Financial System

Financial Well-Being

The Latest

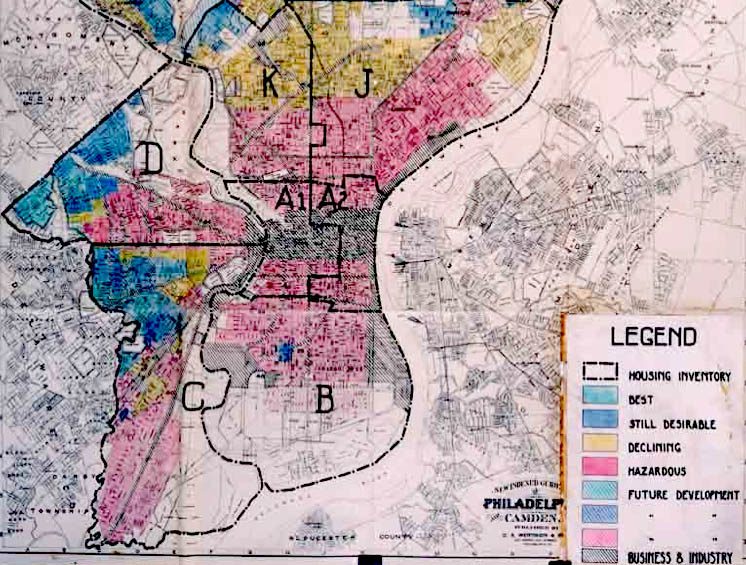

Why the Community Reinvestment Act Must Be Expanded Broadly Throughout the Financial Industry

The financial industry has been one of the main perpetrators of racial discrimination. It should be obligated to serve all communities, particularly communities of color.

Explore Articles in this Topic

Search & Filter Within this Topic

filter by Content Type

filter by Date Range

search by Keyword

Financial System

Asset-Building Comes of Age

From IDAs to comprehensive community wealth building, the number of strategies to increase personal and collective assets is growing.