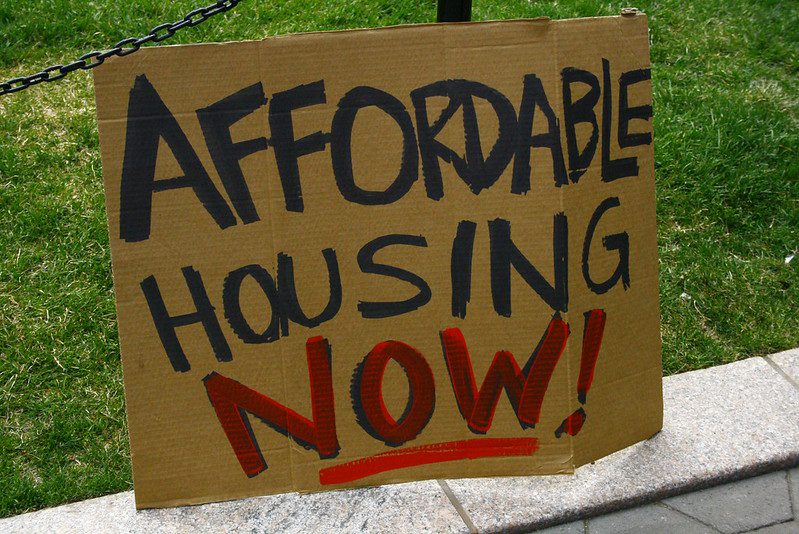

| Down But Not Out | The campaign for a National Housing Trust Fund suffered a setback in July, when the House Financial Services Committee voted 35-34 to reject the establishment of the fund as an amendment to its omnibus housing bill. In its stead, the committee went with an amendment that offers substantially less funding, and only to states and localities with existing housing trust funds. Sheila Crowley, president of the National Low Income Housing Coalition, said the defeat represented the triumph of “politics over good sense and good policy.” In its press release, the coalition also noted that Rep. Shelley Moore Capito (R-WV), a cosponsor of the National Housing Trust Fund Act, voted against the fund in committee.

Crowley and other fund supporters immediately put opponents on notice that the fight will go on. “The incredible grassroots support for a National Housing Trust Fund is a testimony to the need for federal resources for housing production,” Crowley said in a statement. “Today’s vote strengthens our resolve.” |

|

|

|

| Believe It or Not | Affordable housing tenants are in demand, thanks to an apartment building boom in Northwest Seminole County in Florida. According to the Orlando Sentinel, at least four apartment complexes with more than 1,000 units have opened along the I-4 corridor in the past two years, and another 12 complexes with close to 4,000 units have been proposed. The boom is due in part to a new mall and its growing number of stores and restaurants. Mall employees need a place to live but can’t afford the downpayment on a home. Planners also cite federal tax breaks for building affordable apartments for spurring development.

Of course, some government officials and homeowners are trying to put the brakes on any more units going up, citing traffic, crime, the burden on schools, and the general quality of life. County commissioners are exploring incentives to get property owners to build houses or town houses, instead of apartments. |

|

|

|

| Trying to Right Ruthless Rucker | The National Housing Law Project reports in its May/June Housing Law Bulletin that the Supreme Court decision in HUD vs. Rucker has led to a wide range of practices. In the Rucker decision, you may recall, the nation’s highest court ruled unanimously that public housing agencies can evict entire households for drug-related or other criminal activity, even if those responsible for such activity are not household members, such as guests or even home health aides, and even if they are acting without the tenant’s knowledge.

According to the Bulletin, one public housing agency in Richmond, Virginia interpreted the ruling as making such evictions mandatory, and wasted no time in requesting the unsealing of juvenile records, the better to identify grounds for evicting children and their families. Chicago public housing tenants are luckier: They still have the right to defend themselves from eviction on the grounds that they did not know, nor should have known, of the criminal activity. The Chicago Housing Authority decided to retain a lease provision that allows tenants to mount such a defense and sustain it with a preponderance of evidence. HUD has twice clarified the ruling, first with an April letter to public housing directors, urging “compassion and common sense” in responding to drug activity cases, and then again in June, pointing out that public housing agencies are not “required to evict an entire household – or for that matter, anyone – every time a violation of the lease clause occurs.” |

|

|

|

| Connecticut’s Unkindest Cuts | There’ll be $1.8 million less in Connecticut’s Rental Assistance Program (RAP), thanks to a budget agreement between state legislators and Governor John G. Rowland. Housing advocates estimate that 250 to 300 families on the RAP program waiting list will not be served. Also under the ax: Housing and homeless services administered by the Department of Social Services, which will be reduced by more than $1.8 million. “Again, it’s Robin Hood in reverse,” said Lynne Ide of the Connecticut Housing Coalition. “State leaders would rather rob millions here and there from programs that serve the state’s most needy residents than raise $219 million in revenue through a temporary, one percent surtax on incomes in excess of $1 million dollars.” The act to balance the budget also transferred $85 million from the reserves of the Connecticut Housing Finance Agency to the general fund. |

|

|

|

| …And King County’s | Nearly 100 human services programs are in jeopardy next year because of budget cuts proposed by the King County Council in Washington. Community leaders and human services advocates have told the Seattle Post-Intelligencer that child care, home health care for the elderly, food banks, and housing programs would be affected if the county council approves the 50 percent cut in the fall. Many of the programs receive 100 percent of their funding from the county, and more trouble lies ahead. The entire $37 million county budget in 2004 is at risk. Even after cutting over 300 jobs in two years, the county still faces a $52 million deficit for 2003 and cuts in all discretionary programs. County officials say the root of the problem is that the costs of operating human services programs run 2 to 3 percent above the revenue brought in by property taxes, which are limited to a 1 percent annual increase. |

|

|

|

| Bounce This Check | Check ’N Go, the nation’s second-largest payday lender, would like to purchase the Bank of Kenney in Illinois. The National Community Reinvestment Coalition (NCRC) thinks that’s a lousy idea. Check ‘N Go is on their “unscrupulous lender radar” for interest rates exceeding 500 percent, easy rollover, no credit checks, no collateral, and high default rates. If the Federal Reserve approves the transaction, Check ’N Go will operate close to 800 outlets in 24 states. Many payday lenders currently rent bank charters to avoid state consumer protections but “if payday lenders are allowed by regulators to buy a bank charter, our nation’s communities will fall victim to federally-sanctioned loan sharking,” says NCRC President and CEO John Taylor. (See article, this issue.) |

Shelter Shorts: Community Development News

Down But Not Out The campaign for a National Housing Trust Fund suffered a setback in July, when the House Financial Services Committee voted 35-34 to reject the establishment of […]

Comments