A Win-Win for Families, the Housing Finance Industry, and the Markets

The NCRC proposal addresses the single most challenging hurdle that current modification efforts have faced: the inability to restructure or refinance loans held in securitized pools by investment banks. By purchasing those loans, servicers could be immediately directed to offer meaningful modifications that create long-term homeownership affordability. The market helps defray costs up front by selling loans at a discount to the government. Lenders can offer refinancing options that meet the borrower’s ability to repay loans based on the current and realistic value of properties. And families who have lost their homes to foreclosure can recover that loss. By including soft seconds in subsidized loan agreements, the government is paid back a substantial share of its upfront investment.

This broad-based plan not only addresses the most significant challenges facing the housing industry related to the foreclosure crisis, but also ensures that the private markets play the lead role in stabilizing families in their homes. HELP Now would provide a needed stimulus to the housing market that should contribute significantly to the ailing economy. Finally, HELP Now is not a bailout, but instead is a true public-private partnership that shares the burden for ending the foreclosure crisis.

The Long-Term Answer

Atlas and Dreier are also right that anti-predatory lending legislation is needed. Today, astonishingly, the U.S. Congress has yet to present President Bush with comprehensive legislation outlawing the kinds of predatory lending practices that created the foreclosure crisis in the first place. Predators are still taking advantage of now-desperate homeowners and getting them to take out loans that further strip home equity and add additional debt.

Sen. Chris Dodd (D-Conn.), chairman of the Senate Banking, Housing & Urban Affairs Committee, has proposed a strong, anti-predatory lending bill that will, if enacted, eliminate nearly all of these predatory practices and hold all participants in the lending process — from broker to lender to Wall Street securitizer — accountable for violations of this law. Given what we now know about predatory lending practices, it would be a colossal failure on the part of this Congress and the White House to not pass Dodd’s bill.

Congress should also change the bankruptcy laws to protect homeowners and conduct comprehensive oversight hearings and investigations into the regulatory failure endemic to this crisis. The White House should instruct the U.S. Attorney General to investigate the discriminatory lending practices that have proliferated and caused financial damage to many communities.

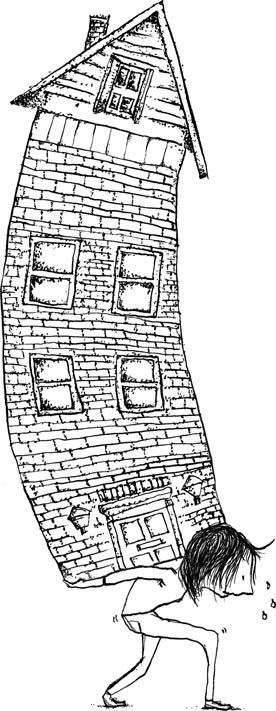

The current reality should dispel once and for all the notion that individual borrowers were somehow to blame for the subprime crisis. It’s now indisputable that widespread unfair and deceptive lending practices significantly contributed to the current economic downturn. And consumers have been the big losers in a system in which their loans are no longer held in a lender’s portfolio but instead are securitized by Wall Street and those who earn by using other people’s money. The financial damage from this unprecedented, infectious greed and malfeasance will affect us all, possibly for decades.

In order for Wall Street to be as accountable as portfolio lenders, it must be subject to a direct line of accountability and liability. Otherwise, usurious practices will inevitably arise once the housing market heats up again. To stanch the flow of foreclosures, we need immediate and effective interventions that sustain homeownership. And, in the long term, we will continue to work for strong, national anti-predatory lending standards that will prevent future abuses in the housing finance market.

Very informative and trustworthy blog. Please keep updating with great posts like this one. I have booked marked your site and am about to email it to a few friends of mine that I know would enjoy reading. club penguin cheats