Same Challenges, Bigger Numbers: 30 Years of Reporting on The State of the Nation’s Housing

While each annual State of the Nation’s Housing report has documented housing changes incrementally, looking back 30 years provides a unique frame of reference for just exactly how much worse housing affordability challenges have become.

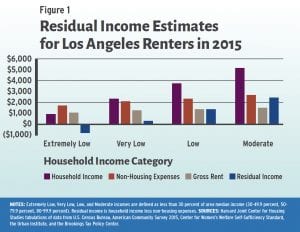

In Defense of the 30 Percent of Income to Housing Affordability Rule–In Some Cases

At an individual level, the 30 percent standard and the residual-income standard can produce very different results. But as a regional measure of affordability problems, they’re not so far apart.

As Affordability Worsens, State and Local Governments Act on their Own

While local and state resources are increasingly stepping up as federal funding continues to be strained, it remains a question as to whether these actions and resources will be enough to meet affordable housing needs.

Staying Afloat: The Ongoing Struggle for Affordable Housing

A multi-faceted approach is necessary to stem the rising number of severely cost-burdened households in the United States.

A Tale of Two Markets: Affordability and the State of the Nation’s Housing in 2010

For first-time homebuyers with good credit, stable employment, and savings for a down payment, buying a home is more affordable than it has been in decades. For everyone else, however, lower home prices have been a disaster.

The Painful Impact of the Housing Downturn on Low Income and Minority Families

The current downturn in housing has seized the markets, pushed home prices down further than any time in generations and has sparked the worst recession since the Great Depression. At the same time, nearly 18 million households are severely burdened with housing costs that consume over half their household incomes. While few have escaped the fury of the recent downturn in housing, tenant, low-income, and particularly minority, households have fared the worst.