purchase of SFRs was quickly turned into a new financial product: rental-backed securitizations, a cousin of the mortgage-backed securities that got us in so much trouble during the foreclosure crisis. As this phenomenon grew, Deirdre Pfeiffer and Jake Wegmann and I analyzed SFRs to understand who was living in them. The short answer is children, and especially low-income children, who were both disproportionately represented in SFRs compared to other housing tenures back in 2016 (and I am willing to bet it has not changed).

Investors Are Making Up a Higher Percentage of Total Home Sales.

This isn’t just a post-foreclosure crisis phenomenon. It’s also clear that slowly but steadily more and more homes are being purchased by investors. (Redfin defines an investor as “any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes.” They also define an investor as a buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This may include purchases made through family trusts for personal use.)

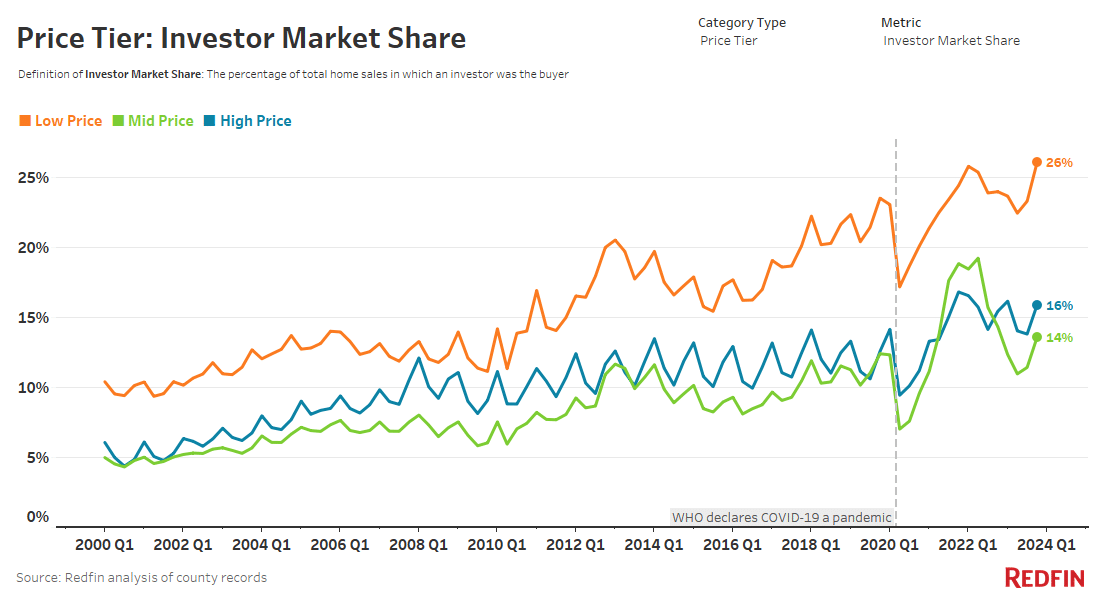

Investors made up 18 percent of total home sales in Q4 of 2023. They make up a larger share of the low-price market share.

These investor owners aren’t just buying at higher rates, they’re evicting at higher rates.

But it’s not just about who buys the homes. It’s about the practice they employ as landlords. What our research highlighted, and what has been proven over and over, is the link between these new investor-ownership regimes and an uptick in evictions. It’s not just that they’re evicting more because they own more homes, they’re evicting on a higher per-unit basis. This is also not even mentioning reports of substandard property maintenance and habitability.

One of the reasons this issue is so important is that we’ve never really reckoned with the legacy of the foreclosure crisis. As Maeve Elise Brown and I discuss on the latest episode, Housing After Dark Episode 10: Maeve Elise Brown on Remembering the Foreclosure Crisis and Debt’s Radioactive Half Life, people and communities are still struggling with what happened 15 years ago, a crisis whose roots run much deeper. The types of predatory practices that helped create the crisis (and build some of these SFR portfolios) have much older origins. Worse yet, there are so many new forms of predation, exploitation, and outright home thievery out there that organizations like Brown’s Housing and Economic Rights Advocates (HERA) have to work to combat that it is mind-numbing.

From our conversation:

“With the foreclosure meltdown, there were a lot of bad actors and almost nobody went to jail. And that’s a real shame.”

“In my list of injustices that make this country a hard place to work, if number one is the number of sharks in the water, number two is how very small problems can become this radioactive half life. You hear it when it comes to a parking ticket or a small fine the way we allow these things to escalate, and it’s partly driven by the predatory sharks in the water that are moving this along.”

Maeve Elise Brown, Housing After Dark Episode 10

This is Not Actually About Single-Family Rentals, Which Are Not the Problem

So this brings us back to these bills and the corporate ownership of single-family homes. I hope to convince some of the skeptics inside housing that this is an issue that demands attention and understanding. But first, there are a few things to keep in mind.

First, single-family rentals are not the problem.

Homeownership advocates concerned about investor activity and who want to make sure to grow homeownership need to be careful about not making the rise in SFR the problem. People have long rented single family homes, and this is a perfectly wonderful thing. The problem is how this happened—through mass foreclosure of homes and the largest loss of wealth for people of color in U.S. history—and who now owns these homes and what this means for the tenants living there. I would be applauding the new availability of SFR for people who want and need it if these homes came with real rights, better landlords, the ability to purchase them, and if they weren’t ripped from so many people in the first place.

Second, limiting investor ownership of SFR is not a panacea for homeownership (nor should it be).

I’m not challenging the numbers that show investor ownership of SFR as a limited part of our ownership housing stock (at the moment).If we want real change in homeownership numbers, we need an across the board change in how we think about homeownership.

My original Ownership Matters Substack from 2022 argued for thinking about “resident-controlled housing,” a way of seeing how traditional homeownership was not at odds with community land trusts and other forms of “community ownership,” or even tenures like mutual housing associations where residents have control over their homes without having any equity at all.

More recently, I’ve worked with my partners at California Community Builders to focus on multifamily homeownership, another way of seeing housing tenure that includes all the ways in which humans can own homes together, from condos and co-ops to CLTs and even informal home sharing. Multifamily homeownership can even occur in the same kinds of units these bills focus on: single-family homes.

Why This Fight is Part of a Bigger Challenge in Housing Politics

So wait—if I am saying that SFRs are fine, and this won’t fix homeownership, why again do I applaud the authors of these bills for trying to do this? There are two reasons.

Again, Ownership matters.

As I said at the beginning, ownership matters. I support any housers in California willing to stand up and say that part of our housing problem is who owns homes and how we own them. Money and streamlining alone will not make California better housed or more equal. We must start digging more into property ownership, and building a housing ownership system that allows people and organizations to own homes safely and securely, with clear rights and responsibilities for all parties involved in a home.

This issue cross-cuts common silos in the housing world.

This space—more than these bills—is an opportunity for homeownership supporters, affordable housing advocates, and the tenants rights movement to work together. These bills should be seen alongside other bills that think about ownership. There are efforts to make LLCs and property ownership more transparent, or to build rent registries, so that all homes regardless of tenure are equally visible. They are connected to public land efforts, which create processes for public land that try and favor affordable housing and other community uses. And they are connected to “opportunity to purchase” acts, or public noticing bills for expiring LIHTC properties, both of which attempt to level the playing field for multifamily housing at the point of sale. They are connected to public land efforts, which create processes for public land that try and favor affordable housing and other community uses.

Only by working together can homeownership advocates, affordable housing developers, community land trusts, and tenant-ownership advocates make progress across the board to help change the structure of how California’s housing market—rented, owner, and in-between— operates. I’m not sure we can “level the playing field,” as some would ask for. But we can change the game being played, focusing our attention on making both ownership, rentership, and all those housing tenures in between secure and affordable.

You’ve Convinced Me. So What Should We Do?

First, we need to accept that these fixes are hard.

This isn’t fixing zoning, which is a 20th century overlay—and fixing zoning has been anything but easy. This goes deeper: into property rights, into who owns what and how they got it, and is backed by even deeper ideologies and more powerful interest groups. We need to take a deep breath and start building bridges. There is no tent big enough for this coalition—it will require folks to be willing to leave their tents.

Second, we need to see that the fixes are more likely to be found in housing finance, tax policy, and tenants rights than in point-of-sale regulations.

I don’t have a lot of faith in corporate whack-a-mole like some of the bans being proposed – except for the bulk bans, which should be kosher and effective—but I can see us building a tax and finance regime that truly favors certain types of buyers and owners over others. We can create a stronger affirmative system that advantages individuals and quality landlords in this space, and that recognizes that owning property is both hard and a responsibility. We can create funds that really help people buy their own homes individually or collectively, and helps subsidize a wide range of property owners who are willing to abide by basic tenant rights and fair housing rules, create humane living conditions, and accept basic restrictions on rent increases and rent gouging. We can also create capital gains tax incentives to convince some landlords who don’t belong in the business of housing humans to take the high road out of town.

At the same time, the way to prevent the worst actors is to give the tenants of these buildings real rights and real support. AB 1482 made history by extending basic tenant rights to some SFRs for the first time. If a legislator wanted to both protect existing SFR tenants and change the math on future SFR purchases, look beyond SFR. Give all tenants—no matter the size, shape and age of the building—the strongest possible protections you can. That will make the kind of investors we don’t want and need in California to think twice before buying, and help us usher other bad actors out the door.

We don’t have a clear vision over what the ethical ownership of homes looks like, but I am certain California can help figure it out.

Great article. Thanks for sharing, Alex.

I believe, though, that the summary is missing a piece: state-supported homeownership schemes.

The Dream For All program was a great success when it launched and consumer appetite was off the charts. So much so that the program exercised all of its funding in an unexpectedly short window. And then they altered the program to make it less attractive with no clear explanation as to why.

Helping people get on the first rung of the ladder through alternative purchasing will go a long way toward creating individual and community wealth, as opposed to solely corporate share price increases.

Great article.

I currently work for a Planning and Zoning office in Georgia and tenant rights is a big issue in the state. We try our best to facilitate affordability but it seems like its going to take National and State level efforts to truly address our issues. There is space for all type of housing but we are setting a dangerous precedent by letting Corporations walk all over private citizen home ownership.