Happy New Year! And what better time to talk about my favorite ideas for getting us out of this fine mess of an economic jim jam we’re all bunched up in. But first, a recap of my previous two posts:

In Dear Mom (Part I) I talked about the absolutely bizarre and vitriolic discussion around what role US federal housing policy played in the collapse of the global economy. Basically, it played a very minor role, in spite of lingering (or, should I say, malingering) opinions to the contrary. When even the industry publication American Banker weighs with a super geeky online commentary saying pretty much what I already said in my blog post, I think we can all put this bugbear to bed.

In Dear Mom (Part II) I took a pretty heady Wall Street Journal editorial by Republican dissenters to the Federal Crisis Inquiry Commission and broke down their top ten reasons for the economic collapse into plain English. I’m proud of this blog post, really. It works. And my mom says you should read it because it’s good for you.

But now that I've debunked the junk and laid down the ground, I owe it Mom and to you, dear reader, to put my money where my mouth is and talk about what my favorite fixes include. So to begin:

Invest in Employment

First off, let me just come right out and say that I’m a Keynesian. I think we should spend our way out of this crisis. I don't see any signs of runaway inflation (even the Federal Reserve is saying it won't raise interest rates until 2013), and given the fact that we won’t be relying our on friends in Europe to bolster demand for US goods and services anytime soon, we need a good old fashioned jobs programs, employment training, education incentives and tax benefits that create working and middle class jobs.

- One problem with our current employment system is that most publicly funded employment programs tend to focus on non-skilled or under-skilled workers — the very lowest income workers out there. While these folks definitely need work supports (which by the way should also include child care, paid sick leave and health benefits of some kind), we don't have strong programs nationally that financially support the re-training of mid-career and older workers. With so many baby boomers pushing back their retirement dates, upgrading computer skills and teaching new technologies to make them more competitive is important to maintaining their economic stability. Nor do we have programs that can employ the millions of young, eager college graduates — many of whom would be interested in public service efforts. Expanding Peace Corps and AmeriCorps, and building programs that create incentives for hiring new workers (especially in targeted industries like green housing, medical technology and records, transit-oriented development, water treatment and delivery, education and childcare) are practicable and would make a big difference.

- We also need to beef up public and private lending programs to support small businesses. Many business owners are being denied credit, or simply choosing not to go after credit because the general economic outlook is so flat. Developing programs that make credit available cheaply and with a higher risk tolerance could help spur growth in this important submarket.

Address the housing crisis

I mean, come on. No matter what you do with the broader economy, nothing is really going to work until we get to the bottom of the housing crisis. The best way to do this, and the least expensive from a public policy perspective, is to stabilize existing homeowners by allowing them to keep their homes. Oh, I know this just makes some people soooooo angry and resentful — My neighbor gets a bailout and I don’t?! What ever happened to personal responsibility?! Look, your bank got a bailout and you didn't. Your car maker got a bailout and you didn't. Chances are your state and local government got a bailout and you didn’t. It's not fair. You’re absolutely right. And unless you want the economy to sit in the crapper for another 3 to 4 years, then it's what we’ve got to do. Hold your nose, get out the plunger, and start pumping. Here's how:

- Reform the bankruptcy code, allowing first home mortgages to be restructured by the courts. We should have done it when we had the chance, but at the time our national leaders were too worried about health care reform. We face a stark choice here: reform the bankruptcy code or continue with a broken system that encourages folks to default and walk away from their homes, leaving creditors in the lurch. That’s what’s mostly happening now. Ugh.

- Improve other alternatives to foreclosure, such as short sales, distressed mortgage note purchasing strategies, bridge loans to homeowners who have suffered reductions in income, leaseback programs and so on. Many of these programs have been tested in various markets, frequently with clear success, but none of them has been embraced as a panacea. They shouldn’t be. They are all niche solutions, and what we need is about 10-15 niche solutions, each of which can address 5-10% of the troubled housing stock. Aside from bankruptcy reform, there is no far reaching alternative other than convincing banks to start reducing principal because, you know, we think they should. That's gonna happen when pigs fly, so we’d better start putting in the hard work of mucking our way out of this mess house by house. I’m serious. It’s gonna be this way for years, and the only question is whether or not we can make the process shorter be being more creative and aggressive with solutions now. I think we can, and we’re long overdue to invest seriously in that process.

Limit Wall Street Excesses

But son, you ask, how can taking on Wall Street now improve the economy? Hasn't the damage already been done? Touché, Mother. You are correct. The banking industry continues to take it on the chin these days as Europe falters, lawsuits from the foreclosure crisis and economic collapse continue to mount, and the overall economy slouches toward bull market territory. I guess my hope is that appropriate reform to the banking sector will a) keep this mess from happening again in our lifetimes, and b) ease some of the growing national tension between the very wealthiest and the rest of us. My thoughts here are oft-repeated in the current national dialogue, but are worth repeating:

- Reform executive compensation, particularly at the largest firms, where pay can equal $2,500 per hour. Check out this very nice summary published in 2007 by Wharton business school, which includes recommendations like exerting more control over board procedures for executive compensation, creating safeguards that limit CEO speculative behavior and inappropriate risk-taking, and eliminating golden parachutes.

- Reinstate the Glass-Steagall Act, particularly those aspects of the law that separate investment banking (the highly speculative part of banking which issues and purchases securities) from commercial banking (the boring part of banking which takes deposits and manages our checking accounts). The idea is that you don't want bankers taking undue risks with capital from depositors (mostly us little folks with our checking and savings accounts, pensions and retirement funds). There are lots of other banking reforms under Dodd Frank that are being hashed out now as well (like disclosing credit default swaps and other hedge products through a regulated exchange). In general, there needs to be greater transparency and clearer lines about how much capital banks are allowed to put at risk in comparison to their equity. In other words, banks should have solid rainy day funds (because rainy days happen), and the multiplicity of regulators should be able to understand and oversee their business.

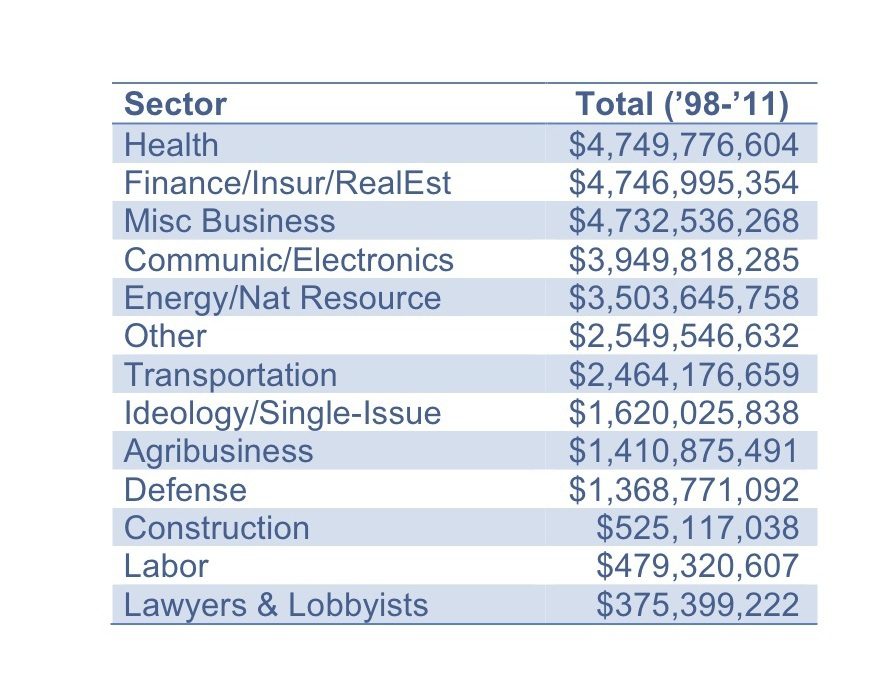

- Limit bank lobbying. Why? Because bank lobbying ranks only behind the health care industry in terms of financial contributions and influence peddling, having spent an estimated $350 million last year, beating it’s previous year’s record for the sixth straight year (and out-lobbying the defense industry almost 4:1). As a matter of fact, limit all lobbying.

Lobbying stinks. Really bad. It clearly privileges the wealthy and deeply compromises our political process by sacrificing fairness in favor of favors. Many knowledgeable and capable advocates (not to mention our plebeian selves) are effectively silenced by industry lobbies that can afford access we simply can't. If Occupy Wall Street has one thing right (and I believe it has more than one thing right), then fairness is not possible in a democratic process so deeply influenced by financial perks and favoritism. Double ugh.

So, Happy New Year to you, Mom, and to all the other moms, dads, brothers and sisters, uncles, aunts, nephews and nieces out there. Stick close with your family, and cherish them in the upcoming year. I invite you to stay tuned to my next series of blog posts where I start to lay out my thinking on how nonprofit fundraising is changing, and how it needs to change.

Lobbying stinks. Really bad. It clearly privileges the wealthy and deeply compromises our political process by sacrificing fairness in favor of favors. Many knowledgeable and capable advocates (not to mention our plebeian selves) are effectively silenced by industry lobbies that can afford access we simply can't. If Occupy Wall Street has one thing right (and I believe it has more than one thing right), then fairness is not possible in a democratic process so deeply influenced by financial perks and favoritism. Double ugh.

Lobbying stinks. Really bad. It clearly privileges the wealthy and deeply compromises our political process by sacrificing fairness in favor of favors. Many knowledgeable and capable advocates (not to mention our plebeian selves) are effectively silenced by industry lobbies that can afford access we simply can't. If Occupy Wall Street has one thing right (and I believe it has more than one thing right), then fairness is not possible in a democratic process so deeply influenced by financial perks and favoritism. Double ugh.

Michael, thank you for your concise words. I’m not sure of the potential nightmare of slogging through 3 million foreclosed homes 1 by 1, but nothing else seems to be working. David Smith from ReCap Advisors has some thoughts as well. It’s avail here (https://recapadvisors.com/article/22/SOM_42_Reviving_the_foreclosure_inventory_Jan_12.pdf ). I work as a housing consultant in Colorado, and it’s always a pleasure hearing from others in the industry. Looking forward to more of your thoughts. Andy

Andy, thanks so much for taking the time to comment, and I’m glad that you enjoyed the piece. I’m so glad you posted the link to the very compelling thought piece David Smith wrote about updating rent-to-own strategies to meet the demands of the current distressed housing market.

I agree that dealing with 3 million properties one home at a time just sounds like a complete nightmare. It has been and will continue to be. We got into this mess because we created a wholesale system of mortgage origination (by cutting a lot of corners we should never have cut), but it’s very hard to find any wholesale solutions to dig us out. The idea that we’ll need a whole array of solutions is not mine, and many advocates have already made significant strides in pioneering new models like the ones David writes about.

There are some strategies that can be applied at scale: note purchasing is already going on in many markets, and it’s likely to grow exponentially. Word has recently leaked of a potential trillion dollar re-fi strategy to be offered by Fannie and Freddie if Obama makes another recess appointment (to HFA). And the new AG settlement apparently does include some provisions for limited principal reductions.

Still, we’re going to also need solutions that deal with the situations of individual homeowners a home at a time, and the leaseback strategy David talks about is one such proposal. Others include improved shorts sales, homeowner stabilization loan funds, and other concepts that I mention above.

My overall point is that there’s no silver bullet, and that we can expect “rough justice” as a friend of mine put it. Given the wide damage that’s been done to the housing market, we simply can’t come up with a simple, “fair” solution. Our best option, I believe, and the one that’s likely to really have the greatest impact, is to roll up our sleeves and do the hard work of managing multiple strategies. This will require a much higher level of coordination and communication nationally, in addition to having a whole boatload of bright people to figure out how to make these programs happen. Still, the potential is there, and it sure would go a long way to helping us find the bottom much sooner (and with any luck, at a much more shallow level).