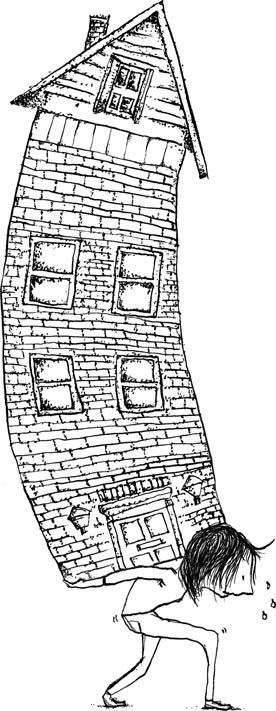

The Homeowners Emergency Loan Program (HELP Now)

Faced with a major foreclosure crisis resulting from the economic turmoil of the Great Depression, the federal government responded in 1933 by creating a housing finance agency, the Home Owners Loan Corporation (HOLC). A similar entity, the Resolution Trust Corporation (RTC), was established in the 1980s to aid in the clean-up of the failing savings and loan industry. Although these institutions fulfilled their missions, the creation of a similar entity to respond to the current mortgage mess could take more than a year to accomplish, given the time required to approve, fund, staff, and create programs for a new agency. The immediacy of the crisis does not allow that luxury of time.

Create a Program, Not an Agency

NCRC has developed a proposal to immediately respond to the crisis, recommending the creation of a three-year recoverable loan program, the Homeowners Emergency Loan Program (HELP Now). It would build on the HOLC model, but rely on existing institutions such as the U.S. Department of the Treasury, FHA, the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, or the Federal Home Loan Banks to purchase outstanding loans, provide financing, or insure loans. By avoiding the added time that would be required to create and staff a new agency, HELP Now could potentially become operational immediately.

Under the program, the federal government would offer to purchase, at a discount, loans held in securitized pools. Discounting the purchase of loan pools would strike a balance between assisting homeowners and ensuring that lenders, servicers, and securitizers are not rewarded for financing and servicing predatory loans. Once held in portfolio by the federal government, the loans could be restructured in a meaningful way to create long-term affordability, or refinanced.

Use the Private Markets to Refinance Loans

Borrowers requiring refinancing would be allowed to refinance their loans through private lenders based on standardized underwriting criteria that would include consideration of a borrower’s ability to repay the loan and the accurate value of the home. Loans underwritten by lenders could be sold to Wall Street or the GSEs for securitization.

Government Is Paid Back

The discounted value of the home (the difference between the value of the current mortgage and the new refinanced mortgage) would be reflected in a lien, in the form of a soft-second (guaranteed, subsidized, forgivable) mortgage loan. This lien would be recaptured by the government when the asset is sold (assuming adequate equity growth and that the property is held for at least five years) or if the property is refinanced. There would be no repayment obligation by homeowners in excess of that which could be captured by appreciation. Losses would be borne by the federal government, but would be minimal relative to the costs of failing to end the foreclosure crisis.

Nonprofits Act as Trusted Advisers

Studies have shown that consumers are wary of contacting their loan servicers to request loan modifications or other advice. Given the substantial level of predatory lending in the market, and growing concerns over fraud, their fears are neither surprising nor irrational. Under the HELP Now program, nonprofit intermediaries would serve as conduits to do outreach and provide counseling to homeowners, linking them to the HELP Now program. The key here is that the lending industry would be reengaged in the process, but would use criteria that include prime rates and consideration of the borrower’s ability to pay, thereby helping homeowners remain in their homes at a monthly rate that makes sense and allows for long-term homeownership.

Assist Borrowers Who Have Lost Their Homes

The final piece of the proposal would empower HUD with expanded authority and resources to develop a plan, working with nonprofit community-development organizations, to address foreclosed and vacant and abandoned properties. Consumers who have lost their homes because of foreclosure would have a right of first refusal to repurchase their homes. Properties that are not suitable for repurchase or whose former owners are no longer interested in or eligible to buy them back would be transferred to the HELP Now initiative’s REO (real-estate owned) program. It would allow nonprofit housing organizations to acquire properties at substantial discounts, rehabilitate them to bring them up to code, and provide them as either affordable rental housing or as lease-to-own properties to families. The focus of HUD’s HELP Now REO property efforts would be to ensure that properties are returned to productive and affordable use as quickly as possible.

Very informative and trustworthy blog. Please keep updating with great posts like this one. I have booked marked your site and am about to email it to a few friends of mine that I know would enjoy reading. club penguin cheats